Â

John P. Hussman, Ph.D.

President, Hussman Funding Consider

October 2023

The nice bubbles take their time. Moderately a couple of years going up. Moderately a couple of years coming down, and the marketplace suffers from consideration deficit dysfunction, so it at all times thinks each rally is the start of the following nice bull marketplace. My wager is that we can have a recession, I donât know if it’ll be moderately gentle or moderately severe, however it’ll most likely pass deep into subsequent 12 months. Each and every bubble has been greeted with a refrain of âcushy touchdown,â and thereâs by no means been one. Each and every cycle is other, so each and every cycle, one thing else occurs. Itâs at all times a wonder, however you at all times have a wonder, so the very concept of a wonder is unsurprising.

I’d argue you must be courageous purchasing when costs are prolonged and top, since youâre a lot more prone to lose cash. The actual bravery to shop for when the marketplace is smashed all the way down to a discount turns out to me to be little or no. That isn’t now. In the event you take a look at essentially the most predictive measures, and Mr. Hussman does the most efficient of the ones â very detailed ancient file of which of them in reality do the most efficient â the ones measures are about as top as theyâve ever been, these days. Theyâre within the most sensible 2 or 3 % of all time. Thereâs a spike in 2000 and a spike in 2021, and that is above 2000 however under the spike in 2021, however we’re proper up there.

So as to get the marketplace all the way down to the place it will in most cases outperform the lengthy bond by means of 5%, which you want to argue it will have to, the marketplace, simply sheer mathematics must drop by means of greater than 50%. This isn’t my forecast. I’ve an overly genteel forecast the place the rest under 3000 would make me assume it used to be affordable, and if the whole lot works out badly, which it every now and then does, I’d now not be amazed if it went to 2000 at the S&P, however that will require a few wheels to fall off. And wheels have a tendency to fall off when the nice bubbles resolve, but it surely doesnât imply they’ve to. It might be not going to not get to one thing with regards to 3000 at the S&P. You’ll be able toât get blood out of a stone. In the future, the easy mathematics suggests that you simplyâll both have a dark go back eternally, otherwise youâll have a pleasing endure marketplace after which an ordinary go back, and the great endure marketplace will confidently be lower than 50%.

â Jeremy Grantham, GMO, Bloomberg UK (abridged), October 5, 2023

Worth-conscious, historically-informed, full-cycle buyers position quite a lot of emphasis at the dating between the cost an investor will pay these days and the money flows they are able to be expecting to obtain someday. The reason being easy. For any given flow of long run money flows, the upper the cost you pay these days, the decrease the long-term go back you’ll be able to be expecting, and the larger your problem threat. The decrease the cost you pay these days, the larger the long-term go back you’ll be able to be expecting, and the smaller your problem threat.

It kind of feels counterintuitive, but it surelyâs true â decrease anticipated marketplace returns pass hand-in-hand with upper threat of loss; upper anticipated marketplace returns pass hand-in-hand with decrease threat of loss. That proposition turns out to run counter to whatâs taught in finance, however talking as a former finance professor, thatâs as a result of the idea that of âinefficient threatâ isnât mentioned sparsely sufficient. As I wrote in Go back-Unfastened Chance on the January 2022 marketplace height:

âTraders are accustomed to the speculation of a âtradeoffâ between go back and threat, which is in most cases said as a proposition that buyers will have to settle for upper threat in the event that they search upper anticipated returns. What buyers are in most cases now not taught is this proposition applies most effective to âenvironment friendlyâ dangers. For instance, if a portfolio is poorly varied, one can in most cases in finding every other portfolio that may goal a better stage of anticipated go back for the same quantity of threat, or a decrease stage of threat for a similar anticipated go back. Likewise, in a wildly overestimated marketplace, buyers will have to be expecting now not most effective deficient returns but in addition upper potential threat. Put merely, buyers aren’t by hook or by crook rewarded for accepting upper ranges of what Ben Graham described as âunintelligentâ threat.ââ

The connection between valuations and next marketplace returns has a tendency to be moderately tight even over horizons at the order of 10-12 years, but it surelyâs now not highest, in particular if the tip of that 10-12 12 months funding horizon occurs to be the valuation excessive of a bubble.

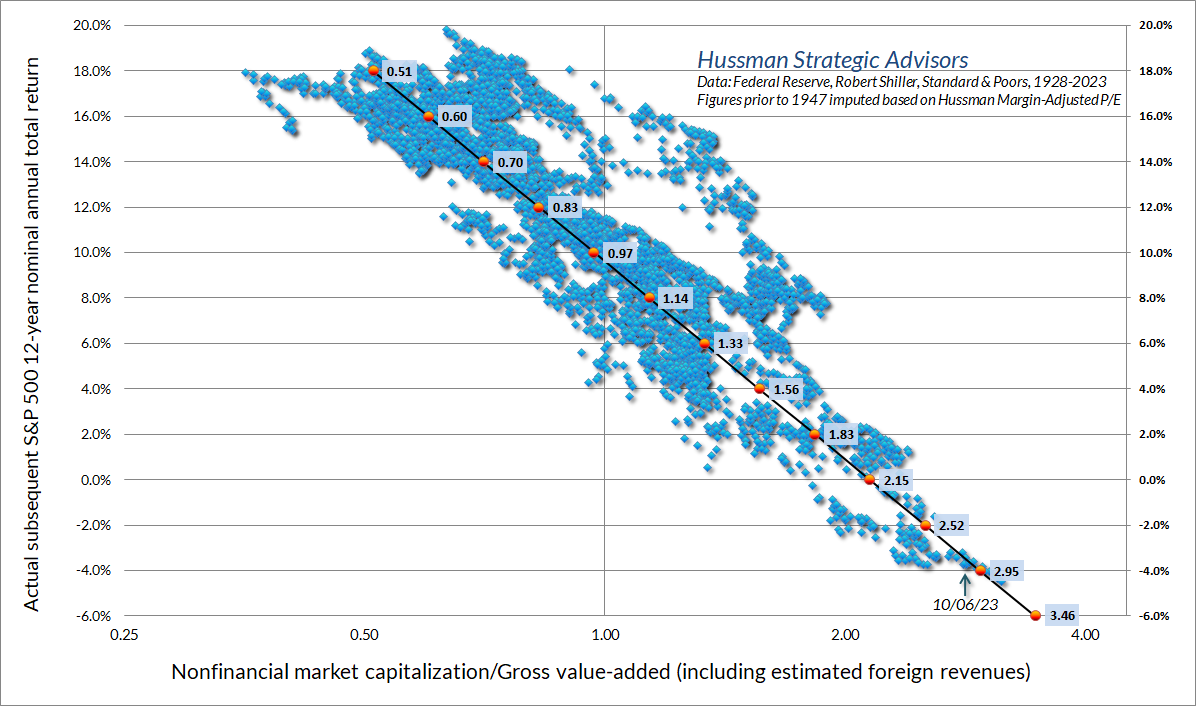

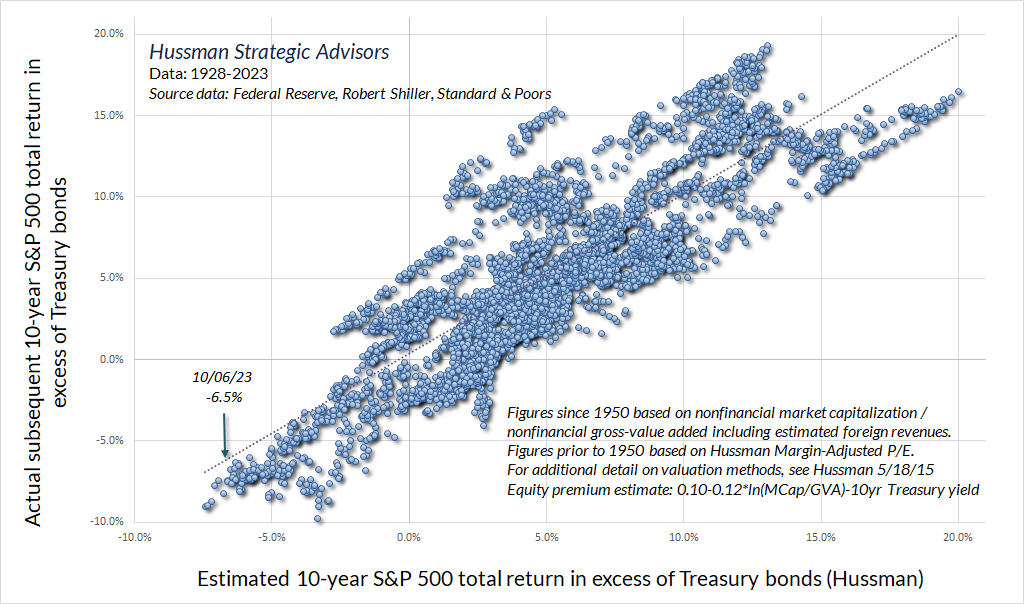

To replace the present valuation image for shares, the chart under displays the connection between our maximum dependable valuation measure, the ratio of nonfinancial marketplace capitalization to nonfinancial company gross value-added, together with estimated overseas revenues (MarketCap/GVA) and exact next 12-year moderate annual S&P 500 general returns, in information since 1928.

Bubble extremes lead buyers to overlook historical past. Traders glance again at the advance of the previous years, and notice most effective that top valuations had been adopted by means of even upper valuations; that each setback used to be adopted by means of a resumption of superb returns. They conclude that valuations are nugatory. They believe that the returns they loved from the purpose of wealthy valuations to the purpose of maximum valuations are in reality returns that they’re going to stay over your complete cycle. Worse, like economist Irving Fisher catastrophically proposed in 1929, many buyers insist that marketplace cycles now not exist, and that valuations will care for a âcompletely top plateau.â

Buckle up.

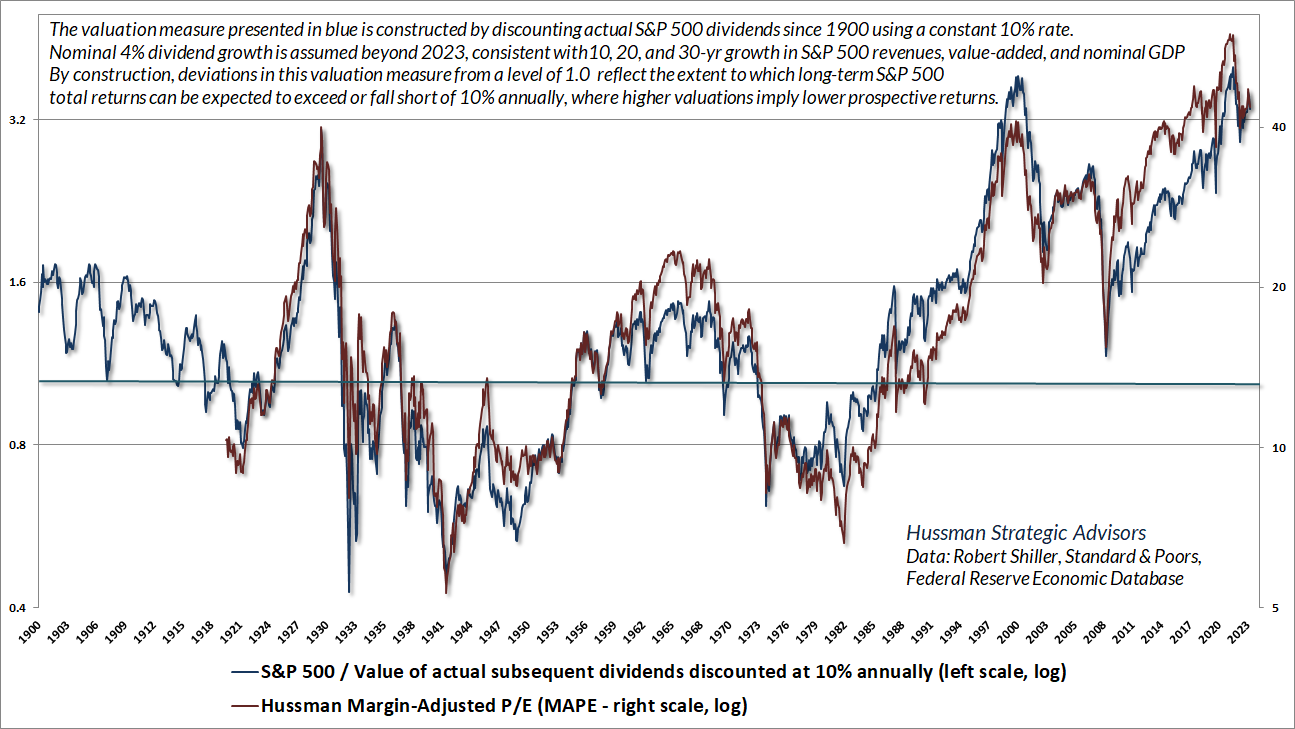

The purple line within the chart under displays our Margin-Adjusted P/E (MAPE), which isn’t reasonably as dependable as MarketCap/GVA however outperforms the Shiller cyclically-adjusted P/E (CAPE) in marketplace cycles throughout historical past. To underscore that each just right valuation measure is simply shorthand for a correct discounted money waft research, the blue line is in line with exact S&P 500 dividends throughout historical past. Each and every level is bought by means of taking the true index dividends of the S&P 500 from that time ahead, and discounting them to give cost at a hard and fast 10% fee of go back. Itâs value noting that âin line with percentageâ index income, revenues and dividends for the S&P 500 come with the affect of inventory buybacks thru changes within the divisor. Over the last twenty years, the S&P 500 divisor has shrunk at a mean annual fee of -0.50%, including 1/2 of 1 % to the once a year expansion fee of per-share S&P 500 basics. For the reason that S&P 500 earnings expansion for the ten, 20 and 30 years thru 2020 averaged simply 4% every year, and present S&P 500 dividends arenât in any respect depressed relative to revenues, the chart displays a expansion estimate of four% every year for long run dividends.

The easy interpretation here’s that after the S&P 500 / discounted dividend ratio has been at 1.0 at the left scale, the S&P 500 been priced at a degree in step with sustainable long-term returns of 10% every year. The bigger the departure from 1.0, the bigger departure of long-term returns from that 10% run-of-the-mill norm.

Now not strangely, as a competent gauge of marketplace valuations, our Margin-Adjusted P/E tells a just about equivalent tale as discounted dividends. Present marketplace valuations, even after the retreat for the reason that starting of 2022, rival the 1929 and 2000 bubble peaks. One don’t need to take quite a lot of estimates as âforecasts,â nor explicit ranges as âfee goalsâ to acknowledge that marketplace valuations stand at one of the crucial 3 nice bubble extremes in U.S. historical past.

Valuations above that cast horizonal line don’t essentially imply the marketplace is âoverestimated and prone to fallâ â they just counsel that long-term returns usually are lower than 10% every year. Regardless of present valuation extremes, the common annual nominal general go back of the S&P 500 since March 1987 has certainly been lower than 10%. Reasonable annual returns had been well-above 10% every year as measured from maximum issues since October 2008, after I noticed âthese days, we will be able to very easily be expecting 8-10% general returns even with out assuming any subject matter build up in price-to-normalized-earnings multiples. Given a modest growth in multiples, a passive funding within the S&P 500 can also be anticipated to succeed in general returns properly in way over 10% every year.â The issue is that the growth in multiples used to be so excessive within the advancing section of this bubble that most probably 10-12 12 months S&P 500 general returns, by means of our estimates, at the moment are unfavourable.

Itâs tempting to suppose an arbitrarily top expansion fee for long run S&P 500 basics in an try to justify present index ranges. The problem is that during fresh a long time, structural U.S. actual GDP expansion, the mix of demographic hard work pressure expansion and productiveness expansion, has regularly slowed from over 4% every year within the 1970âs to lower than 2% every year these days. Nominal GDP expansion has averaged nearer to 4% in fresh a long time. Boosting nominal expansion in S&P 500 basics past that stage calls for one to suppose both consistently increased inflation or completely emerging benefit margins. Even then, a 5% assumption for long run dividend expansion would lift the price of discounted dividends by means of most effective 20%. A 6% expansion assumption would nonetheless go away that cost under the 2000 stage at the S&P 500. In fact, Treasury yields since 1950 have a correlation of with regards to 0.8 with 10-year trailing nominal GDP expansion, so upper expansion would most probably include upper rates of interest.

One don’t need to take quite a lot of estimates as âforecasts,â nor explicit ranges as âfee goalsâ to acknowledge that marketplace valuations stand at one of the crucial 3 nice bubble extremes in U.S. historical past.

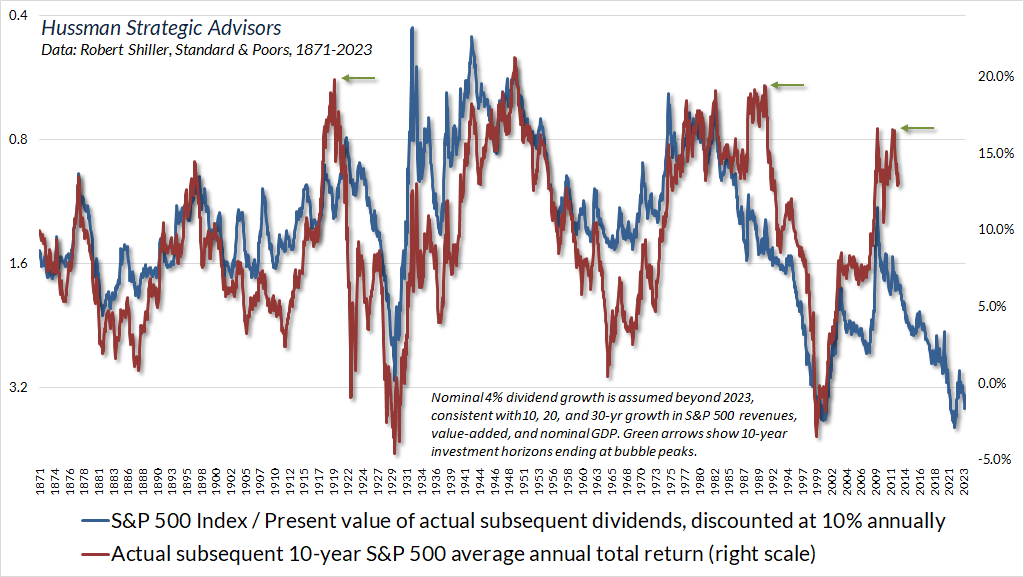

The blue line within the chart under, in information since 1871, is the dividend cut price type described above on an inverted log scale. The purple line displays exact next 10-year S&P 500 general returns. As is correct for many valuation approaches, youâll understand that 10-year horizons finishing at bubble extremes (1929, 2000, and 2022) loved returns a lot upper than what valuations projected on the starting of those sessions (1919, 1990, and 2012). The ten-year general returns main as much as those 3 nice bubble peaks are denoted by means of inexperienced arrows. In fact, the other is correct of the 10-year horizons starting in 1922 and 1964, as a result of those sessions ended on the excessive valuation lows of 1932 and 1974.

As Benjamin Graham lamented in regards to the 1929 bubble height, buyers deserted their worry about valuations on the worst conceivable time, as a result of years of robust returns, within the face of more and more wealthy valuations, led buyers to imagine âthat the data of the previous had been proving an undependable information to funding.â The unwinding used to be disastrous. The similar used to be true of the 2000 bubble. I think the present bubble will unwind the similar means.

For information and dialogue of not unusual justifications for present valuation extremes, together with benefit margins, S&P 500 composition, huge cap glamour shares, era, expansion charges, and rates of interest, and the way those excuses fall brief, see the sections titled âFalse Justificationsâ and âRear-view Expansionâ within the February remark, Headed for the Tail. There, youâll in finding that the benefit margins of the biggest shares these days, relative to the median inventory, are not any upper than theyâve been traditionally. In the meantime, the expansion charges of the biggest glamour firms have slowed regularly as their marketplace stocks have higher â one thing thatâs been true for main firms during historical past.

What is true is that the overall stage of benefit margins has been upper, around the board, than in 2000, even with out the large transient bump from pandemic subsidies. But as I famous in February, cautious exam demonstrates that âthe conduct of S&P 500 benefit margins isn’t pushed by means of hand-wavy ânew financial systemâ dynamics, up to the speaking heads might wax rhapsodic with bafflegab about âmass collaboration and cross-functional mindshare enabled by means of extensible era and international meta-service networks.â No. The drivers are wholly pedestrian, macroeconomic components â essentially hard work and curiosity prices. Each had been depressed over the last decade, and they’re now not at such extremes.â

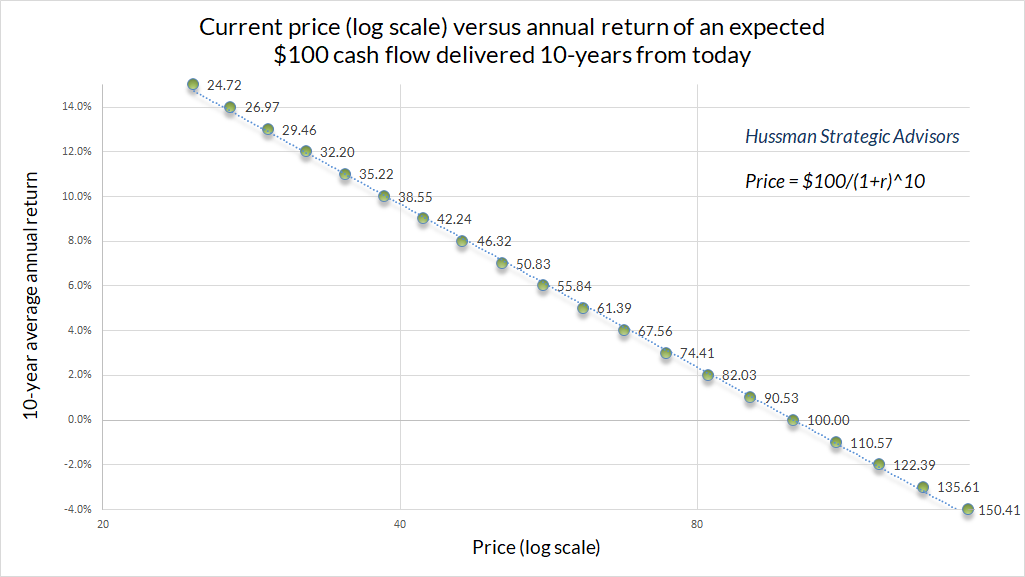

At the linear dating between valuations and next returns

An invaluable perception of cost making an investment is that the connection between valuations and next long-term funding returns is more or less linear â technically log-linear. Think, for instance, {that a} safety guarantees a unmarried fee of $100 a decade from these days. The chart under displays the connection between the cost paid these days for that long run $100 and the common annual go back the investor can be expecting over the 10-year funding duration. The horizontal axis is proven on logarithmic scale. Realize that this chart appears an excellent deal like our chart of MarketCap/GVA as opposed to exact next S&P 500 general returns. The upper the cost you pay for a given set of long run money flows, the decrease the long-term go back you’ll be able to be expecting. That is what I imply after I say that the connection between valuations and next returns is log-linear.

Geekâs Notice: Why log-linear? As a result of provide cost comes to exponentiation. Right here, P = C/(1+r)^T, which we will be able to rearrange as P/C = (1+r)^(-T). It follows that ln(P/C) = -T ln(1+r), which we will be able to rearrange as ln(1+r)= -(1/T) ln(P/C). Our anticipated go back has an inverse and linear dating with log valuations. At the left aspect, ln(1+r) is log gross go back. For small r, it seems that ln(1+r) and r are about equivalent, for instance, ln(1.10) = 0.0953. For massive r, running with log gross returns can also be helpful as a result of they assist to correctly handle compounding. Theyâre additive. For instance, a 100% achieve contributes ln(2.0)=0.693. That achieve is burnt up by means of a -50% loss, which contributes ln(0.5)=-0.693.

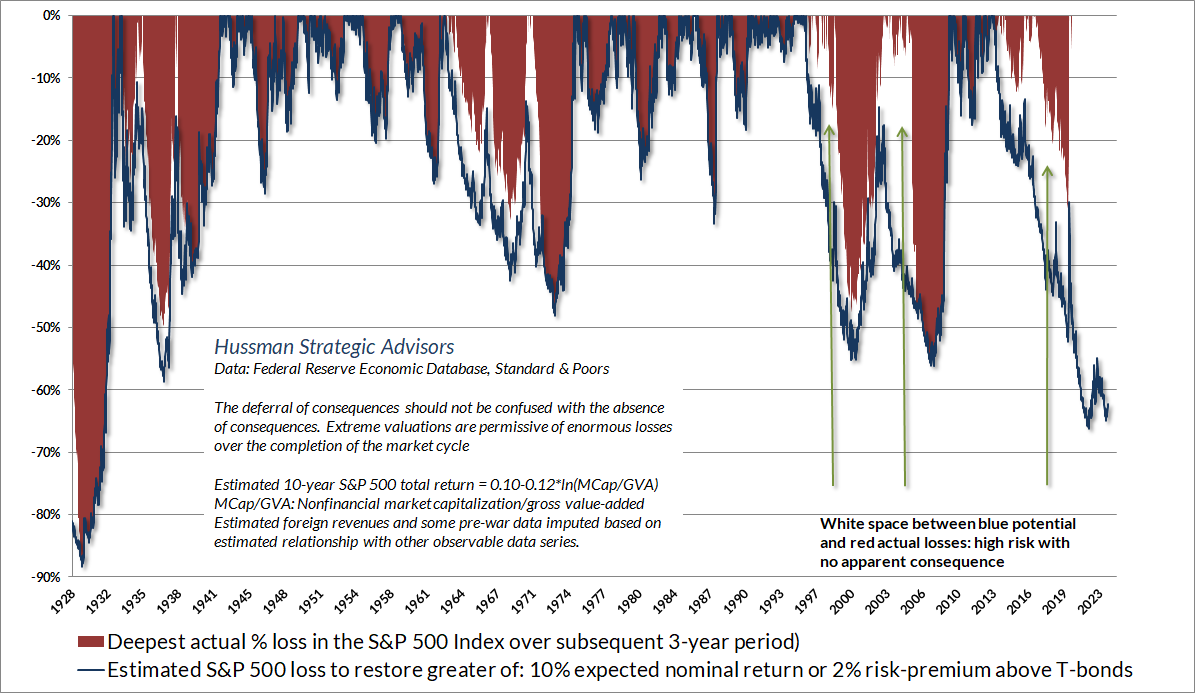

Probably the most often-overlooked options of dependable valuation measures is that they’re extremely informative now not most effective about long-term returns, but in addition in regards to the most probably intensity of marketplace losses over the finishing touch of a given marketplace cycle. Emphatically, those losses don’t essentially emerge right away. Wealthy valuations donât suggest speedy marketplace losses. I willât repeat that usally sufficient. In the event that they did, we might by no means apply bubble valuations. The one means that valuations had been in a position to achieve the extremes of 1929, 2000 and these days used to be by means of plowing thru each lesser excessive, undaunted.

Sadly, the deferral of penalties will have to now not be at a loss for words with the absence of penalties. The finishing touch of just about each marketplace cycle throughout historical past has introduced projected S&P 500 general returns to the upper of a) their traditionally run-of-the-mill 10% norm or b) 2% above prevailing Treasury bond yields. At the present, that will require a marketplace loss at the order of -63% within the S&P 500. Thatâs now not a forecast, but it surely without a doubt is a historically-consistent estimate of the prospective problem threat created by means of greater than a decade of Fed-induced yield-seeking hypothesis.

Iâll notice right here, as same old, that not anything in our self-discipline calls for or âforecastsâ a 63% loss within the S&P 500. The estimate above is a commentary about valuations and the results that experience in most cases adopted over the finishing touch of marketplace cycles throughout historical past.

The most powerful anticipated go back/threat profiles for the marketplace emerge when a subject matter retreat in valuations is joined by means of an development in our measures of marketplace motion. The intensity of the retreat would without a doubt have an effect on our perspectives in regards to the power of the chance, however Granthamâs âgenteel forecastâ of 3000 at the S&P 500 could be a nice alternative, as soon as joined by means of favorable marketplace internals. I doubt that stage could be a sturdy low, so we would possibly have protection nets the place others would possibly now not. Nonetheless, as at all times, our self-discipline is to align our outlook with prevailing prerequisites, and underneath commonplace prerequisites, we predict the ones prerequisites to shift meaningfully no less than a couple of times a 12 months.

Advanced techniques arenât linear

The entirety will have to be at leisure which has no pressure to impel it; however because the least straw breaks the ponyâs again, or a unmarried sand will flip the beam of scales which hang weights as heavy as the sector; so, doubtless, minute reasons might resolve the movements of fellows, of which neither others, nor they themselves are good.

â John Trenchard, Catoâs Letters, 1723

Regardless of the gratifying proportional dating between beginning valuations and long-term, full-cycle funding results, marketplace fluctuations over shorter segments of the cycle are pushed by means of investor psychology, which is able to shift all of a sudden between hypothesis and risk-aversion. The interactions between buyers can create comments loops and extrapolate fee developments simply as simply as they are able to create abrupt reversals and mean-reversion. None of that is linear.

Advanced techniques are explained by means of interactions between quite a lot of elements that produce outputs that is probably not proportional to the inputs. Adaptive techniques contain elements that be informed and alternate their conduct in line with earlier enjoy. Within the monetary markets, for instance, buyers repeatedly alter their conduct in line with fee actions that they themselves produce. Marketplace individuals additionally generally tend to obese fresh enjoy and overlook historical past â what Galbraith described as âthe extraordinary brevity of the monetary reminiscence.â

Within the brief run, not anything forces anticipated returns in line with extrapolating fresh fee developments to be in step with anticipated returns in line with valuations and long run money flows. But in the end, a safety is not anything however a declare on the ones long run money flows. If buyers power costs to excessive multiples of long run money flows, their hopes are certain to be dashed. Therefore Granthamâs remark, âyou’ll be able toât get blood out of a stone.â

Comments loops can produce speculative bubbles. Reasonably than discouraging buyers from chasing shares, emerging valuations can â for some time â inspire further hypothesis or even steeper valuations. As Nobel economist Franco Modigliani warned close to the 2000 height, âthe bubble is rational in a definite sense. The expectancy of expansion produces the expansion, which confirms the expectancy; other people will purchase it as it went up. However as soon as you might be satisfied that it’s not rising anymore, no one needs to carry a inventory as a result of it’s overestimated. Everyone needs to get out and it collapses, past the basics.â

Regardless of the gratifying proportional dating between beginning valuations and long-term, full-cycle funding results, marketplace fluctuations over shorter segments of the cycle are virtually completely pushed by means of investor psychology, which isnât linear in any respect. As an alternative, the monetary markets are a âcomplicated adaptive device,â and shifts in that device can also be abrupt.

The hot âthe whole lot bubbleâ has taken its pricey candy time to cave in. Even if the S&P 500 stays down from its early 2022 height, and 30-year Treasury bonds have misplaced over 1/2 their cost since early 2020, the marketplace has maintained the illusion of âresilience.â To a linear philosopher, satisfied that marketplace conduct at any given time is a proportional mirrored image of underlying prerequisites, it will be simple to conclude that the whole lot is simply nice. In spite of everything, one would possibly assume, if one thing used to be in reality unsuitable, costs would have declined in equivalent share.

Thatâs a tempting concept, but it surelyâs now not how monetary markets paintings.

The failure of the overall marketplace to say no all over the previous 12 months regardless of its glaring vulnerability, in addition to the emergence of recent funding traits, has led to buyers to imagine that the U.S. has entered a brand new funding technology to which the outdated pointers now not follow. Many have now come to imagine that marketplace threat is now not a practical attention, whilst the danger of being underinvested or in money and lacking alternatives exceeds some other.

â Barronâs Mag, February 3, 1969

Because it came about, the S&P 500 had already quietly began a endure marketplace that will take shares down by means of greater than one-third over the following 18 months, and would depart the S&P 500 under its 1968 height even 14 years later.

The upshot here’s that the conduct of a fancy device isn’t a easy, proportional mirrored image of its underlying state.

That is the longest duration of almost uninterrupted upward push in safety costs in our historical past⦠The mental phantasm upon which it’s founded, although now not necessarily new, has been more potent and extra well-liked than has ever been the case on this nation up to now. This phantasm is summed up within the word âthe brand new technology.â The word itself isn’t new. Each and every duration of hypothesis rediscovers it⦠Throughout each previous duration of inventory hypothesis and next cave in industry prerequisites had been mentioned in the similar unrealistic model as lately. There was the similar well-liked concept that during some miraculous means, ceaselessly elaborated however by no means in reality explained, the elemental prerequisites and necessities of development and prosperity have modified, that outdated financial ideas had been abrogated⦠that industry income are destined to develop quicker and with out restrict, and that the growth of credit score can don’t have any finish.

â The Industry Week, November 2, 1929

Gauging the state of the device

Rock-a-bye child at the treetop

When the wind blows the cradle will rock

When the bough breaks the cradle will fall

And down will come child, cradle and all

Iâve by no means reasonably understood how this can be a comforting tune. Making a song it to a kid turns out passive-aggressive at perfect. I grew up in Chicago, the place Harry Schmerler, your making a song Ford broker, would open his advertisements crooning ârock-a-bye your childâ in a Vaudeville melody, however thatâs every other tale. For our functions, whatâs helpful about this tune is that it distinguishes the attainable state of a device from its kinetic state. Letâs summary from the concept that thereâs a child in there.

Believe a cradle, at the treetop. For a cradle of any given weight, the âattainableâ power within the factor is proportional to its distance from the bottom. The similar is correct of the prospective power saved in a rubber band â itâs proportional to how some distance you stretch it. Within the monetary markets, valuations are the similar means. Thereâs a pleasing linear dating between the peak of the article and the space it in most cases retreats over the entire cycle. However understand that even huge quantities of attainable power don’t need to be launched till one thing offers means â changing all that attainable power into movement, cave in, and for the markets, monetary disaster.

To explain the âstateâ of a fancy device, it is helping to incorporate measures that gauge the interactions between elements. In techniques which are liable to catastrophic shifts, reminiscent of landslides or structural disasters, itâs additionally helpful to have measures that gauge when the device is coming underneath in particular critical pressure or drawing near a âcrucial level.â For landslides, the gradient or âsteepnessâ relative to the bottom is vital; for construction foundations, the extent of soil moisture issues; for different techniques, temperature gradients, inhabitants density, or load weight issues, or even a small alternate past a definite threshold can cause a disaster.

Within the monetary markets, valuations are emphatically now not sufficient to gauge the state of the device. As well as, we’d like measures to gauge the adaptive facet: whether or not the present state of investor psychology leans towards hypothesis â extrapolation of upward fee developments; or risk-aversion â worry about attainable losses, defaults, and money flows. For us, those measures contain facets of fee, quantity, and investor sentiment that we seize with ideas like uniformity, divergence, unfold, participation, breadth, management, exhaustion, compression, and overextension.

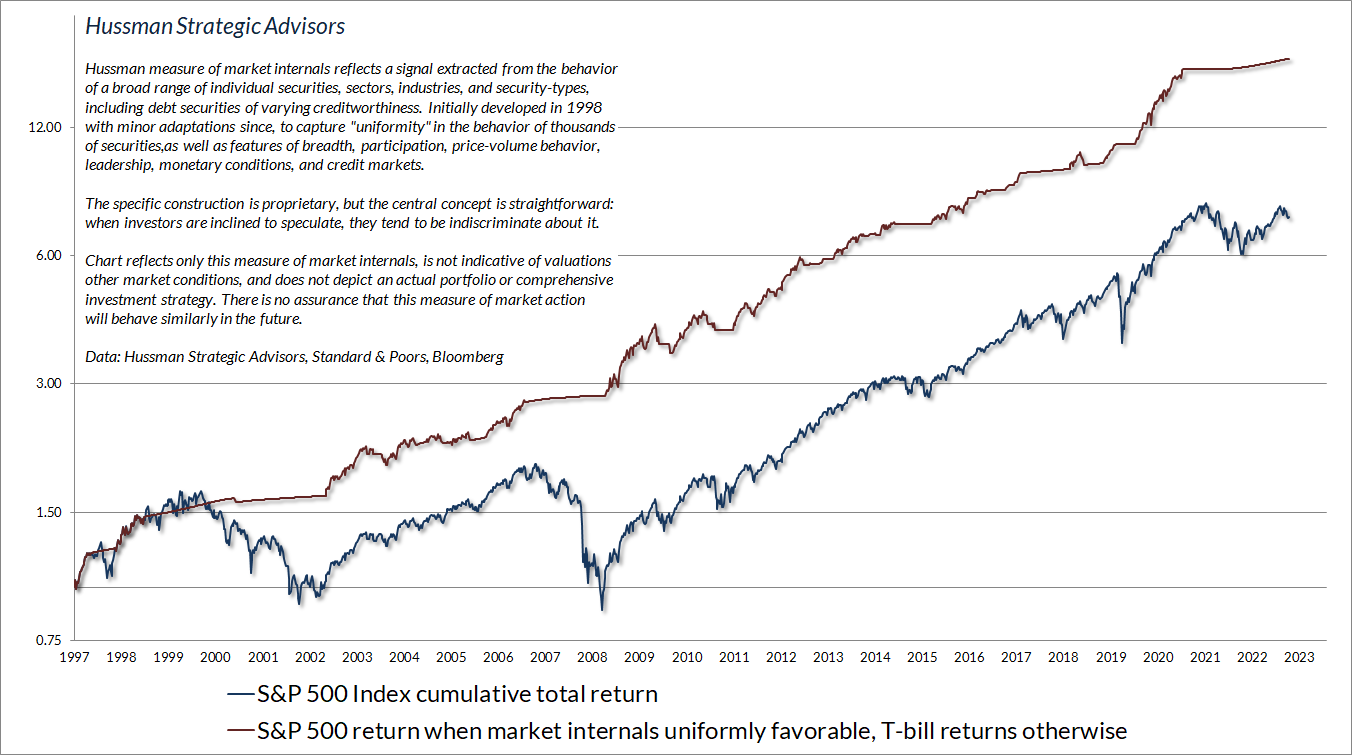

In our personal self-discipline, we pay specific consideration as to if buyers are vulnerable towards hypothesis or risk-aversion. When buyers are vulnerable to invest, they have a tendency to be indiscriminate about it, so our most dear measure is the uniformity or divergence of marketplace motion throughout a wide vary of particular person shares, industries, sectors, and security-types, together with debt securities of various creditworthiness. The chart under items the cumulative general go back of the S&P 500 during periods the place our major gauge of marketplace internals has been favorable, accruing Treasury invoice curiosity differently. The chart is ancient, does now not constitute any funding portfolio, does now not replicate valuations or different options of our funding means, and isn’t an assurance of long run results.

Having admirably navigated a long time of entire marketplace cycles previous to this one, together with the tech and housing bubbles and collapses, itâs vital to notice our problem all over the hot half-cycle zero-interest fee bubble. In earlier marketplace cycles throughout historical past, excessive âoverestimated, overbought, overbullishâ prerequisites had been incessantly adopted by means of abrupt air-pockets, panics, or crashes. Our measures of âoverextensionâ are distinct from our gauge of marketplace internals, and incessantly helped us to spot when the markets had reached a crucial level. Sadly, as soon as the Fed flooded the monetary device with 18-36% of GDP in zero-interest liquidity â which somebody needed to hang, as zero-interest liquidity, at each second in time â the ensuing yield-seeking hypothesis blew thru all of the ones historically-reliable limits.

Watch out to be told the fitting lesson: Supplied that buyers are vulnerable to invest, as gauged by means of favorable marketplace internals, thereâs no dependable ârestrictâ to the extent of hypothesis that deranged Fed coverage can inspire. In that state of affairs, one needs to be content material to gauge the presence of speculative lemmings with out assuming that their urge for food for Molly, uppers and coke has a ârestrict.â The painful penalties emerge as risk-aversion units in, as gauged by means of ragged and divergent marketplace internals.

We presented variations in 2017 and 2021 that repair the strategic flexibility that we loved for many years previous to quantitative easing. Those variations can be in particular useful within the tournament the Federal Reserve resumes 0 rate of interest insurance policies. For now, suffice it to mention that even amid present valuation extremes, there are well-defined prerequisites through which our outlook could be now not simply impartial however optimistic â albeit with place limits and protection nets. For main points on our reaction to 0 rate of interest insurance policies and quantitative easing, see the phase titled Adapting to experimental financial coverage within the July remark.

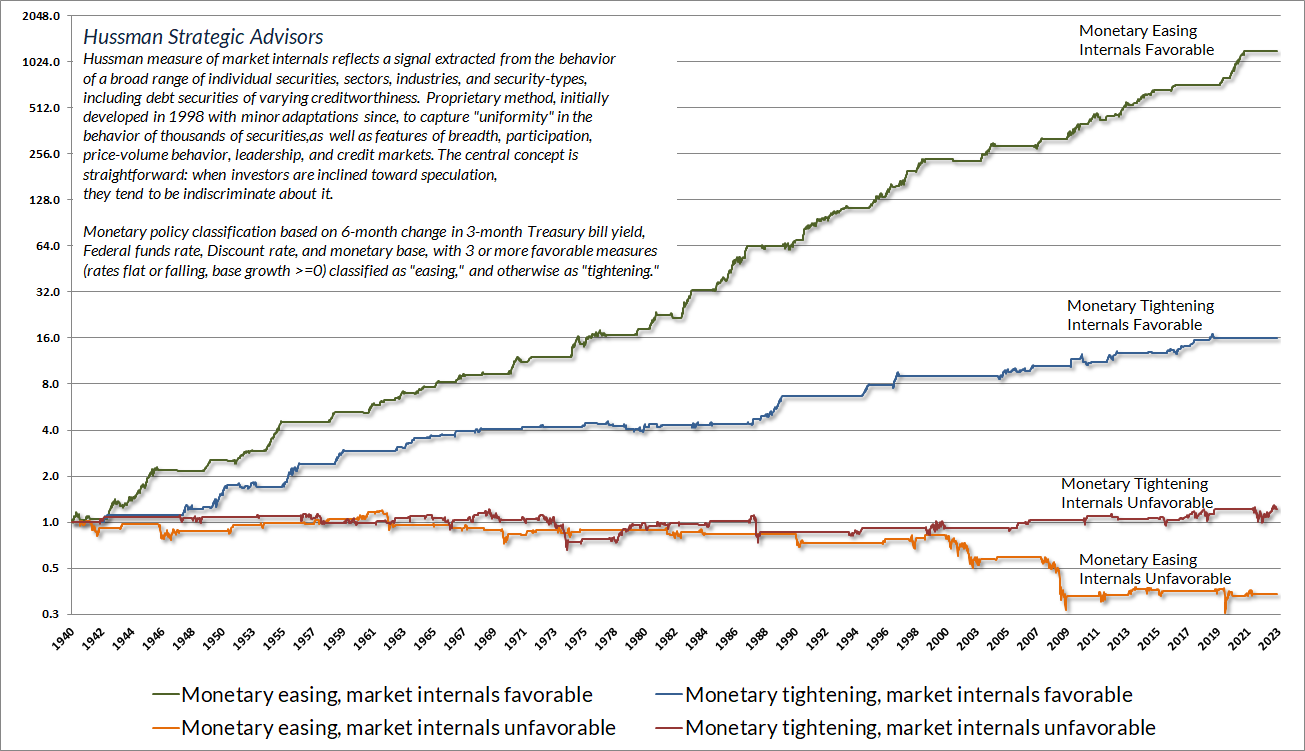

Whilst zero-interest fee coverage did elevate the âlimitsâ to reckless hypothesis, watch out to not believe that Fed easing overrides the mix of destructive valuations and risk-aversion. It does now not. Fed easing âworksâ to improve the monetary markets most effective when buyers view low-interest liquidity as an inferior asset. When buyers develop into risk-averse, which we gauge in line with destructive marketplace internals, they deal with low-interest liquidity as a fascinating asset. In that state of affairs, growing extra of the stuff does now not impress hypothesis, and it does now not improve the marketplace.

Watch out to be told the fitting lesson: Supplied that buyers are vulnerable to invest, as gauged by means of favorable marketplace internals, thereâs no dependable ârestrictâ to the extent of hypothesis that deranged Fed coverage can inspire. In that state of affairs, one needs to be content material to gauge the presence of speculative lemmings with out assuming that their urge for food for Molly, uppers and coke has a ârestrict.â The painful penalties emerge as risk-aversion units in, as gauged by means of ragged and divergent marketplace internals.

The chart under displays the cumulative general go back of the S&P 500 throughout historical past, partitioned into 4 mutually unique prerequisites. The flat parts of each and every line are issues when that exact situation used to be inactive. Realize that the worst aggregate emerges when risk-aversion (destructive marketplace internals) is joined by means of financial easing. That in most cases happens all over crashes and crises. The Fed eased aggressively and consistently during the 2000-2002 and 2007-2009 collapses. Itâs development in marketplace internals, now not easing by means of the Fed, that reliably defines an development out there outlook.

The worst marketplace losses in most cases happen when valuations are excessive however the speculative herd has misplaced its uniformity. The quotes under might assist to drag the ideas of valuation, marketplace internals, and overextension in combination â although as Iâve famous, weâve tailored our reaction to overextended âlimits,â in particular when marketplace internals and financial pressures stay favorable.

The guidelines contained in income, stability sheets, and financial releases is just a fraction of what’s identified by means of others. The motion of costs and buying and selling quantity unearths different vital knowledge that buyers are prepared to again with actual cash. For this reason development uniformity is so an important to our Marketplace Local weather means. Traditionally, when development uniformity has been sure, shares have normally overlooked overvaluation, regardless of how excessive. When the marketplace loses that uniformity, valuations usally subject and with a vengeance. This can be a lesson perfect realized sooner than a crash relatively than after one.

â John P. Hussman, Ph.D., October 3, 2000

Probably the most perfect indications of the speculative willingness of buyers is the âuniformityâ of sure marketplace motion throughout a wide vary of internals. One of the vital vital facet of final weekâs decline used to be the decisive unfavourable shift in those measures. Since early October of final 12 months, I’ve no less than normally been in a position to mention in those weekly feedback that âmarketplace motion is favorable at the foundation of fee developments and different marketplace internals.â Now, it additionally occurs that when the marketplace reaches overestimated, overbought and overbullish prerequisites, shares have traditionally lagged Treasury expenses, on moderate, even if the ones internals had been sure (a truth which saved us hedged). Nonetheless, the favorable marketplace internals did let us know that buyers had been nonetheless prepared to invest, then again all of a sudden that willingness would possibly finish. It appears that evidently, it simply ended, and the reversal is broad-based.

â John P. Hussman, Ph.D., July 30, 2007

Self assurance bubbles, section transitions, and catastrophes

Monetary markets are in particular delicate to interactions between individuals as a result of each percentage purchased by means of one investor will have to concurrently be offered by means of every other investor. Likewise, each unmarried percentage thatâs offered will have to even be purchased. Each and every greenback a purchaser places âinâ is a greenback a supplier takes âout.â Costs alternate relying on which player â the patron or the vendor â is extra keen.

Keep in mind that, the perception of âmoney at the sidelines ready to get investedâ drives me nuts. Each and every greenback of liquidity created by means of the Fed will have to be held by means of some investor till the Fed retires it by means of shrinking its stability sheet. That liquidity can also be held in most effective 3 bureaucracy: forex on your pockets, financial institution reserves that you simply hang not directly as a financial institution deposit, or price range on âopposite repoâ with the Fed that you simply hang not directly as a cash marketplace fund deposit. It could possiblyât become anything. The money is already âhouse.â You’ll be able toât put it âintoâ the inventory marketplace and not using a supplier taking it proper again âout.â Somebody has to carry it. Thatâs how zero-interest fee coverage created a bubble. Somebody needed to hang the stuff, and no one sought after it. Thatâs over. Except for for bodily forex, all that liquidity is now incomes 5.4%.

When buyers start to act as a herd, costs can transfer an excellent deal as it turns into tougher to meet the herdâs collective makes an attempt to shop for, or to promote. So along with valuations, marketplace internals, compression, and overextension, we additionally use quite a lot of measures of fee/quantity conduct to gauge when teams of buyers start âopting for facetsâ â moving from a bullish herd to a bearish herd.

Iâve famous through the years that really extensive marketplace declines are usally preceded by means of a mix of inside dispersion, the place the marketplace concurrently registers a reasonably huge collection of new highs and new lows amongst particular person shares, and a management reversal, the place the statistics shift from a majority of recent highs to a majority of recent lows inside a small collection of buying and selling periods.

That is similar to what occurs when a substance is going thru a âsection transition,â for instance, from a gasoline to a liquid or vice versa. Parts of the fabric start to act distinctly, as though the debris are opting for between the 2 levels, and because the transition approaches its âcrucial level,â you begin to apply greater clusters as one section takes priority and the debris that experience âmade a callâ have an effect on their neighbors. You additionally apply speedy oscillations between order and dysfunction in the remainder debris. So a section transition options inside dispersion adopted by means of management reversal. My influence is this analogy additionally extends to the marketplaceâs tendency to enjoy expanding volatility at 5-10 minute periods previous to main declines.

â John P. Hussman, Ph.D., Marketplace Internals Move Detrimental, July 30, 2007

The explanation we align our funding outlook with prevailing, observable marketplace prerequisites like valuations and internals is that shifts in herd conduct are necessarily not possible to are expecting. âIt’s within the nature of a speculative increase,â wrote Galbraith, âthat virtually the rest can cave in it. Any severe surprise to self belief could cause gross sales by means of the ones speculators who’ve at all times was hoping to get out sooner than the general cave in, however in spite of everything conceivable positive aspects from emerging costs had been reaped. Their pessimism will infect the ones more effective souls who had idea the marketplace would possibly pass up eternally however who now will alternate their minds and promote. Quickly there can be margin calls, and nonetheless others can be pressured to promote. So the bubble breaks.â

My pal John Mauldin has usally used a âsandpileâ analogy to explain the non-linear conduct of catastrophes. In 2021, he shared a quote from writer Mark Buchanan, describing the idea that of âself-organized criticalityâ proposed by means of 3 physicists, Consistent with Bak, Chao Tang, and Kurt Wiesenfeld of the Brookhaven Nationwide Lab:

Believe peering down at the pile from above and coloring it in in line with its steepness. The place it’s reasonably flat and solid, colour it inexperienced; the place steep and, in avalanche phrases, âable to head,â colour it purple. What do you spot? They discovered that on the outset, the pile seemed most commonly inexperienced, however that, because the pile grew, the fairway turned into infiltrated with ever extra purple. With extra grains, the scattering of purple risk spots grew till a dense skeleton of instability ran during the pile. Right here then used to be a clue to its atypical conduct: a grain falling on a purple spot can, by means of domino-like motion, purpose sliding at different within reach purple spots.

If the purple community used to be sparse, and all hassle spots had been properly remoted one from the opposite, then a unmarried grain will have most effective restricted repercussions. But if the purple spots come to riddle the pile, the results of the following grain develop into fiendishly unpredictable. It could cause only some tumblings, or it could as a substitute spark off a cataclysmic chain response involving thousands and thousands. The sandpile appeared to have configured itself right into a hypersensitive and peculiarly volatile situation through which the following falling grain may cause a reaction of any dimension in any way.

Mark Buchanan, Ubiquity: Why Catastrophies Occur (h/t John Mauldin)

Traditionally, the mix of maximum valuations and destructive marketplace motion has created a âlure doorâ state of affairs for the marketplace. That doesnât imply that the marketplace at all times collapses in brief order. Reasonably, the steepest marketplace losses have normally emerged from that aggregate of marketplace prerequisites, and those losses have a tendency to emerge all of a sudden, with out further caution.

Stability sheet losses and debt burdens

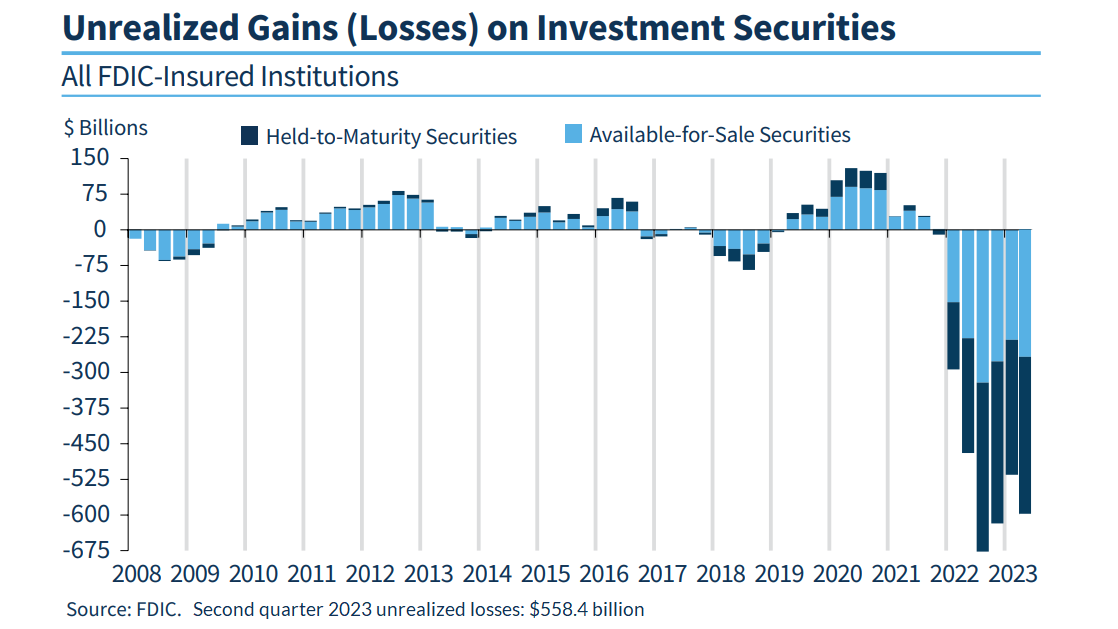

Including to the âskeleton of instabilityâ created by means of wealthy valuations and destructive marketplace internals, the chart under displays unrealized losses within the U.S. banking device as of the second one quarter of 2023. Significantly, 10-year Treasury yields have higher from 3.8% to 4.7% since then, so this profile has certainly worsened in fresh months. In step with the most recent FDIC quarterly banking profile, over 40% of U.S. industrial financial institution deposits are uninsured â a end result of a Federal Reserve coverage that pressured trillions of bucks of reserves into the banking device.

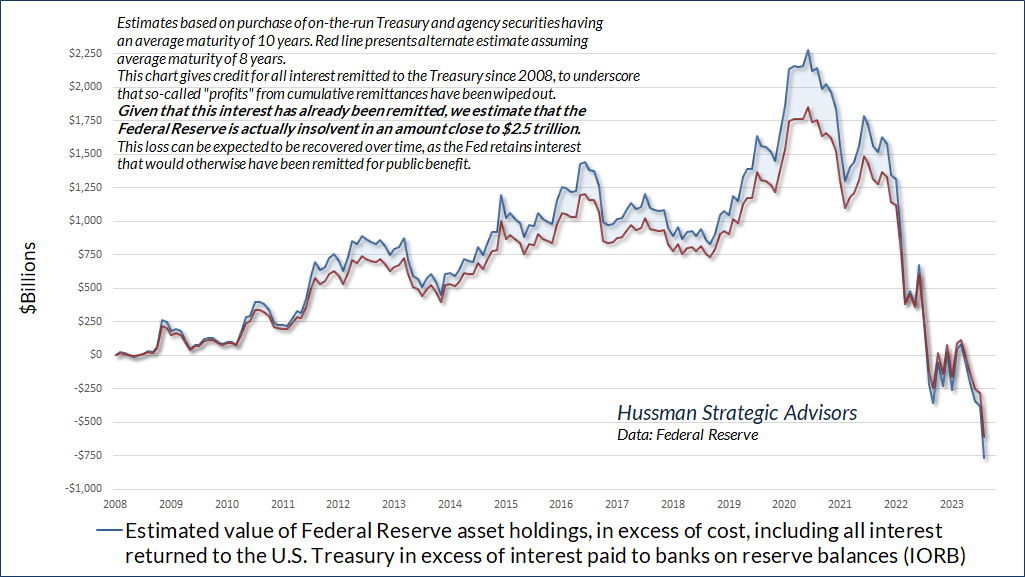

In the meantime, issues aren’t going properly throughout the Federal Reserveâs stability sheet. Through our estimates, even giving the Fed credit score for the entire curiosity it has returned to the U.S. Treasury because it introduced quantitative easing in 2008, the Fed has misplaced just about $750 billion bucks, at public expense. Apart from curiosity that the Fed has remitted to the Treasury, the true hollow within the Federal Reserveâs stability sheet â liabilities in way over property â is with regards to $2.5 trillion. In impact, the Fed has created govt liabilities which are now not sponsored by means of corresponding property, because the Federal Reserve Act meant.

There is not any speedy felony or regulatory end result to this, however the public will have to remember the fact that this hollow can be stuffed by means of the Fed over the years, by means of keeping curiosity that will differently had been returned to the Treasury for public use. For a complete dialogue of the variation between illiquidity and insolvency (the Fed isn’t illiquid, however it’s maximum without a doubt bancrupt), see the September remark, Central Bankers Wandering within the Woods.

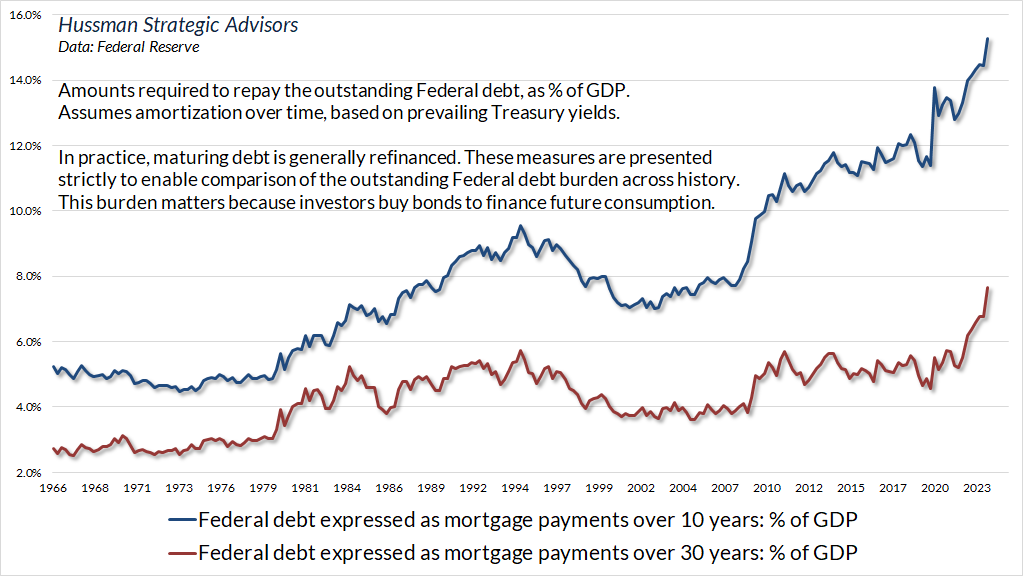

Along with steep losses within the bond marketplace, the banking device, and the Federal Reserveâs personal stability sheet following years of Fed-induced hypothesis, zero-interest fee coverage inspired a large growth of the Federal debt, by means of making that debt appear quickly costless. The issue right here isn’t such a lot that the debt must be repaid â in observe, maturing debt is refinanced by means of issuing new debt â however relatively that weâve assumed that long run buyers can be prepared to sacrifice their very own intake to refinance that debt, regardless of how huge the debt could be, with none alternate within the tradeoff between intake and govt liabilities. In undeniable language, adjustments in that tradeoff are referred to as âinflationâ and âsustained top rates of interest.â

Why do other people purchase bonds? As a result of theyâre prepared to cast off present intake to supply for his or her long run intake. Since 2005, because the U.S. inhabitants has elderly, the proportion of intake spending by means of the ones elderly 65 and over has grown from lower than 14% to just about 22%. An expanding cohort of American citizens has entered the intake section of lifestyles, whilst the proportion of people within the produce-and-accumulate section has declined. But weâre all simply having a bet that this debt can be mechanically refinanced at the shoulders of long run patrons, status on a turtle, status on every other turtle, and that itâs turtles the entire means down.

From this standpoint, itâs helpful to believe how a lot of the rusticâs manufacturing would should be paid over to bondholders to be able to in reality honor the debt over the years. That is certainly a hypothetical workout, for the reason that debt is predicted to be refinanced. Nonetheless, we will be able toât merely suppose that the tradeoff between govt liabilities and long run intake can be unaffected by means of the volume of the ones liabilities. A worsened tradeoff, by means of definition, would imply inflation, increased rates of interest, or each.

The chart under expresses the Federal debt as though it used to be paid down like a loan over 10 years and 30 years. It takes account of each the dimensions of the debt and the extent of rates of interest. You could now not wish to listen this, however even supposing rates of interest had been to fall by means of 1/2, the weight would nonetheless be upper than at any level in historical past previous to 2020.

Consider, monetary markets arenât linear. Itâs not possible to give an explanation for the inflation of the 1970âs as a linear serve as of observable variables (until one of the crucial variables is inflation itself). The price that buyers position on paper forex and govt debt is a serve as of self belief in long-term fiscal and financial restraint. As economist Peter Bernholz has famous: âThere hasn’t ever took place a hyperinflation in historical past which used to be now not led to by means of an enormous funds deficit of the state⦠In all instances of hyperinflation, deficits amounting to greater than 20 in line with cent of public expenditures are provide.â Weâve exceeded that stage in each and every of the previous 5 years â even in 2019, sooner than the pandemic â however that during itself supplies no details about whether or not or once we would possibly apply a spoil in self belief.

The sandpile can tolerate a continual trickle of increasing debt, free coverage, excessive overvaluation, and banking losses for reasonably a while. Ponzi schemes can pass on for years. All we would possibly apply for some time are a couple of localized âtumblingsâ like Silicon Valley Financial institution, or a short lived spike in inflation, and we’d believe that the whole lot is contained. In the meantime, threat quietly extends throughout the entire device as a âskeleton of instability.â When a self belief bubble in any case breaks, it has a tendency to wreck all of a sudden. The unwelcome penalties can additional undermine self belief and enlarge the disaster, as they did with inflation within the 1970âs, tech shares in 2000-2002, and the worldwide monetary device in 2007-2009.

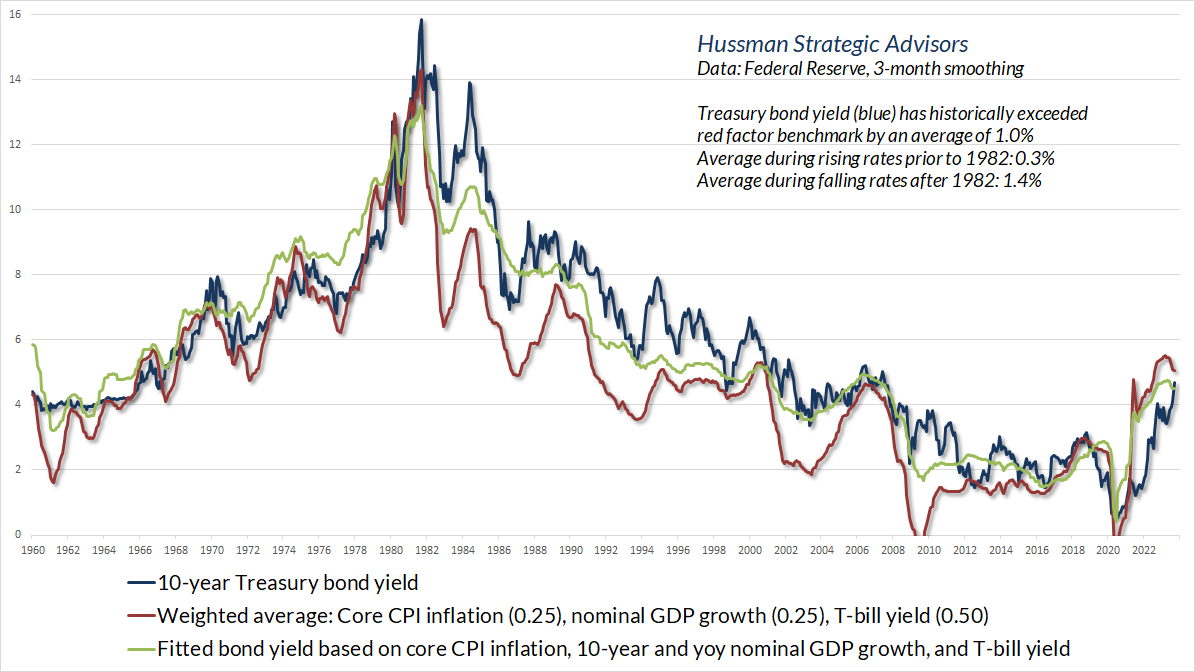

On bond yields and recession

Within the bond marketplace, the extent of long-term rates of interest has returned to a spread that we view as âgood enough,â although it has taken a 50% loss in 30-year Treasury bonds and a 25% loss in 10-year bonds to take action. Certainly, the whole go back of 30-year Treasury bonds for the reason that starting of quantitative easing in 2008 has been burnt up to 0. Nonetheless, weâre in any case vulnerable to nibble on longer adulthood debt in accordance with upward spikes in charges, with about 1/2 of that publicity in inflation-protected securities.

Itâs value repeating that the complete ancient general go back of Treasury bonds, over-and-above T-bill returns, has gathered when the 10-year Treasury yield has been above those benchmarks â preferably above each. We donât view the prevailing stage of yields as surprisingly beneficiant or sexy, so âgood enoughâ stays our most popular description. As same old, our outlook will alternate as measurable, observable prerequisites alternate. For bonds, the slope of the yield curve, inflation pressures, and nominal GDP expansion are in particular vital.

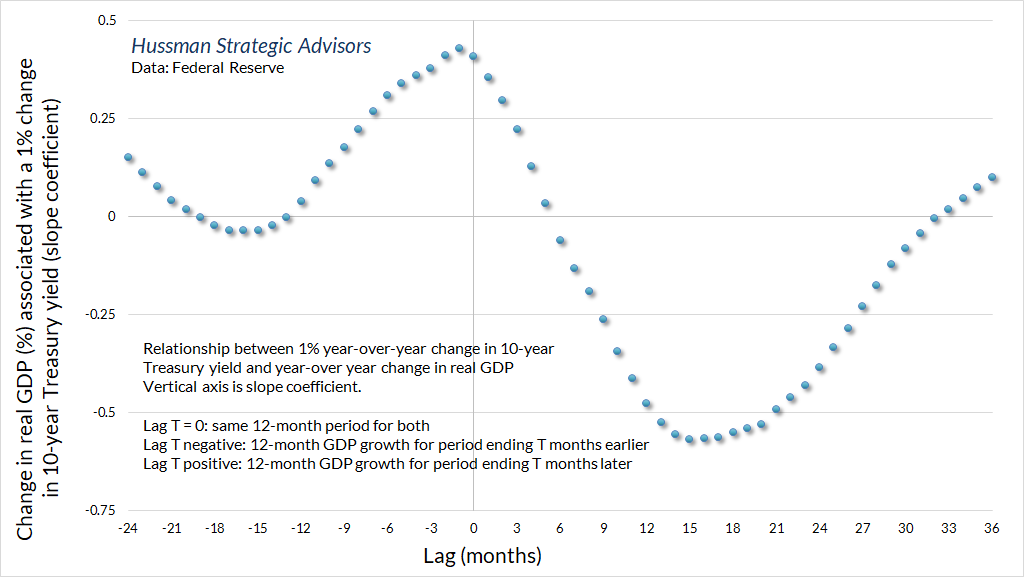

Iâve famous sooner than that almost the entire fluctuations in actual GDP expansion, employment, or even inflation that one can are expecting the usage of financial variables can also be predicted the usage of non-monetary variables on my own â see the phase on âGranger Causalityâ in Central Bankers Wandering within the Woods. For the reason that truth, one needs to be cautious when discussing the connection between rates of interest and next financial results, as a result of buyers or even coverage makers usally wildly overestimate the level to which financial results can also be manipulated. That mentioned, purely from the perspective of correlation, itâs useful to acknowledge that financial adjustments have a tendency to noticeably lag adjustments in long-term rates of interest.

The chart under displays the year-over-year proportion alternate in actual GDP related to a 1% year-over-year alternate within the 10-year Treasury yield. At the horizontal axis, a lag of 0 months signifies that weâre browsing on the identical 12-month duration for each. Realize that on moderate, if Treasury bond yields have higher over the last 12 months, actual GDP has in most cases additionally higher over that very same duration. Itâs most effective after about 15-18 months that an build up in Treasury bond yields is related to a decline in actual GDP. You receivedât be shocked, then, that I believe Granthamâs evaluation: âMy wager is that we can have a recession, I donât know if it’ll be moderately gentle or moderately severe, however it’ll most likely pass deep into subsequent 12 months.â

To be transparent, our recession caution measures aren’t on top self belief but. At the sure entrance, regional Fed and buying managers surveys have loved a modest although noisy jump in fresh months. At the unfavourable entrance, weâve already noticed a year-over-year contraction in actual retail gross sales and transient employment, whilst Gross Home Source of revenue has been markedly weaker than Gross Home Product, even supposing they measure the similar job in numerous tactics. Traditionally, the worst duration for the inventory marketplace runs from more or less two months sooner than a recession to 4 months sooner than it ends. One shouldnât be expecting shares to supply a lot understand prematurely of a recession, but shares can also be down an excellent deal by the point an ongoing recession is well-recognized. My influence is that, blended with the elements which are already in position, a decline within the S&P 500 under about 4100 will be the final straw.

If we do see a recession, donât blame the Fed for the downturn. Blame the Fed for greater than a decade of yield-seeking hypothesis, and ensuing monetary distortions â excessive valuations, speculative losses, leveraged loans, uninsured deposits, and light-weight covenants â that can certainly complicate that downturn.

Iâll say this once more. The following recession is probably not âas a result ofâ the Fed raised charges â certainly, the Fed price range fee stays quite under the extent that has traditionally been in step with prevailing unemployment, inflation, and financial slack. As I famous final month, as an financial growth progresses, slack in hard work markets and productive capability is regularly taken up, fee pressures boost up, actual GDP expands past its sustainable attainable, and mismatches emerge between call for and provide. But even with out Fed motion, that is already a state of affairs the place recession is much more likely. Emerging long-term rates of interest and Fed tightening of non permanent rates of interest do precede recessions, however the ones recessions â exactly as a result of tight capability and mismatches between the combination of products and services and products provided and demanded â had been already much more likely than now not.

In the meantime, buyers will have to watch out about the concept that the financial system has been âresilientâ within the face of emerging long-term rates of interest. Itâs now not ordinary for the financial system to seem resilient as charges are emerging.

But every other lengthy however unstable go back and forth to nowhere

After all, a few of the largest threat components for buyers here’s that whilst bond valuations have normalized, inventory marketplace valuations stay close to historical extremes. Through our estimates, the space in anticipated returns between equities and bonds has joined the worst ranges in historical past, matched most effective by means of extremes in mid-1929 and early-2000. We understand that you’ve a number of âfairness threat top classâ fashions to make a choice from, so thanks for flying with ours, as a result of the most well liked ones are runway rubbish, and you’ll be able to end up that to your self by means of evaluating their implications towards exact next marketplace returns. Wall Boulevard doesnât do that, as itâs a lot more straightforward to subtract the 10-year Treasury yield from the ahead income yield of the S&P 500, with out all that further paintings of analysis and checking out.

Over the approaching decade, from present valuations, we predict the whole go back of the S&P 500 to lag Treasury bond returns by means of about -6.5% every year. Our 12-year estimate is even worse, at -7.5% every year. That can appear preposterous. Itâs simple to overlook that we noticed a identical consequence within the years following the 2000 excessive. Throughout the 12-year duration from 12/31/1999 thru 12/31/2011, the whole go back of the S&P 500 lagged the whole go back of Treasury bonds by means of -8.9%. Itâs similarly simple to overlook that the whole go back of the S&P 500 lagged Treasury bonds from August 1929 to July 1950, and extra not too long ago, from March 1998 to March 2020. Bubbles have penalties.

More than likely the worst a part of being a value-conscious investor, in particular when valuations are increased, is that your perspectives about valuations can also be interpreted as near-term marketplace forecasts. I infrequently write a marketplace remark with out noting, emphatically, that this isn’t the case. Our funding self-discipline is to align ourselves with prevailing, measurable, observable marketplace prerequisites â in particular the mix of valuations marketplace internals â and to modify our outlook as the ones prerequisites alternate. Our funding self-discipline without a doubt advantages from variation in marketplace prerequisites, however not anything in that self-discipline calls for valuations to retreat to ranges any place close to their ancient norms. The issue is that present prerequisites are so excessive, and the results from identical extremes had been so dismal, that nuance is sort of not possible.

For the reason that valuations stay excessive, and our measures of marketplace internals stay firmly destructive, Iâm much less involved than same old about our risk-estimates being misinterpreted as forecasts. My major worry is that the instability of the complicated device that we name the âmonetary marketplaceâ options rising pressure on a wide vary of interconnected elements, in particular throughout credit score, debt, fairness, and banking measures. In Buchananâs phrases, those interconnected elements create a âskeleton of instability.â There don’t need to be a proportional dating between the dimensions of the final grain of sand, the period of the final straw, or the load of the touchdown butterfly, and the level of the disaster they impress. When the bough breaks, my sense is that it is going to spoil all of a sudden.

Stay Me Knowledgeable

Please input your e-mail cope with to be notified of recent content material, together with marketplace statement and particular updates.

Thanks to your curiosity within the Hussman Budget.

100% Unsolicited mail-free. No record sharing. No solicitations. Choose-out anytime with one click on.

Through filing this kind, you consent to obtain information and statement, without charge, from Hussman Strategic Advisors, Information & Remark, Cincinnati OH, 45246. https://www.hussmanfunds.com. You’ll be able to revoke your consent to obtain emails at any time by means of clicking the unsubscribe hyperlink on the backside of each e-mail. Emails are serviced by means of Consistent Touch.

The foregoing feedback constitute the overall funding research and financial perspectives of the Guide, and are supplied only for the aim of data, instruction and discourse.

Prospectuses for the Hussman Strategic Expansion Fund, the Hussman Strategic Overall Go back Fund, the Hussman Strategic World Fund, and the Hussman Strategic Allocation Fund, in addition to Fund studies and different knowledge, are to be had by means of clicking âThe Budgetâ menu button from any web page of this web page.

Estimates of potential go back and threat for equities, bonds, and different monetary markets are forward-looking statements founded the research and affordable ideals of Hussman Strategic Advisors. They aren’t a ensure of long run efficiency, and aren’t indicative of the potential returns of any of the Hussman Budget. Precise returns might vary considerably from the estimates supplied. Estimates of potential long-term returns for the S&P 500 replicate our same old valuation method, that specialize in the connection between present marketplace costs and income, dividends and different basics, adjusted for variability over the commercial cycle. Additional main points in relation to MarketCap/GVA (the ratio of nonfinancial marketplace capitalization to gross-value added, together with estimated overseas revenues) and our Margin-Adjusted P/E (MAPE) can also be discovered within the Marketplace Remark Archive underneath the Wisdom Heart tab of this web page. MarketCap/GVA: Hussman 05/18/15. MAPE: Hussman 05/05/14, Hussman 09/04/17.