Expense Pugliano

As financiers were long cautioned, Occidental Petroleum Corporation ( NYSE: OXY) trades at a raised cost due to Warren Buffett. The significant energy handle the sector strengthened this circumstance. My financial investment thesis stays Bearish on the stock, with oil rates most likely headed lower after even 2 wars can’t keep rates raised.

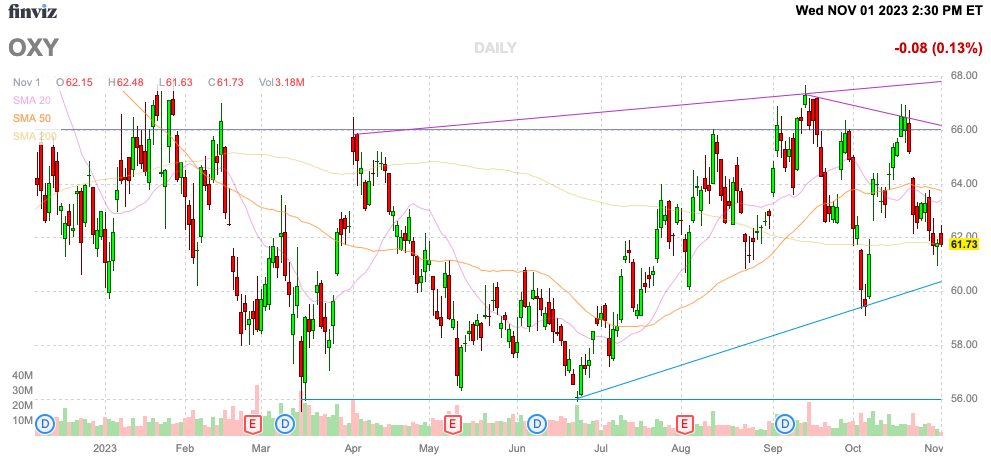

Source: Finviz

Overlooked

In the last month, Exxon Mobil Corporation ( XOM) has actually consented to pay almost $60 billion for Leader Natural Resources ( PXD) and Chevron Corporation ( CVX) has actually consented to pay $53 billion for Hess Corporation ( HES). The 2 mega offers get rid of the biggest prospective acquirers from the swimming pool, leaving Oxy with minimal alternatives aside from a not likely purchase from a European energy business.

No one truly understands why these energy giants bypassed Oxy, however Warren Buffett owning a big portion of the business likely had an effect. Not to discuss, Berkshire Hathaway ( BRK.B, BRK.A) frequently purchased shares in the $60+ variety making any most likely offer needing a premium above a currently superior cost.

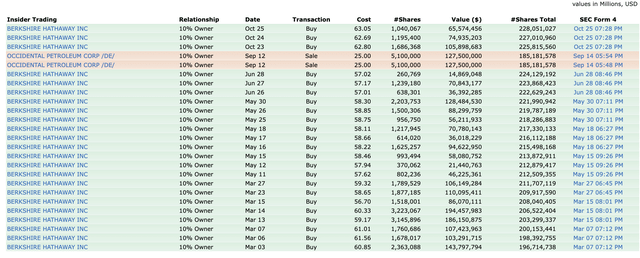

In reality, Berkshire Hathaway simply purchased more shares days after the Chevron offer for Hess was revealed. The financial investment company purchased almost 3 million shares from October 23-25 for ~$ 245 million, paying over $62 per share.

Buffett now manages 25.8% of the exceptional shares plus $8.5 billion in favored shares, together with 83.9 million warrants to purchase shares at $59.62 each. As pointed out above, the issue is that Buffett sees the stock as a buy at the present rates, recommending any offer would need a premium.

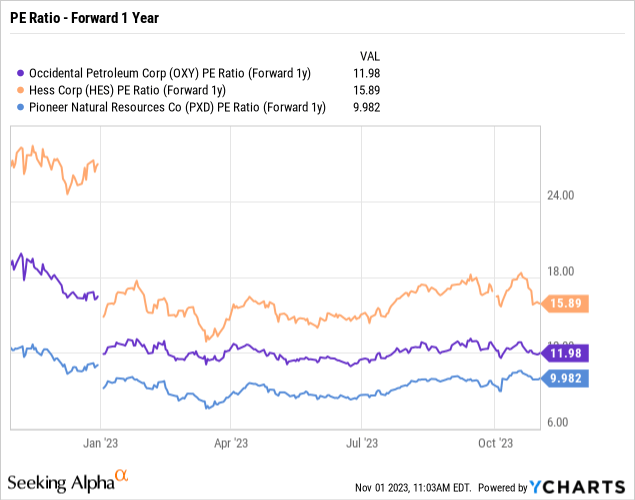

Keep in mind, Buffett currently owns $ 17.8 billion worth of shares of Chevron for a 6.5% position that may have made complex any offer, however Occidental is currently a costly stock in the energy sector. Even after these premium offers, Oxy is even more costly than Leader Natural Resources, while Hess is technically more costly at almost 16x EPS targets.

Hess is a somewhat various story, with experts anticipating the EPS leaping to $9 in 2024 and rising once again to $11 in 2025. The stock just trades at 13x the 2025 projection.

Oil Trending Lower

With 2 wars continuous worldwide and oil dipping back to the low $80s, financiers require to remember the threat to oil rates is lower due to economic downturn worries and lots of excess supply at OPEC+ now. The above P/E ratios are based upon oil rates in the present variety.

Back in Q2, Oxy made simply $0.68 for the quarter, causing an annualized EPS rate of simply $2.72. Experts anticipate significantly greater EPS targets needing a repeat of the March quarter when oil rates were greater and the independent energy business made $1.08 per share.

The energy business understood typical Q2 ’23 WTI rates of $73.83/ bbl with gas understood rates at just $1.36/ mcf. OXY will presently see upside to those outcomes with present rates higher, however the threat is for oil rates to head lower eventually due to regular energy cost cycles.

Oxy reports Q3 ’23 results next week on November 7 with the following agreement price quotes:

- EPS: $0.86 (down 64.6% YoY)

- Profits: $6.96 billion (down 26.8% YoY).

The Q3 ’23 EPS target appears the peak level in the present cycle. WTI rates hurried to $90/bbl on the dispute in Israel, however rates ended the quarter down at $82/bbl, though gas rates will offer some life at $3+/ mcf now.

The issue here is that a $4 EPS target appears aggressive and Oxy currently trades above $60. The stock has a 15x P/E numerous, and the threat is for EPS to slip more towards the $2 to $3 variety shown by the Q2 ’23 outcomes.

Takeaway

The crucial financier takeaway is that Occidental Petroleum Corporation wasn’t purchased in the mega handle the energy sector potentially due to the stock evaluation from Warren Buffett buoying the cost higher from constant stock purchases. Our view is that financiers ought to continue preventing Occidental Petroleum Corporation stock, with the probability Oxy is in fact trading at over 20x stabilized EPS targets of sub-$ 3 with oil rates heading lower.