insjoy

Greater for just how much longer? ” The degree of extra policy firming that might be suitable …”

The FOMC voted all to keep its 5 policy rates the same today, with the top of its policy rates at 5.50%, as had actually been broadly messaged in current weeks in speeches by Fed guvs.

It was the 2nd conference in a row when the Fed kept rates the same, after the rate walking at its conference in July. The Fed has actually treked by 525 basis points up until now in this cycle.

Today, the Fed kept its policy rates at:

- Federal funds rate target variety in between 5.25% and 5.5%.

- Interest it pays the rely on reserves: 5.4%.

- Interest it pays on over night Reverse Repos (RRPs): 5.3%.

- Interest it charges on over night Repos: 5.5%.

- Main credit rate: 5.5% (what banks pay to obtain at the “Discount Rate Window”).

Greater for just how much longer?

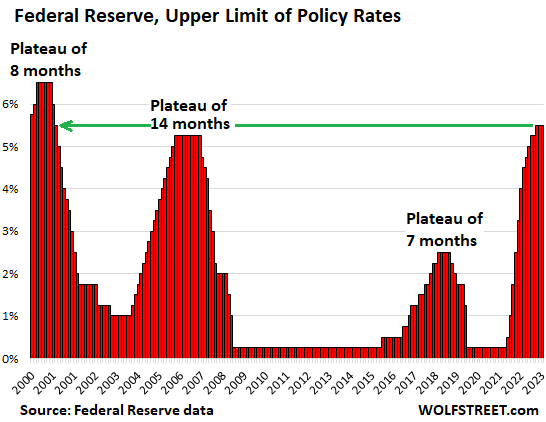

Completion of the rate walkings is usually followed by plateaus before rate cuts start. Completion of the rate walkings might not be here yet, and the Fed has currently stated a billions times for months that the plateau is going to be “greater for longer.”

More rate walkings? Today’s conference was among the 4 conferences a year when the Fed does not launch a “Summary of Economic Projections” (SEP), that includes the notorious “dot plot” which demonstrates how each FOMC member sees the advancement of future policy rates.

At the last conference on September 20, the average forecast in the “dot plot” kept another rate trek on the table for this year. There was absolutely nothing in today’s declaration that modifications that.

Today’s declaration duplicated the language of the previous declarations, which leaves the door open for more rate walkings:

” In figuring out the degree of extra policy firming that might be suitable to return inflation to 2 percent with time, the Committee will take into consideration the cumulative tightening up of financial policy, the lags with which financial policy impacts financial activity and inflation, and financial and monetary advancements.”

When will the rate cuts begin? The Fed will launch its next SEP and “dot plot” at the December conference. In the SEP launched in December 2022, the Fed stunned the world since it got rid of the forecasts of a rate cut in 2023.

In the SEP launched in September, the Fed moved the rate cuts even more out into the 2nd half of 2024, which was another surprise. So the next SEP in December will be fascinating.

QT continues, with the Treasury roll-off topped at $60 billion monthly, and the MBS roll-off topped at $35 billion a month, according to strategy and on auto-pilot. The Fed has actually currently shed over $ 1 trillion in properties in a little over a year, and this will continue.

Banking crisis copy and paste. Today’s declaration repeats the very same language about the banking crisis for the 4th conference in a row: That the “tighter credit conditions for homes and organizations are most likely to weigh on financial activity, working with, and inflation.” And it duplicates that “the degree of these results stays unpredictable.”

My handle the Quarterly Refunding files launched today: The spike of the 10-year Treasury yield has actually obviously rattled the federal government’s nerves. Tsunami of Treasury issuance shifts from longer-term financial obligation to short-term T-bills & & 2-year notes in the middle of extreme navel-gazing about increasing 10-year yield

Editor’s Note: The summary bullets for this post were picked by Looking for Alpha editors.