filmfoto

The destructive damage to humankind from the Israeli-Hamas war that remains in and around the Gaza Strip need to not be reduced or downplayed– innocent lives on both sides suffer in any dispute.

Nevertheless, the financial effect needs to not be overemphasized either. Simply put, the numerous billions of dollars in monetary stock exchange losses this month are not proportional to the Mideast financial losses sustained so far.

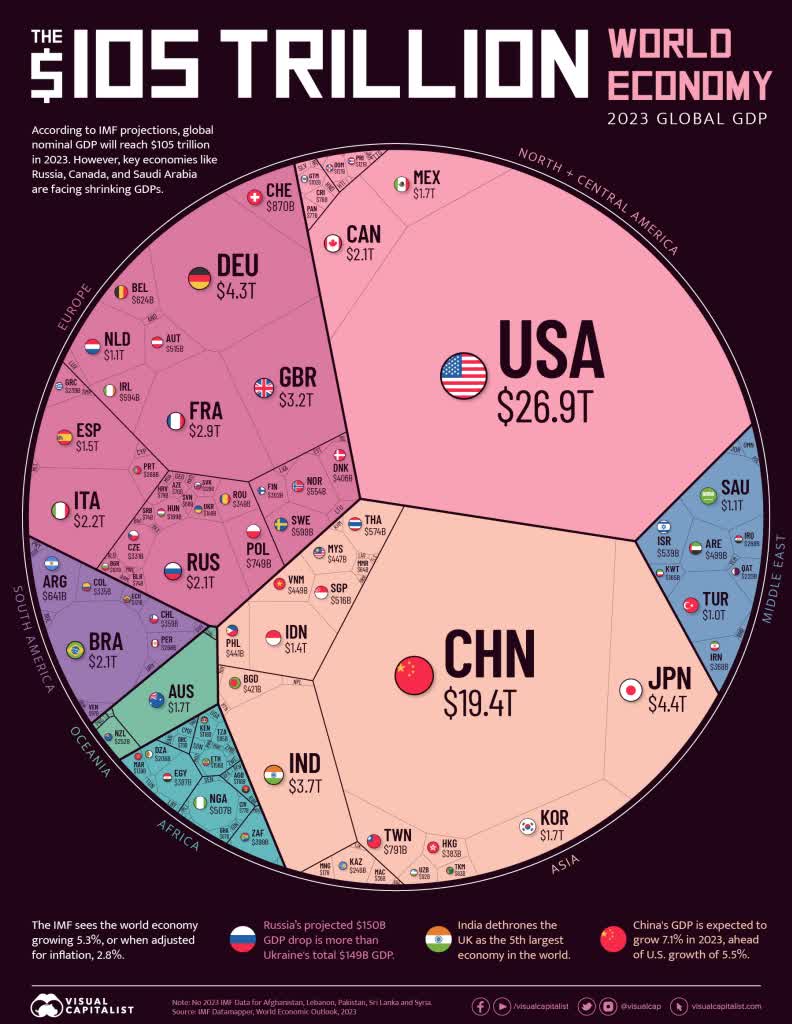

To put the occasions in viewpoint, the population of Israel estimates 10 million individuals and the population situated in the Gaza Strip has to do with 2 million individuals. There are more than 8 billion individuals in the world, so Israel/Gaza represents approximately 1/7 of 1% of the worldwide population.

From a financial perspective, the combined financial output of Israel/Gaza Strip represents around 1/2 of 1% of worldwide GDP.

And let’s not forget, financial activity is not dropping to no. From a financial perspective, the war’s monetary effect is even smaller sized– a rounding mistake.

Source: Visual Capitalist

Nevertheless, wars do not exist in a vacuum, and stress in the Middle East have the capacity of having a causal sequence. Whenever rumblings take place in the Mideast, among the biggest worldwide sectors to be very first affected is the oil market.

Roughly 20-30% of the world’s oil is trafficked through the Strait of Hormuz in the Persian Gulf, so it was not unexpected to see a short-term spike in oil rates to practically $90 per barrel in early October after the Gaza intrusion of Israel.

By the end of the month, oil has actually kicked back down to about $81 per barrel, practically exactly the exact same rate right before the war began. On a year-over-year basis, oil rates are in fact down around -5%, thus offering small relief to gas-powered vehicle motorists.

If Iran, or Iran-backed militant group Hezbollah, tosses their hat into the Israel-Hamas war ring, the U.S. and other Western allies might strike back and intensify stress in the area, which would unlikely be gotten well by the monetary markets.

As an outcome of this cause and effect worries in the area, the stock exchange took another leg down last month with the S&P 500 index decreasing -2.2%, the Dow Jones Industrial Average -1.4%, and the NASDAQ index fell the most, -2.8%.

The world is an unsafe location, however we have actually seen this film in the past– this is absolutely nothing brand-new. We would all choose world peace, however sadly, wars and skirmishes have actually gone on for centuries.

As Rate Of Interest Skyrocket, Bonds Deal More

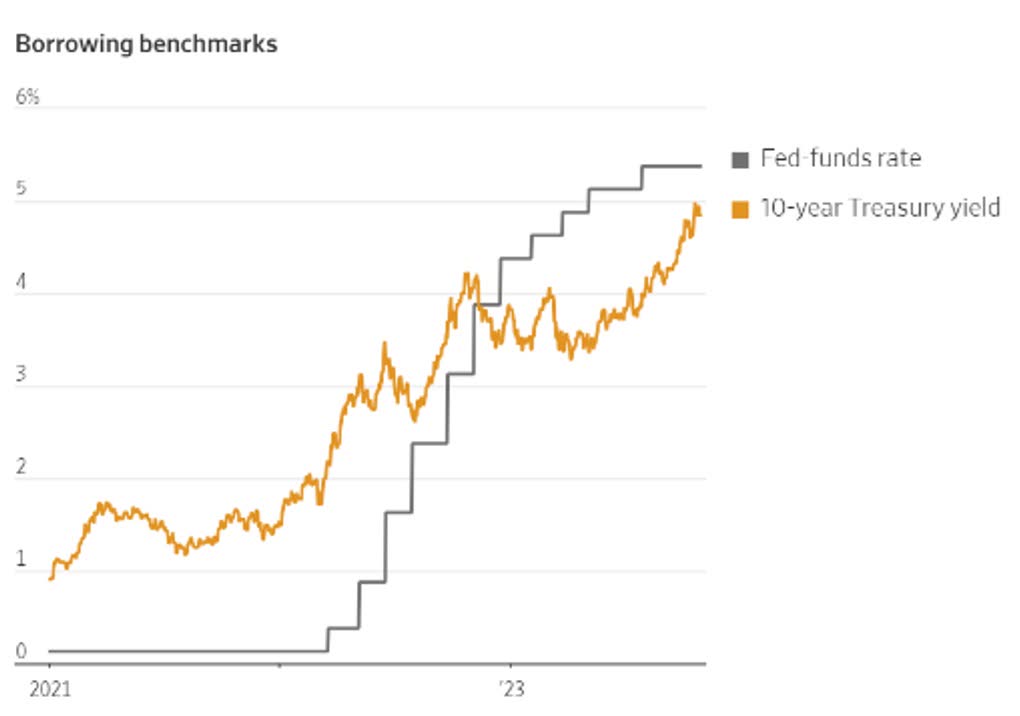

Source: Wall Street Journal

No, TINA is not the name of my high school sweetheart or spouse, however rather the acronym TINA (There Is No Alternative) existed in the last few years throughout the Federal Reserve’s zero-interest rate policy days.

More particularly, TINA described the absence of financial investment options to equities (i.e., stocks) when cash efficiently made 0% in the bank and near to 0% in lots of set earnings securities (i.e., bonds).

In reality, at one point, although it is still tough to think, there were more than $ 16 trillion in bonds paying unfavorable rates of interest– pure madness.

TINA Develops Into FIONA

Offered the big boost in rates of interest by the Federal Reserve over 2 years (from 0% to 5.50%), financiers have actually been offered a short-term present.

As you can see from the chart above, yields on 10-Year Treasury Notes have actually increased to practically 5.0%. And think it or not, much shorter term bonds are presently offering yields even greater than this.

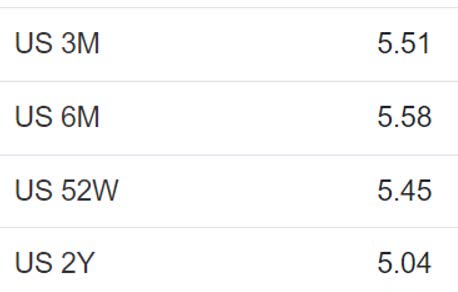

The three-month, six-month, 1 year, and two-year Treasuries are all yielding greater rates than 10-Year Treasury yields (i.e., inverted yield curve)– see table listed below.

So, TINA has actually altered to FIONA– Fixed Earnings Opens New Alternatives. What’s more, for people with taxable accounts, the interest made on Treasuries is tax-free at the state level, thus making this short-term present in yields a lot more appealing for financiers.

Source: Trading Economics

Stock rates were down once again for the month, and financial investment belief has actually been souring due to the war in the Middle East, however there is still lots of factors to stay useful.

Not just is the economy strong (e.g., 3rd quarter GDP of +4.9%), however the customer likewise stays strong (see Customer Wallets Strong) in big part since the joblessness rate stays near record lows (+3.8%).

While stress and anxiety increases due to the war, stock rates get more affordable, and chances increase. And although rates of interest stay raised, the Federal Reserve is signifying they are better to a rate treking end, inflation is cooling and FIONA is providing more appealing yields than throughout the TINA age.

It holds true, this month stocks did not holler due to the war, however client and opportunistic financiers will be rewarded with more.

This short article is an excerpt from a formerly launched Sidoxia Capital Management complimentary newsletter (November 1, 2023).

Disclosure: Sidoxia Capital Management (SCM) and a few of its customers hold positions in specific stocks, and particular exchange traded funds (ETFs), however at the time of publishing had no direct position in any other security referenced in this short article. No info accessed through the Investing Caffeine (IC) site makes up financial investment, monetary, legal, tax or other suggestions nor is to be depended on in making a financial investment or other choice. Please check out disclosure language on IC Contact page

Editor’s Note: The summary bullets for this short article were selected by Looking for Alpha editors.