Wall Street experts are souring on U.S. stocks. Historically, that has actually indicated that the marketplace is most likely to climb up throughout the coming months, with gains in some cases burglarizing double-digit portion area.

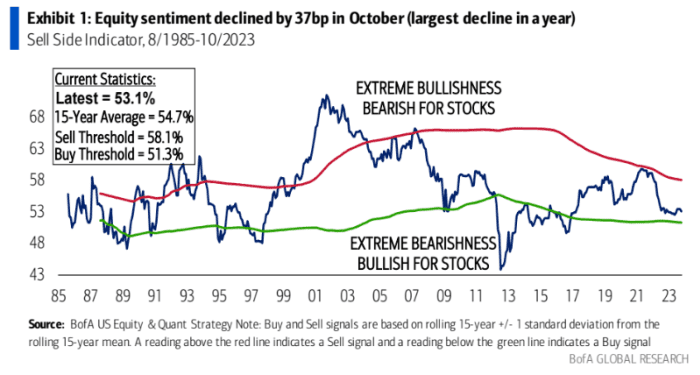

Bank of America’s sell-side sign, a gauge of Wall Street experts’ expectations for U.S. stock-market efficiency, decreased by 37 basis indicate 53.1% in October while the S&P 500 fell by 2.2%, according to a report by Bank of America’s Savita Subramanian gotten by MarketWatch on Wednesday.

The decrease represents the sign’s very first drop in belief because Might, and the most significant drop because last October. The sign is postulated on the idea that Wall Street belief is a dependable counter-indicator, indicating stocks’ tend to climb up when the gauge falls, and vice versa.

” The SSI has actually been a dependable contrarian sign simply put, it has actually been a bullish signal when Wall Street was exceptionally bearish, and vice versa. Although the sign is presently in ‘Neutral’ area (a less predictive variety than the more severe ‘Purchase’ or ‘Offer’ limits), it is even more bearish than bullish, almost 3x closer to a ‘Purchase’ signal than a ‘Offer,'” Subramanian stated.

BANK OF AMERICA.

According to Subramanian, at its existing level, the SSI jobs a 15.5% cost return over the next 12 months for the S&P 500.

SPX,

which would put the index at around 4,850, what would be a brand-new record high.

.