Stephen Brashear

In 2015, I argued financiers must offer Weyerhaeuser ( NYSE: WY) as shares would likely remain in the mid-to-upper $20’s in a year’s time, with homebuilders representing a far much better chance. That has actually played out with shares closing on Tuesday at $28.69 while homebuilders like PulteGroup ( PHM) have actually rallied significantly. Nevertheless, offered the current weak point in WY stock, and its underperformance over the previous year, it deserves re-examining its operating efficiency to see if now is a much better chance to purchase in. Eventually, I do not see shares as being engaging yet.

Looking For Alpha

In the business’s 3rd quarter, changed EPS can be found in a cent listed below agreement at $0.33. This was below $0.42 in 2015 as adjusted EBITDA decreased by $74 million to $509 million. Net sales fell from $2.27 billion to $2.02 billion. In 2021-2022, Weyerhaeuser benefited significantly from greater lumber costs; this has actually stabilized and brought incomes onto a more sustainable footing.

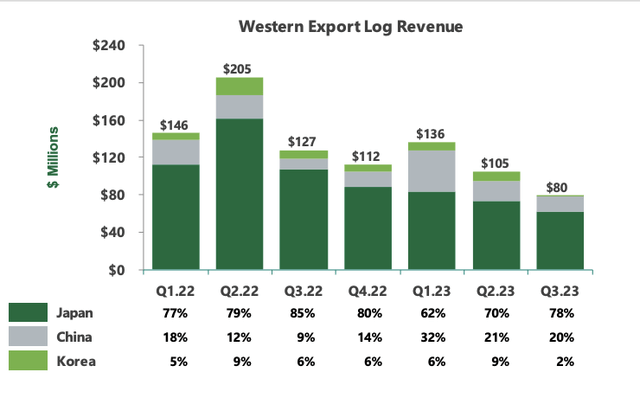

Timberlands EBITDA of $143 million fell by $29 million sequentially and was $25 million lower than in 2015 due to a weakening export market, especially to Japan. In addition, the business is dealing with greater per log expenses as salaries increase. In aggregate, 3 rd celebration awareness in the West, its biggest area, are down 25% over the previous year to $119. As you can see below, export profits has actually been up to a brand-new low with decreases throughout all 3 of its Asian end-markets.

Weyerhaeuser

The Chinese property market’s issues are popular, and a significant healing there in the near term seems not likely. The Japanese Yen has actually been falling all year to reach brand-new lows relative to the dollar. This lowers Japan’s abroad purchasing power and makes WY’s wood fairly costly. Disallowing a substantial turnaround in the yen, this is most likely to keep Japan’s need fairly soft.

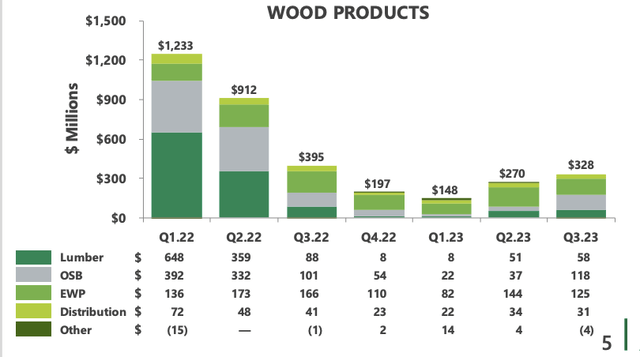

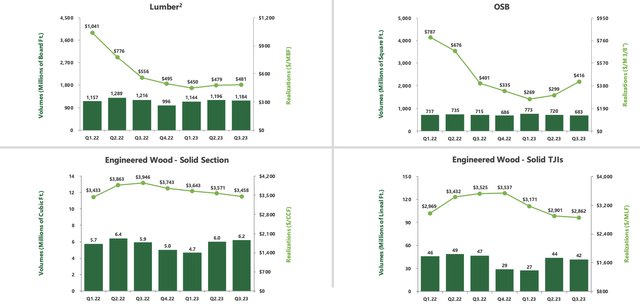

Wood items EBITDA did increase sequentially to $328 million with OSB awareness up 39%, resulting in the item’s greatest earnings of the year. Engineered items by contrast saw a small decrease in costs. As you can see below, EBITDA has actually recuperated from its Q1 low thanks to enhancement in lumber and OSB, however EBITDA stays a portion of its H1 2022 levels.

Weyerhaeuser

This is due to the fact that lumber costs have actually fallen substantially as supply chains stabilized after severe interruptions in 2021. That was taking place simply as the United States homebuilding market came roaring back triggering significant lacks and a rise in costs. Lumber costs have actually fallen by over half however appear to be supporting around existing levels while OSB costs appear to have actually discovered a bottom and crafted items continue to deteriorate.

Weyerhaeuser

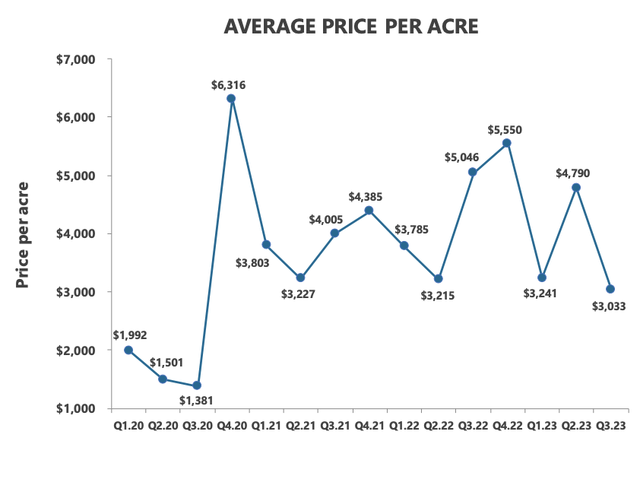

In addition to offering wood, WY likewise is constantly making purchases and sales of its land portfolio to enhance its holding. Property & & natural deposit EBITDA of $94 million was up from $70 million last quarter. This can move substantially quarter to quarter based upon what it offers. It offered 3 times as numerous acres as in Q2, however earnings just increased by 34% due to the fact that the typical list prices was the most affordable because COVID. Now as you can see below, list prices does move substantially, however offered greater rates minimizing property assessments and lumber costs being down, I believe we have actually seen the cycle highs from this sector.

Weyerhaeuser

WY is bring $1.8 billion of money and short-term financial investments. with $861 countless maturities over the next twelve months that it as pre-funded. Management targets a 75-80% payment of capital with a base dividend and after that unique dividends and/or buybacks. Its base dividend expenses $ 138 million/quarter, and management is sticking to a 5% development target through 2025 on this payment. Year to date it has actually produced $894 million in money, indicating it can disperse $693 million. With base money dividends up until now of $417 million, it has $276 million left for discretionary activity. Of that, it has actually done $109 countless typical stock buybacks, leaving $167 million at the mid point of its target.

In Q4, management anticipates comparable forests EBITDA however lower property and wood item EBITDA, indicating we are most likely to see a consecutive decrease in company-wide EBITDA. As such, I am anticipating the business to produce about $250 million in funds readily available for circulation, or $200 million to be dispersed. Deducting out its base dividend and presuming a comparable speed of $25 million in share repurchases, WY will have about $200 million left over.

This would support an unique dividend of about $0.28. Integrated with its base dividend, that would be a 3.6% yield that financiers get. Share repurchases would represent about 0.6% of the marketplace worth, resulting in a 4.2% overall capital return yield.

In a world where the 10-year treasury is yielding over 4.8%, that is not a right away engaging capital return, unless you anticipate significant future development. I have a hard time to see Weyerhaeuser providing much development. Lumber costs are revealing little momentum, and the export markets are most likely to stay soft. The costs WY gotten in early 2021 were actually the abnormality. They provided a fantastic money windfall, however this was mostly one-time, and today’s outcomes are more a sign of run-rate capital.

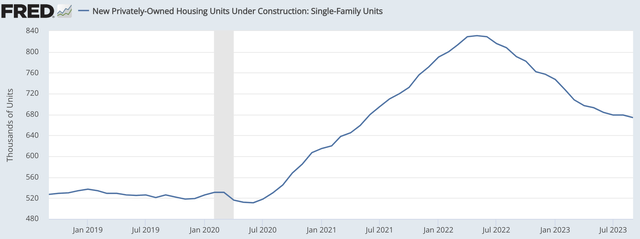

In regards to need for lumber, the variety of United States homes under building and construction has actually fallen as the contractors have actually drawn back. The rate of descent has actually enhanced noticeably, and I am of the view we are most likely to be nearing a point of stabilization, presuming home loan rates do not increase materially even more, however offered where rates and price are, I do not believe it is most likely we see a product velocity in real estate building and construction activity. Missing a boost in building and construction, we might see WY’s EBITDA stop decreasing, however it’s not likely to begin publishing significant development.

St. Louis Federal Reserve

In addition, if one wishes to bank on a strong real estate market, business like Pulte trade at 6x incomes. I would argue the homebuilders continue to mark down a much even worse environment for real estate at that several than WY at 27x incomes with a 4.2% circulation yield. Now offered its large property holdings supporting its worth, WY certainly validates trading at a greater several than contractors, however in an environment where lumber costs have actually increased the 15-20% required to get towards an 8% return, I would think of the homebuilders will likewise be doing rather well as they would be developing and offering more homes.

WY continues to seem pricing in a remarkable cyclical environment than its end-customers, which to me makes the stock as soon as again unsightly. In reality offered the weak point of its significant Asian export markets, the cyclical environment is rather even worse for WY than it had actually been. Investors are getting 4.2% this year, and I anticipate their return will be typically comparable, in between 3.75 and 4.75%, in 2024. That strikes me as uncompelling offered the unpredictability it deals with and the alternative used either by entering into the bond market or purchasing a homebuilder if one is bullish on real estate need. I anticipate to see WY still stuck in the mid-to-high $20’s in a year, and I would cost much better chances in other places.