Leon Neal/Getty Images News

Dear readers/followers,

My protection on Rheinmetall ( OTCPK: RNMBF) ( OTCPK: RNMBY) has actually been practically long-lasting here, and I have actually been an effective financier in the business, my position being up more than 60% RoR in less than 2 years. Sadly, the totality of this advantage was restricted by the truth that I did not invest “adequate” capital when business was low-cost. It’s constantly difficult – you wish to buy a brand-new business, however at what rate? Do you purchase a complete percent of your portfolio worth simultaneously? I do not. I measure thoroughly – and in some cases this implies I lose out on substantial development in business. This, regrettably, was a fine example of this.

What might have been returned in small money worths in 5 or 6 digits are rather much smaller sized, due to the fact that I size my positions thoroughly, and just rest on a reasonably little position in Rheinmetall at this specific point.

I even sold the majority of my position, understanding this earnings after the business went to evaluation heights that I do rule out to be legitimate to any degree here.

I devalued to “HOLD” in my last short article – I will not alter my position in this short article, however I will reveal you what I get out of the business.

Rheinmetall – The advantage is really challenging to see here

The business, at this time, trades at a stabilized P/E of 20x with a yield of less than 1.6%. It’s difficult to envision a circumstance where this service traded at less than 5x P/E, however this has actually held true more than when throughout the last twenty years. In truth, throughout the majority of the business’s trading history in between 2004 and 2020, you ‘d have underperformed the marketplace by buying Rheinmetall. In between 2006, prior to the GFC, and 2020, the business’s return is less than 2% annually, which is abysmal compared to the majority of indexes.

Honestly, if the Russian intrusion of Ukraine had not took place, I think that Rheinmetall would be trading at the lower evaluations we’re utilized to seeing. Thanks to these brand-new defense patterns however, the whole market has actually been altering for the previous 2 years, and Rheinmetall is an excellent example of a cyclical entered into overdrive.

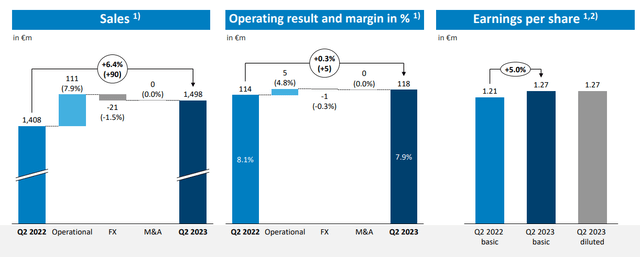

And regardless of this “overdrive” currently being carried out in 2022, the 2023E duration appears to be working out likewise. We have 2Q outcomes of 6% sales boost, an even greater running environment, and a really strong stockpile that for the very first time in a long time is above EUR30B for the business.

The business likewise just recently closed its crucial EXPAL offer, at a EUR1.2 B evaluation for pre-closing modification, which even more grows the core of business for the business.

The one drawback for the business here is a softening margin, which is never ever excellent, however can be anticipated in the present environment.

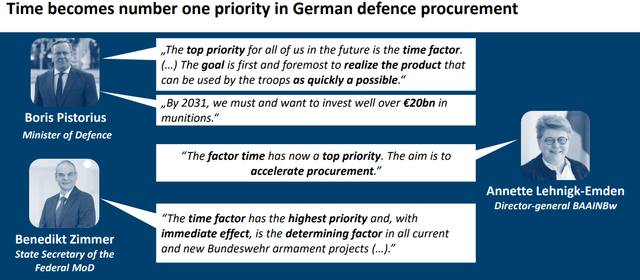

Rheinmetall’s objective is presently basic.

Rheinmetall IR (Rheinmetall IR)

It wishes to be the number # 1 option for the Bundeswehr and the German defense market. Certainly, the business is currently taking pleasure in substantial benefits from increased defense costs, not simply NATO however consisting of NATO, with Germany currently surrounding that 2% target. Procurements are currently signed, and the 2024E agreements are anticipated to drive this even greater.

Rheinmetall provides what the country is trying to find, consisting of regulation for Tanks, Weapons and Medium Calibers, tactical and logistical automobiles, Digital systems for Soldiers such as the Gladius Soldier System and D-LBO, and Air defense systems, both fixed and mobile versions.

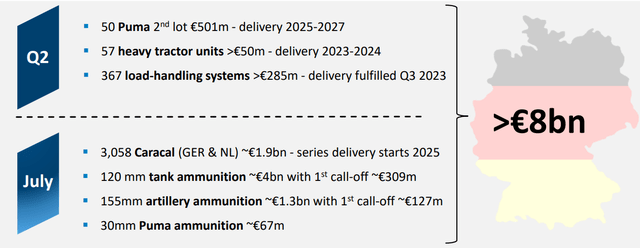

The business had the ability to tape-record substantial order boosts in 2Q, with anticipated sales boosts in 3Q also.

Rheinmetall IR (Rheinmetall IR)

Rheinmetall is likewise an XM30 finalist for the United States market, with a $700M order worth for the business, from a program size of over $45B. This is a long procurement with a long procedure to the choice. The winner is not anticipated up until completion of 2027, however it’s still an intriguing procedure to follow – considered that the business has actually been downselected with financing of $100M for Rheinmetall.

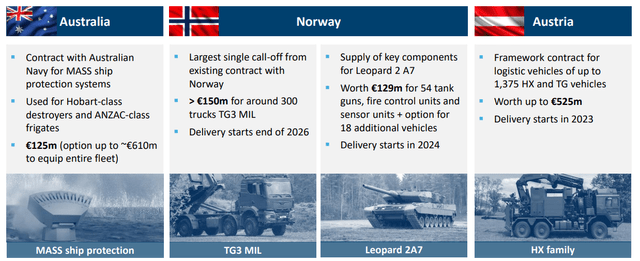

It’s not simply the German sector, however the worldwide sector also – with strong wins in Australia, Norway and in Austria.

Rheinmetall IR (Rheinmetall IR)

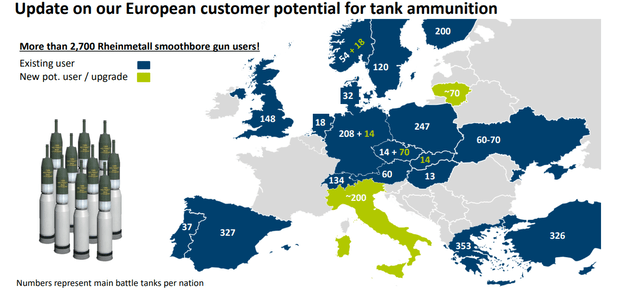

The business is likewise a significant gamer in the sector of tank munition. Rheinmetall currently has a continental market supremacy – however in the last couple of years, we have actually seeing the business broaden into Italy and into the Baltics also.

Rheinmetall IR (Rheinmetall IR)

The business is utilizing its profits and make money from its different wins and substantial boosts to R&D into emission decreases, alternative powertrains, developments, and a total overhaul and change of the Civil market sector.

Nevertheless, the total image that we’re seeing is that the business is now dealing with margin pressure from cost boosts and inflation, where sales boosts are no longer adequate to drive profits substantially greater. This still implies that the business is taping its finest 2Q ever, in history, however YoY, it’s just a small enhancement in EPS and a flat/slight softening in margins.

Rheinmetall IR (Rheinmetall IR)

This likewise pertains to that the business is substantially increasing its stocks to respond to anticipated, increasing consumer needs – we’re talking munitions, we’re talking car systems and we’re talking weapons. Prepayments rather reduced greater WC, however the business still saw increased working capital.

EXPAL is truly worth pointing out, and the resulting business financial resources following this. Following the deal, the business still has undrawn credit of practically a billion euros, along with a Baa2 from Moody’s with a steady outlook. The business has a steady financial obligation, with a net debt/EBITDA of 0.9 x, however it is very important to keep in mind that this remains in the context of the present “upcycle” EBITDA. If there is a slump in defense, then the business’s net debt/EBITDA would increase in response to this.

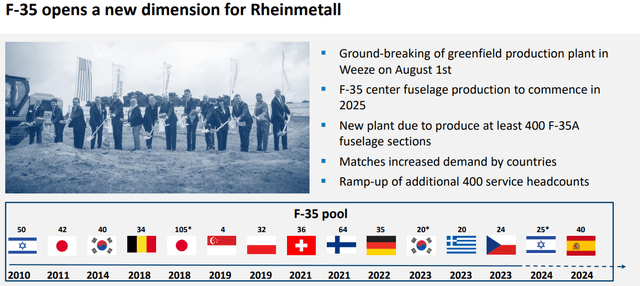

Moving forward, I see a couple of possible drivers for a growth. F-35 is among those. The business is likewise greatly investing its profits into brand-new production, brand-new R&D, and other opportunities – the CapEx is up EUR100M for this year alone, which for a business this size is substantial.

Rheinmetall IR (Rheinmetall IR)

I anticipate 3Q to be a comparable quarter to 2Q – as long as the present macro continues, I do not anticipate a substantial decline for the business at this time – however I do anticipate this increase to ultimately fade. The present price quotes consist of continued development, substantial development even, for the next couple of years. 31% in 2023, another 37% in 2024 and 23% 2025E. I think this is far too positive – unless you think that the present conflict-filled macro continues for those years, and the present need remains at present or greater levels. That’s where I think we’ll see a night out ultimately.

Let’s see how this affects the business’s evaluation.

Rheinmetall’s evaluation – Things just have an upside if you anticipate 20-30% EPS development annually

The problem with Rheinmetall is evaluation expectation. The business on a regular basis misses out on expert expectations. Statistically speaking, business profits miss out on price quotes over 35% of the time even with a 20% margin of mistake, which is well above average, with a number of misses out on of over 100%, highlighting the cyclicality of this specific service and this service sector.

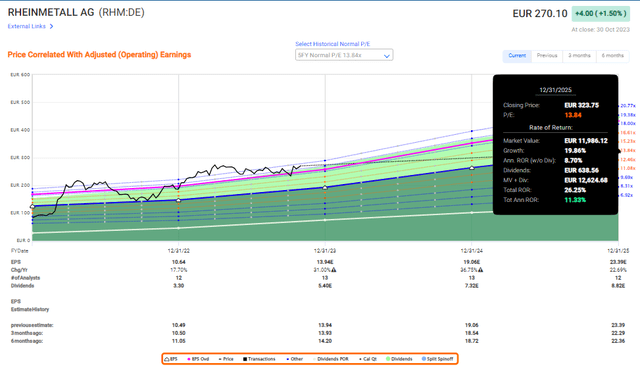

Keep in mind, Rheinmetall normally trades inexpensively. We’re talking 10-15x P/E – compared to the 20x P/E it is at presently. A 5-year average of 13.8 x implies that you’re presently in the market for a sub-15% return annually, even if these price quotes in fact emerge and the historic averages remain in any method most likely.

Rheinmetall Advantage (F.A.S.T Graphs)

The business broke through my preliminary cost target of above EUR200, above EUR225, and even beyond this. Since today, it’s at EUR270, which is well above where I think it needs to be trading over the long term.

I am since this short article keeping my share cost, however I’m likewise stating that this business is unworthy EUR250 conservatively. This environment is truly coloring and impacting how Rheinmetall is being traded, however I would be really mindful here.

This is regardless of the expert averages. S&P Global experts are providing the business a target variety beginning at EUR233 and going to EUR320/share, with average of $298. Nevertheless, regardless of this only 5 of the 12 experts are at a “BUY”, and a number of are at “underperform” here.

This indicates an advantage of 9% from the present cost – however I would call this really abundant. Rheinmetall looks for to separate its appeal mostly from the present European military circumstance and look beyond Ukraine This is an excellent thing due to the fact that it’s something they should do. I believe, nevertheless, that this procedure is since yet far from done – and I think these to be really carefully connected to a degree where I do not believe you need to be purchasing the business.

I would anticipate Rheinmetall at around 10-13x P/E over the long term, which to me would suggest the greatest possible annualized RoR of hardly double digits, and even this is, I think, based upon ongoing development in the military sector.

Combined with the business’s mediocre and reasonably unsightly yield, I do not think this to be sufficient to buy. I have actually offered the majority of my shares of Rheinmetall at an excellent earnings, and I do not think in a growth materially above EUR275/share for this business – unless something essential in the macro modifications and this business’s profits go even greater than is presently anticipated.

However at this time, this business is not a “BUY”, and entering into 3Q23, it’s a certain “HOLD”. If the 3Q report we see in over a week modifications things, I’ll upgrade things here, however for now, I enjoy with my thesis and target.

Thesis

My thesis for Rheinmetall is as follows:

- Rheinmetall is among the substantially crucial German arms and civil production business, with an attractive sales mix, fantastic margins, and direct exposure to the present circulations when it pertains to orders and costs that makes it among the most appealing plays on the German market.

- At an inexpensive evaluation, I continue to think you can produce a substantial alpha here, and you might be taking a look at 20-30% yearly RoR if the business reaches a few of the heights that appear to be indicated. However at this time, the advantage is too restricted to be thought about, due to the large prices we’re taking a look at for the business.

- I think about the business a “HOLD” with a PT of EUR200/share, downgrading my previous target given that my last short article.

Keep In Mind, I’m everything about:1. Purchasing underestimated – even if that undervaluation is small, and not mind-numbingly huge – business at a discount rate, permitting them to stabilize in time and harvesting capital gains and dividends in the meantime.

2. If the business works out beyond normalization and enters into overvaluation, I collect gains and turn my position into other underestimated stocks, duplicating # 1.

3. If the business does not enter into overvaluation, however hovers within a reasonable worth, or returns down to undervaluation, I purchase more as time enables.

4. I reinvest profits from dividends, cost savings from work, or other money inflows as defined in # 1.

Here are my requirements and how the business satisfies them ( italicized).

- This business is total qualitative.

- This business is basically safe/conservative & & well-run.

- This business pays a well-covered dividend.

- This business is presently low-cost.

- This business has a reasonable advantage based upon profits development or numerous expansion/reversion.

An upside, yes. Enough upside, no. I state “HOLD” here.

This short article goes over several securities that do not trade on a significant U.S. exchange. Please know the dangers connected with these stocks.

Editor’s Note: This short article goes over several securities that do not trade on a significant U.S. exchange. Please know the dangers connected with these stocks.