f9photos

Intro

I move my ranking on Unilever PLC ( NYSE: UL) from Hold to Purchase as the business is beginning to look more appealing under a brand-new CEO and the intro of an action strategy to improve volume development. In addition, shares appear valued at a minor discount rate of 4% to reasonable worth. For that reason, I am turning bullish on this protective giant.

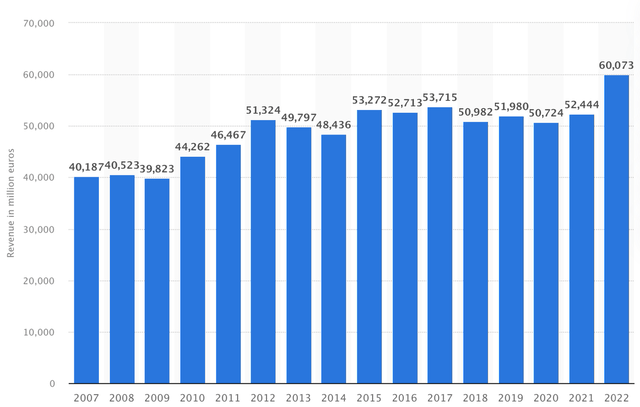

Unilever has actually been anything however an interesting financial investment over the last years, returning 20% over the last 10 years (leaving out dividends) and an unfavorable 11% over the last 5 years. Unilever has actually grown income at a really weak 1.5% CAGR over the last years, and while in part the outcome of numerous divestitures and acquisitions, this still disappoints the majority of its peers and international GDP development, which I think is the minimum development rate need to be able to anticipate from a huge international customer staples corporation.

For That Reason, this disappears than a frustrating efficiency from among the biggest durable goods conglomerates worldwide, bring a number of the world’s most well-known customer brand names like Ben & & Jerry, Magnum, Knorr, Dove, and Axe.

For those not familiar with the business, Unilever is an international durable goods business that runs in numerous durable goods market sectors, consisting of food and drinks and home and individual care items. Unilever runs in lots of nations around the world and has a substantial international existence. The business reports throughout 5 item sections: Charm and health and wellbeing, Personal Care, Home Care, Nutrition, and Ice Cream.

Now, I last gone over Unilever on Looking for Alpha a little over a year ago when I called the business a “ protective fortress” At that time, I ranked shares a hold as I might not see far more upside for the shares without some management modifications and a brand-new development method. And undoubtedly, while providing a favorable return, Unilever has actually underperformed the significant indices given that my last short article, supplying an overall return of 11.5% (consisting of dividends), sitting listed below the 14% returned by the S&P 500 (not a dreadful underperformance, though)

Nevertheless, one year on, Unilever has actually continued its strong development trajectory after reporting 14.5% development in 2022 by reporting 7.7% underlying sales development for the very first 9 months of this year, although still driven generally by rate boosts as an outcome of inflation. On the other hand, volume development has actually stayed unfavorable approximately the most current quarter, and turnover was up simply 0.4% YTD. Yet, I will get much deeper into its latest lead to a bit.

More notably, the business has, in the meantime, presented a brand-new CEO in the kind of previous Heinz executive Hein Schumacher, who has actually taken over from Alan Jope given that July 1 and might bring a fresh wind to the business, something it frantically required. The very first genuine indications of this CEO modification have actually ended up being plainly noticeable with the intro of an “action strategy” presented by the business with the release of the Q3 trading upgrade.

For That Reason, in this short article, I will take a better take a look at the business’s latest monetary outcome, business advancements, and this freshly presented action strategy to much better comprehend the business’s potential customers, assessment, and financier appeal.

Let’s get to it!

Unilever’s Q3 looked strong, however volume development stays an issue

Before entering the extremely expected action strategy, something I have actually long been waiting on, I initially wish to take a better take a look at the business’s Q3 efficiency

Unilever reported Q3 hidden sales development of 5.8% and a turnover of EUR15.8 billion, down 3.8% YoY, as the much better hidden efficiency was balanced out by acquisitions and disposals and an unfavorable 8% currency effect.

This reveals that sales development has actually been moderating over current quarters as inflation is alleviating and Unilever has actually finished the majority of the required rate boosts. As an outcome, Hidden rate development in Q3 was below 9.4% in the very first 6 months of this year to 5.8% in Q3. On the other hand, volume development stayed weak and was down 0.6%, compared to 0.2% in the very first 6 months.

This mix of advancements is what drives the downturn in development and is a rather stressing pattern as rate boosts need to moderate even more, however underlying volume development is up until now revealing little enhancement sequentially.

Nevertheless, the development we saw in the last 2 years of mid-teens and high single-digit development is not a practical expectation. Ultimately, development will moderate to the more practical low to mid-single digits. It is safe to presume development will continue tipping over the next couple of quarters as rate boosts continue to moderate, however volume development will turn favorable once again by the end of the year. As an outcome, development must stay within management’s long-lasting targeted series of in between 3% and 5%, although ongoing customer weak point might lead to volumes staying reduced for longer.

Taking a look at the specific sections, Charm and Wellness and Personal Care provided well balanced volume development of 3.6% and 3.9%, partially thanks to these sections consisting of items that are less conscious the reduction in customer costs power. In mix with ongoing rate boosts, these sections saw underlying sales boost by 7.4% and 8%.

Home Care likewise went back to favorable volume development in Q3 of 0.4%. With costs up 5.4%, this sector saw underlying sales development of 4.8% YoY. Up until now, so excellent.

Yet, the Nutrition and Ice Cream sections continued to see volumes pushed in reaction to high input expense inflation, particularly in Europe. These sections are usually much more discretionary and experience lower prices power. Whereas individuals tend to be really near their normal charm brand names or antiperspirant, we can not state the very same about their ice cream.

Volumes in Nutrition stayed down 3.8% YoY, bringing overall development to 5.6%. Volumes in Ice Cream were down 10.1% as costs increased 8.2%, leading to unfavorable hidden sales development of 2.8%. This sector must rebound in the next couple of quarters as rate boosts moderate.

In general, in regards to top-line development, it was a really decent quarter for Unilever with good hidden sales development, however plainly the business continues to depend greatly on rate boosts to drive this development, and even as these moderated, volumes did not react appropriately.

Concerning this, there are 2 points worth highlighting. For one, while Unilever (and its peers, for that matter) are frequently slammed for the truth that development is mainly being driven by rate boosts instead of volume development, completely highlighted by the last 3 years, I think Unilever likewise should have a compliment for its efficiency over this duration.

The business revealed its outstanding prices power and the non-discretionary nature of its items as it had the ability to grow its leading line and balance out inflationary pressures in a really difficult environment. The business’s strong portfolio of brand names, which are utilized every day by billions of individuals is offering the business extraordinary prices power and resiliency, which is exactly what makes this business such a luring financial investment – no matter the financial environment or macroeconomic headwinds, one can be sure of Unilever to keep its leading line strong.

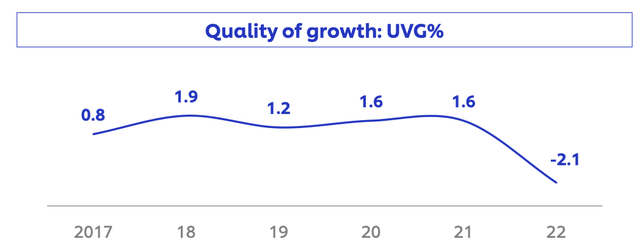

Yet, going back to the topic of its reliance on prices power, this is in fact something financiers need to fret about. Unilever has actually reported volume development of listed below 2% every year for the majority of the last years, with prices undoubtedly being the primary factor of development, something which must preferably be the other method around. It is this weak volume development that has actually mainly triggered Unilever’s underperformance over the last years. With no significant method modifications originating from the management group, I am not anticipating this to alter regardless of it having an unbelievable brand name portfolio. Favorably. management acknowledges this issue as highlighted by this quote from CEO Hein Schumacher throughout the incomes call:

Taken control of the last 6 years, volume development has actually been lagging.

Unilever YoY volume development ( Unilever)

However what triggers this structurally frustrating volume development? Basically, the business’s income stream is looking very excellent and low threat. Obviously, the business has its strong branding, which meaningfully reduces threat, as interacted in the past, however its income stream is likewise incredibly well varied throughout end markets, with not a single sector accounting for over 24% of turnover.

The business is likewise perfectly diversified in regards to local direct exposure, with its biggest area in regards to sales– the Asia Pacific Africa area – representing just 43% of turnover, The Americas for 36%, and Europe for 20%. In addition, the business has 40% direct exposure to emerging markets, and while this income may be viewed as riskier and more unpredictable, it likewise usually is quicker growing due to growing wealth in these areas, improving development for the corporation as a whole.

So, in regards to income diversity, the business is looking truly excellent and de-risked, additional strengthening its protective character.

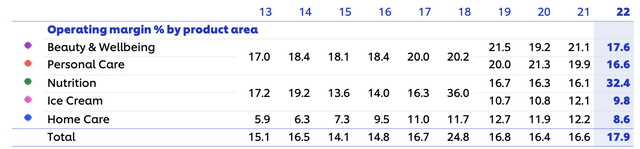

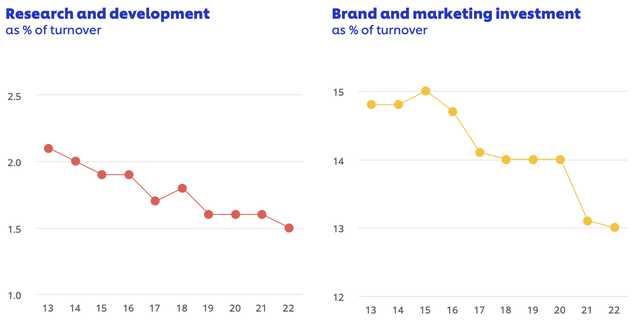

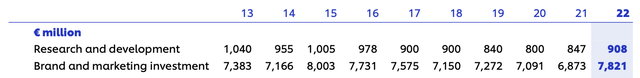

Yet, what looks less excellent are the business’s R&D and brand name and marketing financial investments, which have actually been trending down over the last years as a portion of turnover. Likewise in regards to EUR, the FY22 R&D and brand name and marketing expenditures were sitting listed below 2016 and 2015 levels. While reducing these expenditures has actually operated in favor of the business’s margins, I strongly think this has actually cost it in regards to volume development as Unilever plainly stops working to get the most out of its brand names.

Unilever monetary information ( Unilever) Unilever monetary information ( Unilever)

There is a lot to get here for the business. I think its success over the next years will mainly depend upon its execution on this front, which will need more substantial financial investments in branding and R&D. Fortunately, management has actually lastly presented a clear action strategy to take this one, making me a little more positive in the business’s future volume development.

However before we relocate to this strategy, let’s rapidly take a look at fundamental advancements.

The margin pattern is strong as margins stay best-in-class

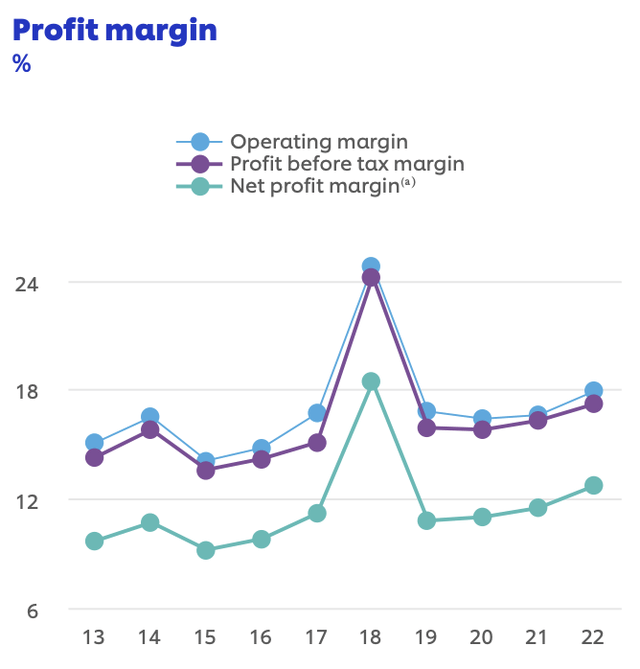

The business’s margin profile has actually been all over the location over the last years. Still, it has actually been on an enhancing pattern just recently, with operating and earnings margins growing progressively over the last 2 years as Unilever had the ability to balance out inflationary pressures.

As Unilever does not supply any fundamental insights with the Q3 trading upgrade, we will need to take a look at the H1 results for the most current information, and this revealed some strong margin enhancements.

The H1 operating margin broadened by 290 basis indicate 18.1%, additional trending up from the 17.9% reported for 2022 and sitting at the greatest level given that 2018, leading to a 22.6% boost in running earnings. Yet, the earnings margin decreased a little YoY by 80 basis indicate 12.8%, triggering a minor dip in a strong enhancing pattern. Omitting the 2018 standout year, Unilever has actually progressively enhanced margins. I see no factor for this not to continue over the next couple of years, although perhaps at a somewhat slower rate, as the business will be concentrated on increasing R&D and marketing expenditures. Still, margins stay best-in-class, and I see 30-50 basis points of margin growth every year as a practical target here.

Unilever margin advancement ( Unilever)

Management presented a brand-new action strategy and it’s looking appealing

Together with the Q3 trading upgrade, CEO Hein Schumacher likewise presented a brand-new action strategy to mainly improve underlying volume development and enhance the gross margin as both have actually been lagging in the last few years. While the strategy did not get a warm welcome from financiers with a drop in the share rate following the statement, I rather like the strategy as it acts upon my primary issues.

As I have actually specified in the past, Unilever, under the hood, is a fantastic business with a magnificent collection of extraordinary customer brand names, of which 80% hold the number 1 or 2 position in their particular classifications and are utilized by around 3.4 billion individuals daily. In addition, while R&D financial investments as a portion of turnover have actually been falling the business still holds 20,000 patents, highlighting its level of development. Plainly, the business has excellent prospective, and this brand-new action strategy is created to emerge this.

To improve hidden volume development, management talked about several elements that it intends to enhance, with the most crucial being concentrating on its leading brand names, increasing R&D and task size, and increasing brand name and marketing financial investment and return.

Beginning with the concentrate on leading brand names, management discussed that it wishes to focus resources on its leading 30 brand names as these represent 70% of turnover and are vital chauffeurs of volume development due to their brand name strength. Through this, management intends to enhance its portfolio. These 30 brand names consist of the EUR1 billion club, like Dove, Magnum, and Hellmann, and 16 other brand names that have the most prospective to join them, like Cif, Vaseline, Liquid I.V., and Nutrafol.

Unilever focus brand names ( Unilever)

While this prioritization resulted in some blended responses from experts, I prefer this relocation as I highly think that Unilever requires to utilize these strong brand names to drive more remarkable development. The very best method to do this is by focusing resources on the most appealing ones. Likewise, management made really clear that it does not plan to leave the staying brand names underinvested or to divest these however just wishes to focus the majority of the resources on its most appealing chances to be able to much better complete in these markets and enhance execution to drive volume development. Ultimately, it may be an excellent relocate to divest the staying underperforming brand names with time, however management is not going for this at this time.

Second Of All, to additional drive volume development, management intends to increase development task sizes, as these have actually shown to be too little in the past, leaving Unilever not able to innovate in line with the competitors. For that reason, management now focuses on multiyear scalable programs that drive classification development. Job sizes have actually currently tripled given that 2020, however management go for another doubling of task sizes in the near term to drive more significant item development, which seems like a fantastic top priority to set, as Unilever requires to capture up here. If management carries out these strategies properly, I see meaningfully more prospective for volume development ahead.

These bigger task sizes will be supported by regularly growing the R&D financial investment, pressing Capex to above 3% of turnover from simply 2.4% in the last 3 years. As I showed previously in the short article, this is what I wished to see from Unilever, and management appears to provide with R&D development. This improves my medium-term volume development expectations.

Turning to the next and last development lever, management wishes to increase the outright brand name and marketing financial investment level to optimize brand name capacity. This is what management included:

This is a need to however we will likewise make sure that our brand name and marketing financial investment invest is more focused with intentional allotment behind larger platforms, more constant, completely moneying our power brand names, more digital and more efficient increasing returns of marketing invest.

This is another excellent relocation, and I am grateful to see management acknowledging and acting upon the truth that it has actually not been taking full advantage of brand name capacity over current years as an outcome of decreasing marketing and R&D spending plans. With this pattern now reversing, I anticipate this to favorably affect volume development in the medium to long term. Yes, it may take a number of years for this to emerge however the objective is excellent.

Likewise, with this shift to concentrate on its high-end brand name portfolio, R&D, and marketing, management will downsize on M&A activity. Management acknowledges that previous acquisitions have not constantly exercised and wishes to up the bar, implying acquisitions are not out of the concern however will take place less regularly and will be of greater quality. In addition, no significant or transformational acquisitions are anticipated in the foreseeable future, which I deem another favorable at this time.

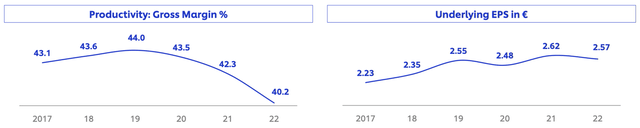

The 2nd part of the action strategy intends to stop the gross margin decrease and begin recuperating it in the next couple of years through a concentrate on net performance rather of development cost savings, which has actually been keeping back the business in the last few years.

Unilever monetary information ( Unilever)

This brand-new focus will extend throughout all P&L lines like product expenses, through competitive purchasing, worth chain interventions, and item reformulations. Likewise, relating to production and logistics expenses, the business has actually set difficult targets to lower the expense per system produced, adding to a healing of the gross margin, which need to indirectly lead to a faster-growing EPS also.

Management has yet to set direct gross margin targets, which I discovered frustrating as I expected management to set clear targets. Throughout the discussion, while clear in objectives and actions, I missed out on a number of strong targets and timeframes, which suggests the strategy isn’t really strong yet.

Obviously, this makes good sense as the brand-new CEO has actually just been active for a number of months. Nonetheless, up until now, Hein Schumacher has actually impressed me with his actions and commentary and makes me rather more positive of Unilever’s development capacity.

Outlook & & UL stock assessment

Following the Q3 results, management left the FY23 outlook the same and anticipates underlying sales development to be above 5%, with rate development continuing to moderate. I anticipate volume development to stay unfavorable in Q4 as an outcome of weak customer costs power and underlying sales development to moderate to a 3-5% level.

In addition, we can anticipate a modest enhancement in underlying operating margin as the healing in gross margin is reinvested in marketing invest, in line with management’s action strategy.

Searching to next year, I anticipate ongoing customer weak point to lead to volumes staying reduced for longer, which, integrated with moderating rate boosts, will put FY24 underlying sales development under pressure and sit at the low end of management’s targeted variety.

Integrated with a boost in R&D and marketing invest, I anticipate margins to likewise fall a little, putting pressure on EPS. I anticipate FY24 to be a tough year for Unilever due to a mix of elements, however this need to recuperate from the 2nd half of the year and into 2025. In the long term, I have actually ended up being more positive in Unilever’s development outlook, which I think need to ultimately sit at the high-end of management’s assisted variety (USG of 3-5%), with EPS growing even quicker due to a gross margin healing resulting in margin growth. As an outcome, I predict long-lasting EPS development at high-single digits.

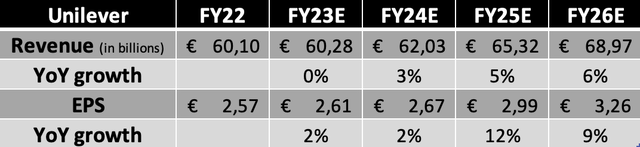

These expectations lead to the following monetary forecasts.

Monetary price quotes ( By Author)

Based upon these price quotes, Unilever shares are presently valued at a forward P/E of 17x or at a 14% discount rate to its 5-year average. Probably, the business is looking much better than 5 years ago regardless of a tough FY24 ahead.

In Addition, if we compare this to peers in the charm and home items market along with other customer staple business, we can see that Unilever is priced rather positively compared to its protective equivalents. On the other hand, its existing assessment sits approximately in line with the market average.

In General, with the business revealing enhancements in the underlying service, having a brand-new CEO, and a (a little uncertain) action strategy, I think shares hold rather some worth and Unilever might be an outstanding worth play from this explain.

Basically, Unilever has actually constantly been a luring financial investment alternative due to the need of its items in the every day lives of billions of individuals, the protective nature of its operations, and its extraordinary brand name portfolio. Nevertheless, execution over the last years has actually been far from perfect, and this now appears to be reversing, or a minimum of, it is preparing to.

For That Reason, I am granting shares a reasonable worth P/E of 19x, still sitting a little listed below its 5-year average as threats stay and a genuine volume development turn-around is yet to emerge. Still, based upon my FY24 EPS price quote and a 19x P/E, I determine a target rate of EUR51. From an existing share rate of EUR44.70, I think financiers are poised for double-digit returns, even when leaving out the really good dividend, which presently yields near 4%, above the majority of its peers, and making this an interesting financial investment chance for those who think in a development turn-around.

For that reason, I moved my ranking on Unilever shares to Purchase from Accept a rate target of EUR51.

Editor’s Note: This short article goes over several securities that do not trade on a significant U.S. exchange. Please know the threats connected with these stocks.