winhorse

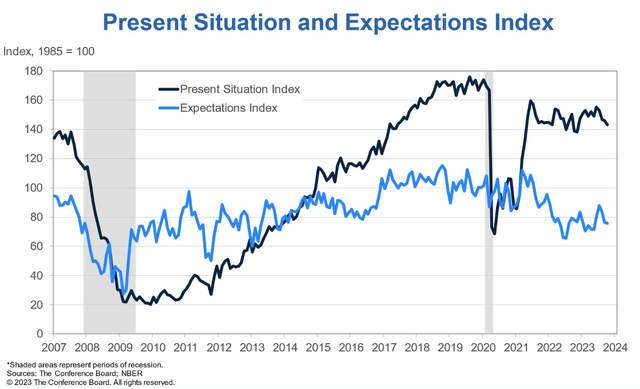

The customer continues to invest, however Americans stay unpredictable about what lies ahead. That has actually been the basic mantra over the last a number of quarters when evaluating Retail Sales report patterns and studies such as the regular monthly University of Michigan report and the Conference Board’s Customer Self-confidence study.

Amidst this blended customer background, I have a buy ranking on American Express ( NYSE: AXP). I see the stock as underestimated after its high 2022 decrease and warm rally compared to year-ago levels. Profits are on the increase regardless of possible headwinds next year.

19.1% of customers stated organization conditions were “excellent,” below 21.0% in September

According to Bank of America Global Research Study, American Express is a totally incorporated payments business. It is a card provider, payment network, and merchant acquirer. The business supplies charge and charge card to customers and organizations, straight and to a much lower degree through bank providing partners throughout the world. It likewise runs an international merchant getting and card processing network.

The New York-based $106 billion Customer Financing market business within the Financials sector trades at a low 13.7 routing 12-month GAAP price-to-earnings ratio and pays a near-market 1.6% forward dividend yield. Following its October profits release, shares trade with a modest 21% suggested volatility portion while brief interest on the stock is low at 1.1% since November 1, 2023.

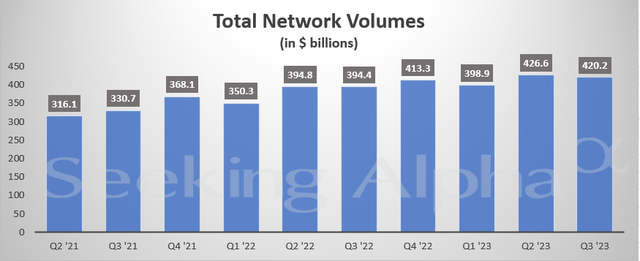

Last month, AXP reported a strong quarter with non-GAAP profits validating at $3.30, substantially ahead of the $2.94 agreement quote. Earnings of $15.4 billion was up more than 13% from year-ago levels, however normally in line with expectations. General card costs was stated to be strong by the management group with overall network volumes of $420.2 billion, a 7% yearly dive

The quarter sufficed to require a multitude of expert upgrades. Piper Sandler raised its outlook on the charge card giant from Underweight to Neutral provided the evident rates in of slower 2024 development ahead. AXP’s underperformance relative to its sector was likewise viewed as exaggerated. Similarly, Citi experts turned less cynical on American Express quickly after the Q3 profits statement provided strong customer costs patterns considering that the summer season and the company’s impressive resiliency.

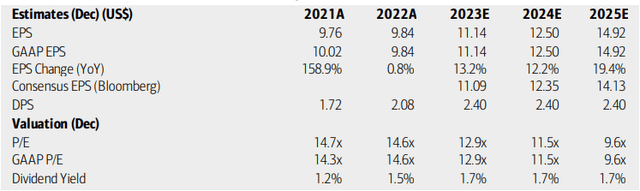

Overall Network Volumes Up YoY

On appraisal, BofA sees profits increasing at a low double-digit portion clip in 2023, which robust EPS development is anticipated to continue through the next 2 years. The Bloomberg agreement projection has to do with on par with what BofA sees, with EPS ultimately increasing above $14. Dividends, on the other hand, are viewed as holding consistent at $2.40 – the company’s low totally free capital yield might not require considerable extra investor accretive activities. Still, AXP trades with low profits multiples thinking about the development trajectory.

American Express: Profits, Assessment, Dividend Yield Projections

If we appoint a revenues multiple that is better to the marketplace’s average (16) and presume a stabilized EPS of $12, then the stock ought to be near $192. I assert that robust fundamental development, above the S&P 500’s typical, warrants a minimum of a mid-teen P/E. Furthermore, AXP’s 5-year typical operating profits multiple is not far from 19. Lastly, the forward PEG ratio is simply near 1 today – a deal compared to the SPX’s 1.8 average.

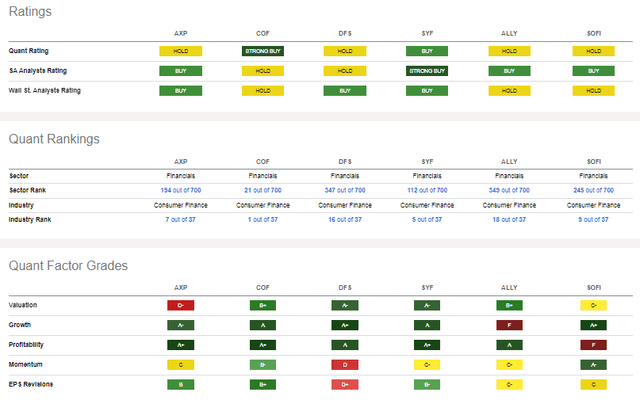

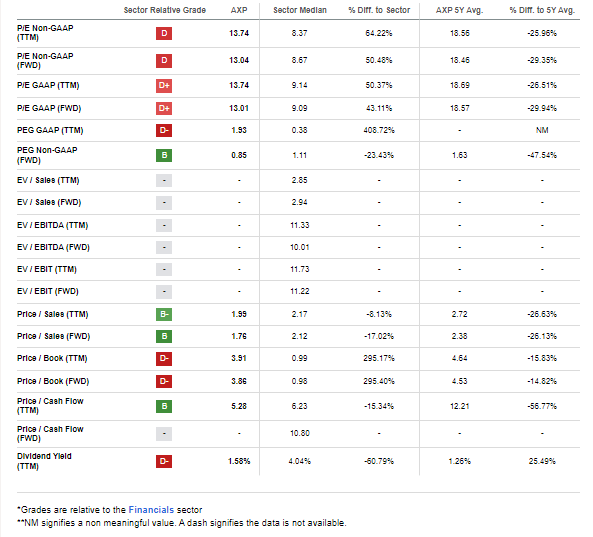

AXP: Affordable Profits Multiples, Lower Yield Vs Its Sector

Looking For Alpha

Compared to its peers, AXP has a rather deceiving D- appraisal grade while other companies are priced much lower. AXP’s higher-end customer base might provide some defense compared to higher-risk card names like Capital One ( COF) and Discover ( DFS). The company’s strong and constant predicted profits development and favorable success history must require a greater appraisal. While share-price momentum has actually damaged in current months, EPS modifications have actually been to the silver lining considering that the company last reported quarterly outcomes.

Rival Analysis

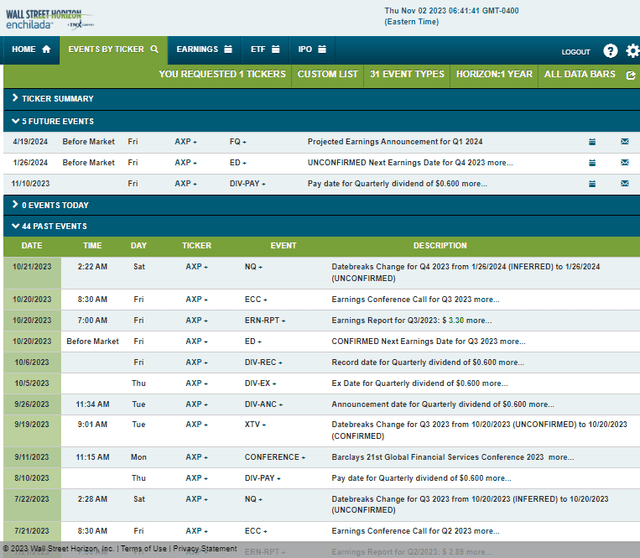

Looking ahead, business occasion information supplied by Wall Street Horizon reveal an unofficial Q4 2023 profits date of Friday, January 26 BMO. No other volatility drivers are seen on the calendar.

Business Occasion Threat Calendar

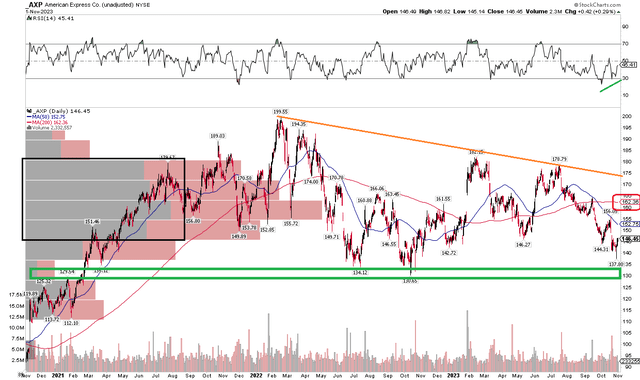

The Technical Take

With a robust development outlook and low-cost outright appraisal (though not as bottom-of-the-barrel as its lower-end peers), the chart continues to suffer. Notification in the chart listed below that shares are stuck in a combination pattern with crucial assistance in the $130 to $135 variety. That is an essential zone for this big cap to hold as a breakdown under that location would hint a substantial additional decrease. I discovered that the pre-COVID high of $138 additional highlights the value of that assistance variety.

The next layer of possible assistance would be near the 2014 peak of $96. Presuming AXP bulls safeguard assistance, then I see upside resistance at a drop line off the $199.55 all-time high notched in early 2022, which presently enters into play around $175, a little listed below my intrinsic worth rate target. Likewise have a look at the considerable quantity of volume by rate in the $145 to $180 zone – that will likely produce difficult slogging for the bulls on rally efforts. Furthermore, the long-lasting 200-day moving average has actually turned flat after increasing for much of the previous year. On the bullish side, nevertheless, is a favorable RSI divergence as seen in the indication at the top of the chart – a rally through the 50dma would assist provide credence to the concept that a near-term bottom remains in which a year-end rally can start.

In general, the chart is not all that remarkable provided the drop considering that early in 2015, however shares stay above essential assistance levels.

AXP: Shares Holding Multi-Year Assistance

The Bottom Line

I have a buy ranking on American Express. I see the stock as underestimated provided its modest profits multiples and strong EPS development potential customers. The technical scenario is not excellent, however the stock is above an essential assistance location.