NoDerog

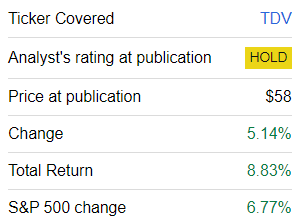

ProShares S&P Innovation Dividend Aristocrats ETF ( BATS: TDV) uses direct exposure to premium, recognized tech dividend development stories. It has actually been a while given that I covered this financial investment car. The previous note was released in April 2021, throughout the prime time of the capital rotation and practically a year before the start of among the most aggressive tightening up cycles in U.S. history. Ever since, in spite of many headwinds, specifically throughout an absolutely difficult 2022, TDV has actually provided a rather strong overall return of 8.8%.

Looking For Alpha

The function these days’s note is to examine TDV’s existing portfolio structure and its direct exposure to design elements, consisting of worth, development, and quality, to choose whether the ETF is worthy of a more positive score this time than simply a Hold.

TDV’s technique: leading tech dividend development stories

According to the ProShares site, TDV’s financial investment required given that its beginning in November 2019 has actually been tracking the S&P Innovation Dividend Aristocrats Index. The technique focuses on resistant, resilient dividend development stories in the tech sector. More particularly, the standard

targets business from infotech, web and direct marketing retail, interactive home entertainment, and multimedias and services sections of the economy. To be consisted of in the index, a business should have increased dividend payments each year for a minimum of 7 years, and its shares need to be noted on a U.S. nationwide securities exchange and satisfy particular minimum liquidity and other requirements.

All the constituents are appointed equivalent weights, most likely to guarantee appropriate diversity and prevent unneeded disproportions in direct exposure, which, in turn, might alter returns. Significantly, the index should consist of a minimum of 25 stocks, and in case the target can not be reached, the dividend development requirement is unwinded. The standard is rebalanced 4 times a year (January, April, July, and October); it is reconstituted just in January.

The element story

Since October 31, the TDV portfolio included 37 stocks, with the significant holding being International Company Machines ( IBM), with a 2.9% weight. Presuming it has actually been more than 2 and a half years given that the previous protection, TDV has actually not altered much. More particularly, my estimations revealed that the portfolios have around 81% overlap as 7 holdings were included given that April 2021, while 8 were gotten rid of.

What does TDV deal in the existing version relating to elements? I see a minor worth tilt and outstanding quality, yet rather suppressed development.

| Metric | 31-Oct |

| Market Cap | $ 224.86 billion |

| EY | 5.17% |

| EBITDA/EV | 6.26% |

| Money Flow/Price | 5.32% |

| P/S | 5.02 |

| EPS Fwd | 5.46% |

| EBITDA Fwd | 4.55% |

| Earnings Fwd | 5% |

| ROA | 12% |

| ROE | 38.4% |

| ROTC | 15.6% |

| FCF Margin | 17.9% |

Computed utilizing information from Looking for Alpha and the fund. Financial information since November 1

- Uncoincidentally, with the 2 members of the $2 trillion league present, particularly Apple ( AAPL) and Microsoft ( MSFT), TDV has a weighted-average market cap of near to $225 billion, even in spite of its considerable direct exposure to the little & & mid-cap tiers (26.7%). Technically, there is even one micro-cap in the mix, Cass Info Systems ( CASS), a 6% yielding stock with around $108.3 million in market cap (since November 1).

- Clearly, a revenues yield of 5.17% looks healthy for a tech-centered equity mix, specifically given that the iShares Core S&P 500 ETF ( IVV) is using just ~ 4.7%, while the Invesco QQQ Trust ETF ( QQQ) is trading with an even thinner EY of ~ 3.7%.

- To offer a bit more color on which parts did add to this outcome, I need to discuss Avnet ( AVT) and Vishay Intertechnology ( VSH), which have an 18.2% and 13.6% EY, respectively.

- Besides, EBITDA/Enterprise Worth (in some cases described as a ‘debt-adjusted revenues yield’) and the money yield both likewise look more than appropriate.

- Nevertheless, I still see a problem here. More particularly, less than 22% of the holdings have a B- Quant Appraisal grade or greater, while 62.4% are relatively miscalculated. I think this is too little, presuming all the unpredictability relating to rates of interest.

- A 5x Price/Sales ratio likewise looks unpleasant, thinking about the IT sector has an average of 2.36 x.

| Criterion | 31-Oct |

| Quant Appraisal B- or greater | 21.6% |

| Quant Appraisal D+ or lower | 62.4% |

| Quant Success B- or greater | 91.7% |

| Quant Success D+ or lower | None |

- It is vital to keep in mind that TDV does provide an outstanding quality story, with none of the holdings having a Success grade weaker than C. Portfolio-wise capital performance signs are likewise informing, specifically the Return on Overall Capital of 15.6%.

- FCF is of vital value for dividend-growth portfolios. And here, TDV can justly take pride in its weighted-average FCF margin. On the other hand, simply 3 business are FCF-negative: CASS, AVT, and Texas Instruments ( TXN).

- Unfortunately, development is primarily a dissatisfaction, with forward EPS, EBITDA, and income development rates just in the mid-single digits. A couple of critics to discuss are Cognex Corporation ( CGNX), which is anticipated to provide a 10% decrease in EBITDA, and Power Combinations ( POWI), with its 5.3% expected income decrease.

Taking a look at the dividend qualifications

Dividend financiers who prefer consistency and development will be happily amazed by TDV’s portfolio. Nevertheless, those looking for market-leading yields to enhance their earnings would likely offer the ETF a cold shoulder. The factors exist listed below:

| Yield TTM | 3-Year Div CAGR | 5-Year Div CAGR |

| 1.94% | 10.51% | 11.95% |

Computed utilizing information from Looking for Alpha and the fund

Definitely, a weighted-average yield of less than 2% is just small for the existing environment, even presuming the portfolio uses double-digit dividend CAGRs, boosted by business like Microchip Innovation ( MCHP).

| Stock | Weight | 3Y Div |

| Microchip Innovation ( MCHP) | 2.6% | 26.28% |

| Power Combinations ( POWI) | 2.7% | 22.80% |

| Amphenol ( APH) | 2.8% | 18.88% |

| Oracle ( ORCL) | 2.8% | 16.55% |

| Lam Research Study ( LRCX) | 2.7% | 15.97% |

Expectedly, practically 84% of the holdings have a B- Quant Dividend Development grade or more powerful. Roper Technologies ( ROP) has the longest dividend development story in the group: in November 2022, it notched its 30th year of constant DPS boosts.

More on efficiency

Throughout the December 2019– October 2023 duration, TDV provided an overall return that was absolutely nothing except strong, as it sturdily beat both the ProShares S&P 500 Dividend Aristocrats ETF ( NOBL) and IVV, partially thanks to its extraordinary efficiency in 2020.

| Portfolio | TDV | IVV | NOBL | QQQ |

| Preliminary Balance | $ 10,000 | $ 10,000 | $ 10,000 | $ 10,000 |

| Last Balance | $ 15,484 | $ 14,204 | $ 12,389 | $ 17,528 |

| CAGR | 11.81% | 9.37% | 5.62% | 15.41% |

| Stdev | 21.42% | 19.42% | 19.01% | 23.17% |

| Finest Year | 29.02% | 28.76% | 24.63% | 48.40% |

| Worst Year | -15.92% | -18.16% | -6.51% | -32.58% |

| Max. Drawdown | -23.60% | -23.93% | -23.23% | -32.58% |

| Sharpe Ratio | 0.55 | 0.47 | 0.29 | 0.66 |

| Sortino Ratio | 0.88 | 0.71 | 0.44 | 1.07 |

| Market Connection | 0.96 | 1 | 0.93 | 0.91 |

Information from Portfolio Visualizer

It was not able to equal QQQ. However, the Nasdaq-100 index-tracking fund still had a greater basic variance than TDV, a considerably much deeper max drawdown, and much weaker efficiency in 2022 (its worst year in the duration, a 32.58% decrease).

Last ideas

TDV is an outstanding choice for financiers looking for dividend sturdiness, consistency, and development in a tech-heavy portfolio. Its constituents have outstanding capital performance and primarily massive totally free capital. The overall returns it provided in the past deserve valuing.

The crucial problem with this car is inadequate worth direct exposure, which is currently apparent from the dividend yield of simply 1.42% So, TDV is more of an overall return play for financiers preferring top-notch tech stories. Nevertheless, they need to comprehend that a 45 bps cost ratio will regularly consume into returns.

All things thought about, I choose to stay on the sidelines this time, with a conservative Hold score preserved.