ValeryEgorov

Step one: Wide-moat stocks with 5-star and 4-star scores

Historic proof states that while quality alone is a bad sign of outperformance, when integrated with a good appraisal filter, Morningstar’s moat ranking shows to be more than beneficial. Based upon the offered information, stocks with a wide-moat ranking that likewise suit the 4- or 5-star classification should have to be the topic of additional analysis. See the comprehensive description and the hidden proof of our primary step in this short article

We concentrate on those business that are covered by a Morningstar expert as appointing a wide-moat ranking without extensive analysis is a doubtful practice in our viewpoint. Since January 8, there were 79 worldwide wide-moat stocks satisfying our requirements (the same from last month).

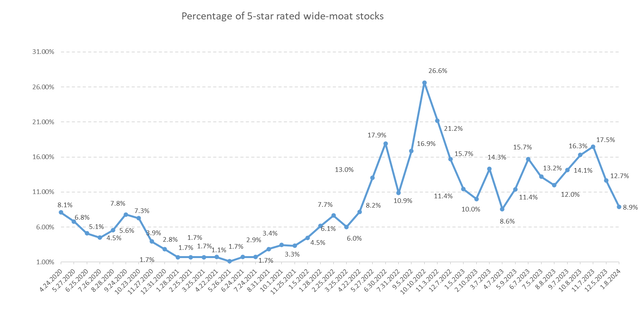

Just 8.9% (7 stocks) of this wide-moat group made a 5-star (most appealing) appraisal ranking. Here are they:

Our company believe that the portion of 5-star-rated wide-moat stocks is an excellent sign of market belief When this portion is high, even the very best business are on sale. When the portion is very low, market conditions might require care. (Please keep in mind that this is not a sign for market timing!)

Source: Information from Morningstar. Dataset after 12/2022 just consists of worldwide stocks.

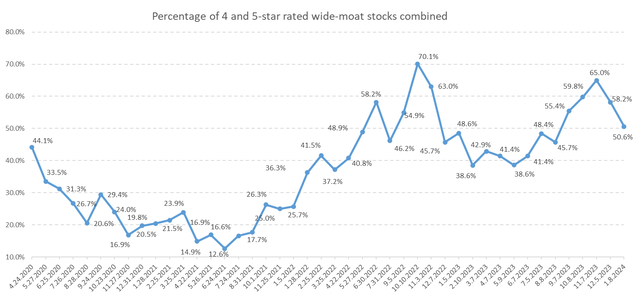

As these finest of type business might deserve a better look even when they are simply a little less expensive than their reasonable worth however are not in the deal bin, we likewise note the 4-star-rated wide-moat stocks since January 8:

All in all, we have 40 companies that pass our extremely first requirements.

Source: Information from Morningstar. Dataset after 12/2022 just consists of worldwide stocks.

Step 2: Historic appraisal in the EVA structure

Our company believe that the most commonly utilized appraisal multiples are extremely flawed. See this short article on why we think about the Future Development Dependence metric the best-of-breed belief sign that deals with accounting distortions, therefore provides us a real image of which wide-moat business appear magnificently valued in historic terms. We wish to purchase our high-grade targets when the baked-in expectations are low, because that is when unexpected on the benefit has the greatest possibility. As financial investment is a video game of likelihoods, all we can do is stack the chances in our favor as much as possible.

14 of the 40 stocks endured this 2nd action Here’s the list:

We are rather stringent when it pertains to historic appraisal. There are stocks that certainly stop working both our brief- and long-lasting tests. There are some targets, nevertheless, that might look magnificently valued if you just concentrate on the short-term (like the last 5 years), however the longer you zoom out, the more you lose your cravings. It boils down to individual choice where you fix a limit. For us, just those stocks are enabled to appear on the heat map in our 3rd action that appear magnificently valued in both a short-term and long-lasting context. (We return as far as twenty years, determine averages and typicals on various amount of time and let our algorithm do the callous work.)

Action 3: The heat map of the most investable wide-moat stocks

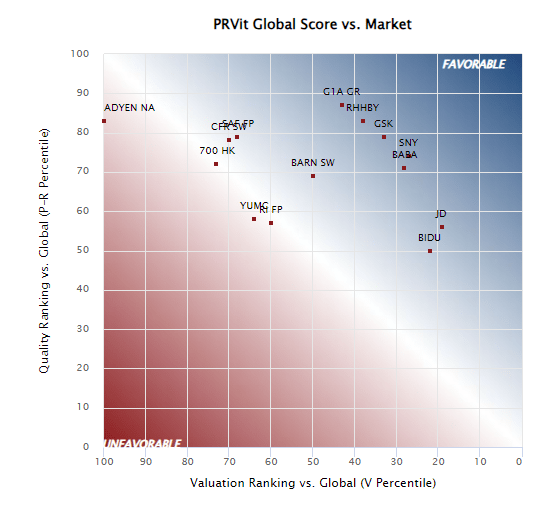

Seeing the stocks of our shortlist on a heat map with a quality and appraisal axis is something that can show extremely beneficial when we require to decide on which prospects to examine completely. As described in our previous short article, we utilize the PRVit (Performance-Risk-Valuation financial investment innovation) design of the EVA Dimensions group.

All in all, PRVit is a multifactor quantitative stock choice design based upon EVA-centric procedures of Efficiency, Danger, and Appraisal. It initially approximates the essential worth of a business based upon its risk-adjusted EVA efficiency (revealed on the vertical axis) and after that compares it to its real appraisal (revealed on the horizontal axis). All consider this design were picked heuristically based upon sound judgment, and not by information mining, yet strong and statistically substantial backtests show the stability of the PRVit method both in the U.S. and internationally. ( See the information here)

Here is the heat map since January 8:

Source: Institutional Investor Solutions Inc.

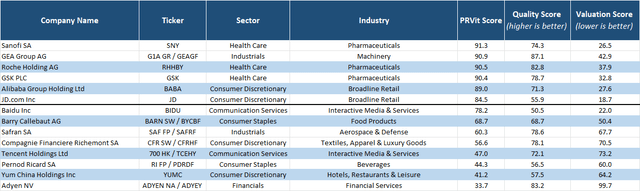

We likewise provide the lead to a table format to make your choice much easier.

Source: Institutional Investor Solutions Inc., Morningstar

( Stocks highlighted in light blue are Morningstar’s 5-star-rated worldwide wide-moat names that endured the 2nd action of our procedure.)

In PRVit, the aspects are organized into 3 classifications: Efficiency, Danger, and Appraisal. Each business has a composite 0-100 rating in each classification, where greater is much better for Efficiency and lower is much better for Danger and Appraisal. Our company believe stocks that have a 5-star Morningstar ranking and/or surface in the upper quintile of the PRVit ranking (with a PRVit rating above 80) deserve a better look.

We prepare to run this three-step procedure on a month-to-month basis and release the shortlist of targets it produces.

Editor’s Note: This short article talks about several securities that do not trade on a significant U.S. exchange. Please know the dangers connected with these stocks.