French telco crew Iliad has submitted an offer to UK-based Vodafone Team in regards to the attainable merger in their respective operations in Italy.

If a success, the merger may have a large affect at the Italian cell marketplace, decreasing it from 5 gamers to 4, whilst additionally combining the fastened broadband operations of the 2 corporations.

The deal is in no way assured to head via, on the other hand. Even though Vodafoneâs reaction is sure, regulatory government should then find out about its results on pageant.

Extra Main points

The proposal values Vodafone Italy at â¬10.45 billion ($11.4 billion) and Iliad Italy at â¬4.45 billion.

Vodafone Team would download 50% possession of the merged entity (dubbed NewCo) at the side of a â¬6.5 billion money cost and a â¬2.0 billion shareholder mortgage. Iliad, in the meantime, would get 50% of NewCo at the side of a â¬500 million money cost and a â¬2.0 billion shareholder mortgage.

As a part of the proposed transaction, Iliad would have a choice possibility on Vodafone Teamâs fairness stake in NewCo and would be capable to gain a block of 10% of the NewCo proportion capital once a year at a worth in line with proportion equivalent to the fairness worth at remaining. Within the match Iliad chooses to workout the decision choices in complete, this may generate an extra â¬1.95 billion in money for Vodafone Team.

In response to Vodafone Italyâs estimated EBITDA after Hire (EBITDAaL) of â¬1.34 billion for FY 2024 (as in line with dealer consensus), the proposed transaction implies an EBITDAaL a couple of of seven.8x. That is upper than the 7.1x EBITDAaL a couple of introduced via Iliad in its â¬11.25 billion takeover be offering for Vodafone Italy in February 2022, which was once temporarily rejected via Vodafone Team.

The merged trade can be anticipated to generate revenues of round â¬5.8 billion and EBITDAaL of approximatively â¬1.6 billion for the monetary 12 months finishing March 31, 2024.

The merged trade can be anticipated to generate revenues of round â¬5.8 billion and EBITDAaL of approximatively â¬1.6 billion for the monetary 12 months finishing March 31, 2024.

In keeping with Iliad, the financing of the transaction is supported via main global banks and the deal has the unanimous strengthen of its board of administrators plus its primary shareholder, Xavier Niel.

Thomas Reynaud, Iliad Team CEO, commented: âThe marketplace context in Italy requires the introduction of essentially the most leading edge telecom challenger, with talent to compete and create worth in a aggressive atmosphere. We consider that the profiles and complementary experience of Iliad and Vodafone in Italy would let us construct a robust operator with the power and fiscal power to speculate for the long run.â

âNewCo can be totally dedicated to accelerating the rusticâs virtual transformation and particularly fiber adoption and 5G deployment, with greater than â¬4 billion of funding deliberate over the following 5 years,â he added.

Vodafone Background

Vodafone has been found in Italy since September 1995, when it introduced as the primary pageant within the cell marketplace for incumbent operator Telecom Italia (TIM).

The corporateâto begin with referred to as Omnitelâwas once based via plenty of shareholders, together with Olivetti, Bell Atlantic World (now Verizon Communications), and Telia World (now Telia Corporate).

It rebranded as Omnitel Vodafone in January 2001 after which Vodafone Omnitel in Might 2002 in a bid to capitalize at the popularity of the UK-based Vodafone Team, which had come on board as an investor two years previous. In Might 2003, the Omnitel moniker was once dropped altogether, during which time Vodafone were left because the 100% proprietor following the sluggish departure of its companions.

Vodafone Italy introduced 3G in 2004, 4G in October 2012, and 5G in June 2019.

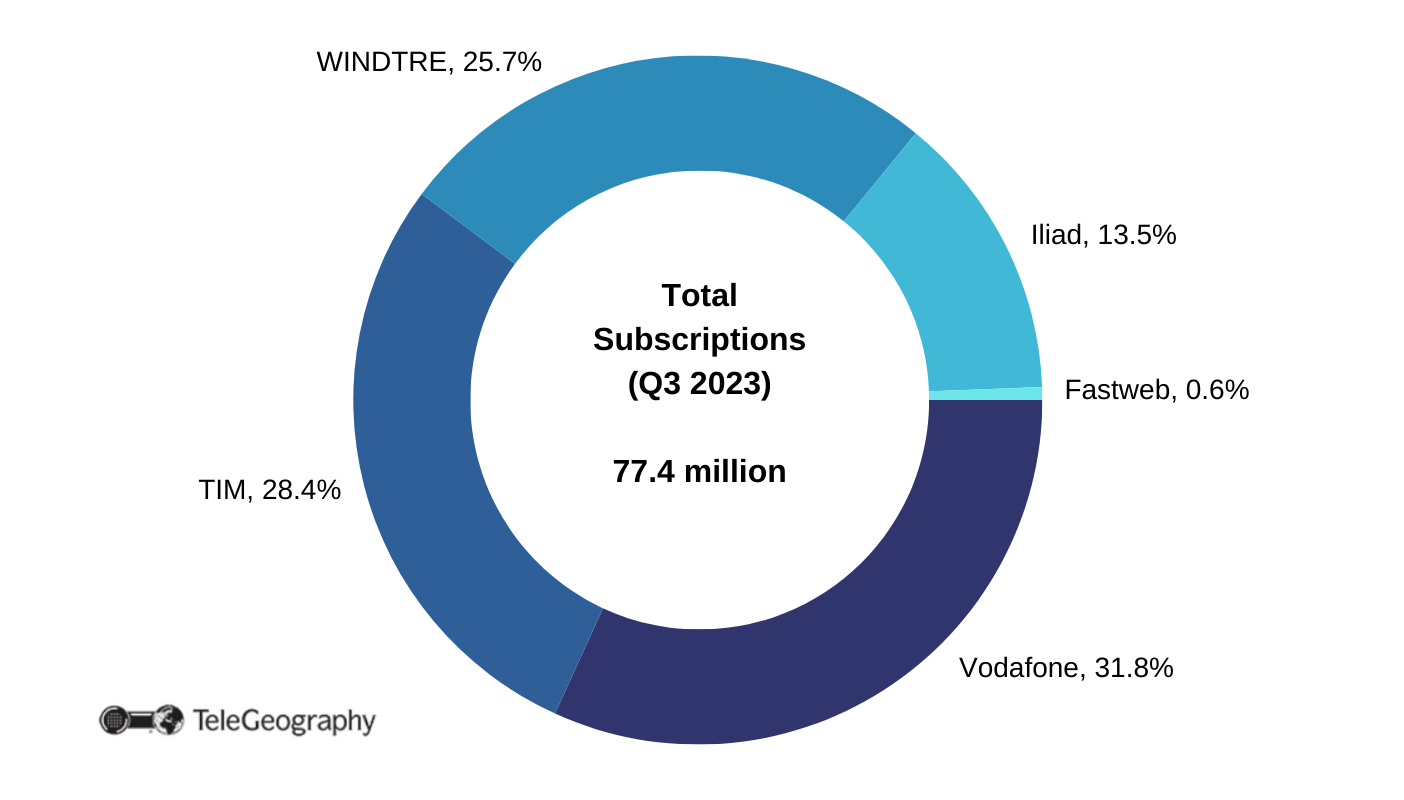

In keeping with TeleGeographyâs GlobalComms Database, on the finish of September 2023, it had collected an estimated 24.6 million cell subscriptionsâtogether with shoppers of its MVNO companions however apart from M2M connectionsâmaking it the rusticâs greatest cellco with 32% of the marketplace.

Within the fastened broadband sector, Vodafone gives a spread of get entry to merchandise in line with VDSL and fiber-to-the-home applied sciences, the use of its personal networks plus the ones of wholesale companions. It additionally makes use of its 4G and 5G networks to attach families outdoor of the fastened community footprint.

As of September 30, 2023, Vodafone had 2.95 million fastened broadband subscriptions.

More recent Challenger

Iliad Italy is a miles more youthful corporate, established in 2016 to obtain spectrum and a few community belongings from cell community operators (MNOs) 3 Italia and Wind Telecomunicazioni, which had agreed to a merger.

With a view to appease regulators frightened in regards to the dealâs results on pageant, the pair created a âtreatment bundleâ to permit a brand new MNO to sign up for the marketplace.

Iliad ultimately introduced cell products and services in Might 2018, occurring to win 5% of the total marketplace inside of 365 days and 10% via the primary quarter of 2021. As of September 30, 2023, Iliad had 10.48 million cell subscriptions and a 13.5% marketplace proportion.

Italy Cell Marketplace, Q3 2023

It joined Italyâs fastened broadband sector in January 2022, having signed wholesale agreements with the likes of Open Fiber and TIM. It had 172,000 broadband shoppers via end-September 2023.

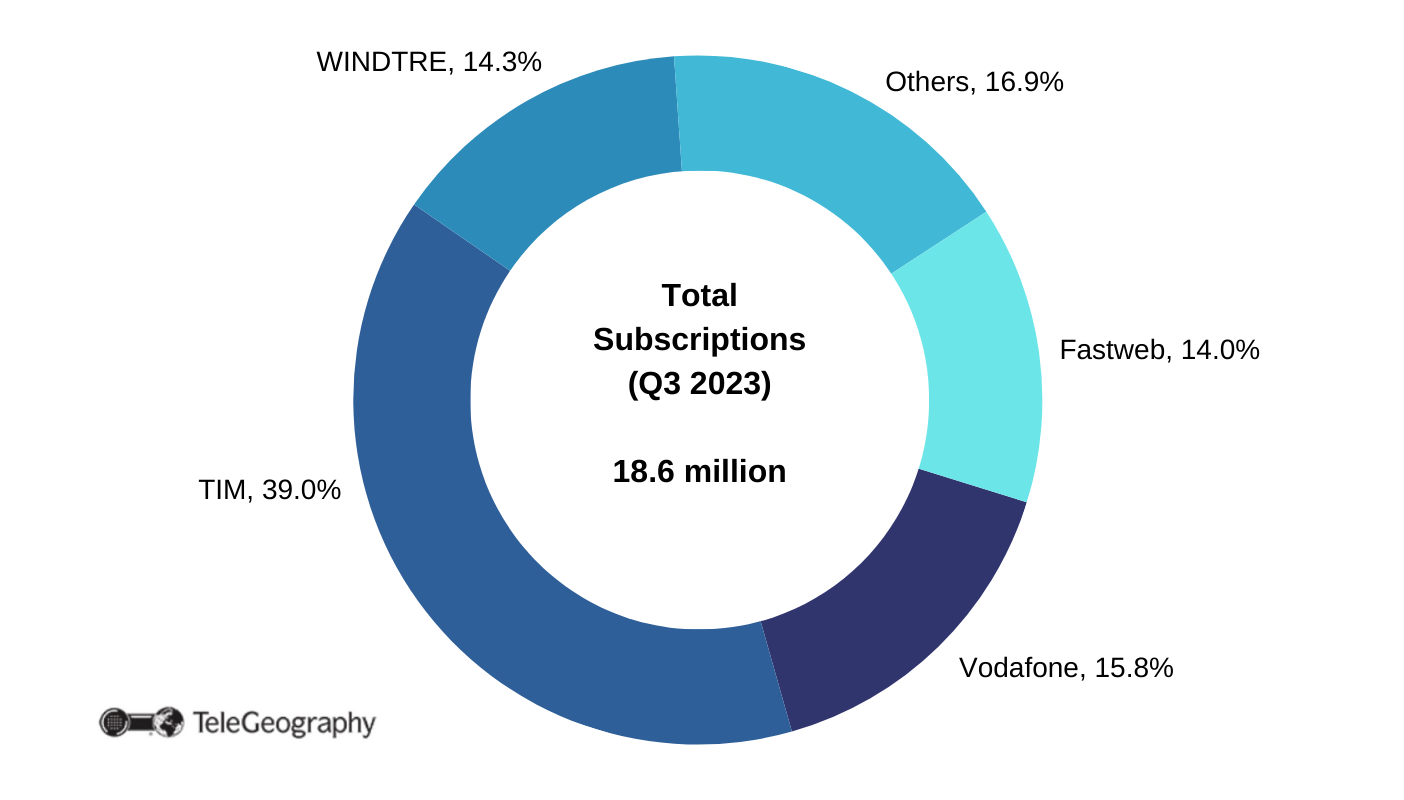

Italy Fastened Broadband Marketplace, Q3 2023