ArtistGNDphotography

Financial Investment Thesis

Experts were extremely downhearted about 2023, talking about the likelihood of an economic crisis and high joblessness as the Fed continues to increase rates. The stock exchange and the economy definitely surpassed expectations

I released a “Buy” short article in August 2023 on among the biggest homebuilders: NVR ( NYSE: NVR). Although evaluations had actually currently increased this year, I thought that it had the prospective to attain even greater gains, driven by continuous patterns such as the real estate scarcity and the hesitation of property owners to offer in the face of high home loan rates.

The stock has actually surpassed the marketplace up until now, however I still think it must be priced greater. The U.S. economy stays strong, and while the current market optimism around rate of interest cuts may make this trade dangerous, I restate my “Purchase” ranking for NVR due to the strong long-lasting and short-term patterns discussed in this short article.

Intro

I released 2 posts on homebuilders, one on NVR and the other on Cavco Industries ( CVCO). If you have actually checked out these posts, you understand my bullish position on the market, especially relating to those 2 business. This short article is going to concentrate on NVR and review my preliminary thesis in August 2023.

While these business gain from comparable patterns we were experiencing, I had somewhat various inspirations for the 2. The real estate stock in the U.S. was insufficient and high home loan rates disincentivized property owners from offering as they had actually secured lower rates in 2020 and 2021. Subsequently, I anticipated the need for brand-new homes to increase not just in the long term however likewise in the short-term as purchasers had actually restricted alternatives.

This has actually undoubtedly occurred. We’ll enter into the information later on, however brand-new home sales escalated while existing home sales collapsed. There have actually been a great deal of advancements because I released those posts. Fed rotated (as lots of state), the economy surpassed expectations in 2023, and inflation and home loan rates began to decrease.

Provided these advancements, I think an evaluation is required.

Business Description

NVR constructs single-family homes, townhouses, and condo structures. It is among the biggest in the U.S. The business likewise has a home mortgage banking arm to support clients purchasing homes.

One huge differentiator for NVR is the truth that it does not own any land. The business focuses entirely on structure. It gets a completed structure lot, pre-sells the task, and after that develops. However this is not the greatest element making NVR a fascinating business. It is assuring mainly due to the truth that it is substantial in a market where size matters.

By gross earnings, NVR was the 4th biggest homebuilder in the U.S. in 2022. Its recognized position in 15 states and 35 cities permits it to identify huge chances quicker than its rivals and close offers on beneficial terms. The substantial quantity of money it rests on is just helpful. As I’ll point out later on, this money quantity keeps growing.

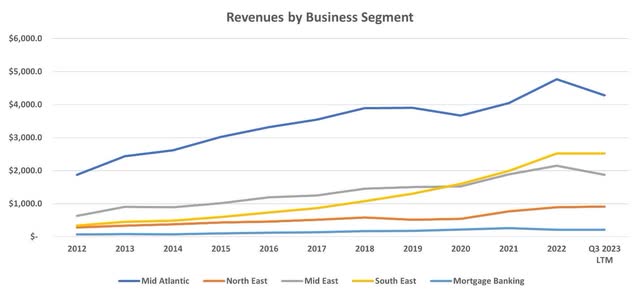

It has 5 operating sections, 4 being geographical and the other one being Home mortgage Banking. Its greatest footprint remains in the Mid-Atlantic, although it has actually been proliferating in the South-East with a CAGR of 23% because 2012. While the Mid-Atlantic earnings decreased in LTM Q3 2023, the South-East continued to grow.

S&P Capital IQ

Efficiency Because Publication

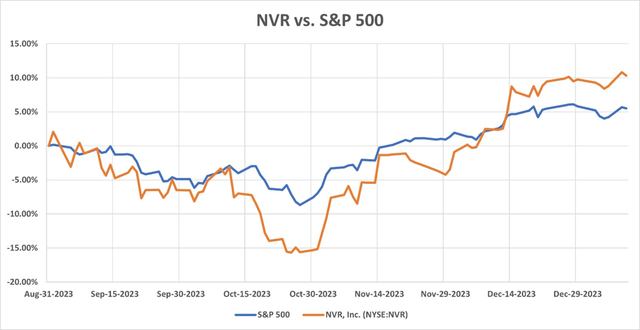

I released the NVR short article on Aug. 31, 2023. At first, homebuilders’ stocks decreased due to issues about a possible economic downturn and high home loan rates, however they responded favorably to market advancements in the previous 3 months.

Given that the suggestion, NVR is up 10.5% at the time of this short article’s writing, while the S&P 500 is up 5.3%.

Take a look at it listed below.

S&P Capital IQ

A lot has actually occurred because last summertime that needs a deep dive into the financial truths.

The U.S. Economy And The Real Estate Market

Let’s tackle this action by action.

Firstly, the U.S. economy endured 2023 much better than the majority of people anticipated. GDP development, which turned unfavorable at the start of 2022 and was somewhat above 2% at the start of 2023, leapt to 4.9% in Q3 2023. Omitting the unstable years of 2020 and 2021, this quarter’s development was the 4th fastest in the last 20 years.

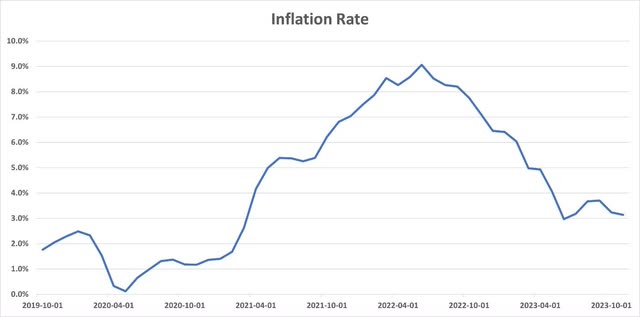

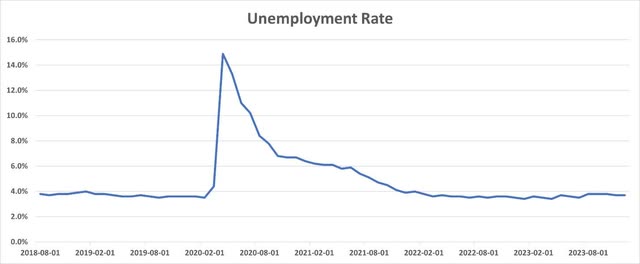

While it holds true that the Federal Reserve pressed rates of interest greater strongly in the last 2 years, it has actually not led the economy into an economic crisis as at first anticipated. In truth, inflation has actually been on a down pattern because June 2022, while joblessness stays lower than 4%.

Some might specify an economic crisis as having back-to-back unfavorable GDP development. Nevertheless, as long as the labor market is strong and joblessness is low, individuals will have cash to invest, promoting the economy.

You can see how inflation and the joblessness rate altered listed below.

FRED – Federal Reserve Bank of St. Louis

FRED – Federal Reserve Bank of St. Louis

While the economy stays much better than anticipated, the marketplace has actually blended viewpoints about the real estate market.

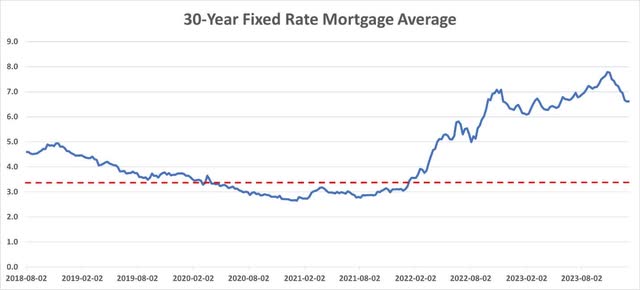

Home mortgage rates are naturally affected by the Fed funds rate. We have actually seen it be up to listed below 3.5% after the pandemic and individuals took that possibility to either re-finance or purchase brand-new homes, efficiently securing incredibly low rates.

As the Fed increased the rates, home loan rates likewise trended greater, with the 30-year set rate home loan typical reaching almost 8%. Just recently, the typical dipped listed below 7%, in the middle of expectations of rate cuts in 2024.

FRED – Federal Reserve Bank of St. Louis

High home loan rates impact unique parts of the real estate market in a different way. It disincentivizes property owners who secured low rates of interest from selling, as they would deal with much greater home loan rates on a brand-new home purchase. That is why existing home sales were down 15% year over year in October 2023.

In the meantime, purchasers who can not discover any existing homes turn to brand-new homes. In spite of the high home loan rates, brand-new home sales rose 18% year over year in October 2023.

Outlook

With inflation falling faster than anticipated, the marketplace believes the Fed is going to stop briefly or begin to cut rates in 2024 If in the meantime the labor market stays strong, there is an opportunity we will see a soft landing.

These advancements would cause lower however still high home loan rates. As long as rates are fairly above 3.5% or rates seen in 2020 and 2021, property owners will hesitate to offer. Each drop in rates will benefit homebuilders, as purchasers gain simpler access to funding.

In Addition, there is another strong pattern that impacts need for NVR.

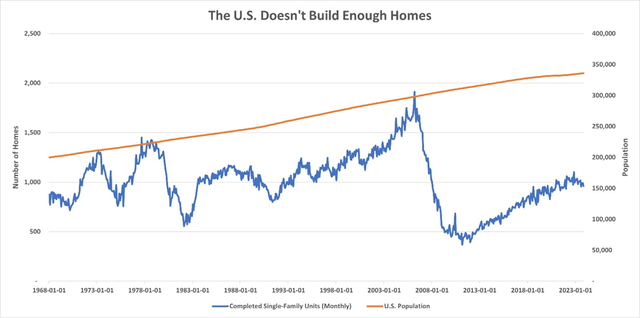

The U.S. requires more homes. Real estate stock continues to be low, making it hard for individuals to discover homes to acquire. In truth, a contrast of the U.S. population and the variety of single-family systems built regular monthly programs the issue plainly. The population keeps increasing every year, while the real estate market is cyclical and has actually never ever actually recuperated from the Great Economic crisis.

FRED – Federal Reserve Bank of St. Louis

This is and is most likely to stay a long-lasting concern, causing consistent need for homebuilders like NVR.

The Business Continues To Prosper In This Economy

While financial information exposes a beneficial environment for NVR, the company-specific advancements because August reveal that NVR is placed well to flourish.

The 3rd quarter outcomes reveal that while the business’s earnings reduced 7% year-over-year, its earnings increased 5%. More notably, brand-new orders increased by 7% compared to the 3rd quarter of 2022. Thanks to high rates of interest, home loan banking earnings more than doubled from $17.6 million to $38.5 million.

Since September 30, 2023, NVR had $2.8 billion in money, which is even greater than the $2.5 billion it had at the start of the year. This is very crucial for NVR to be able to act on finding chances in the markets it exists.

Thanks to this strong money position, NVR had the ability to authorize a buyback of as much as $750 million of its exceptional typical stock, as the business revealed on November 9.

Evaluation

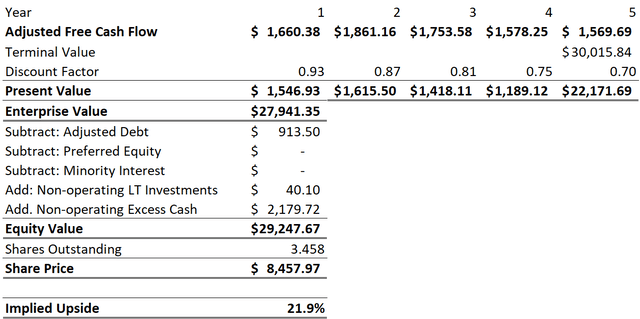

This assessment follows the design I constructed for NVR for my preliminary protection.

I utilize an extremely conservative terminal development rate of 2%, in line with long-lasting inflation targets. The expense of equity is computed utilizing a long-lasting safe rate of 2%, a market danger premium of 5.7%, and the stock’s 5-year equity beta. I utilize 5.14% for the expense of financial obligation, which is the existing yield to worst of its 2030 bonds.

I different money and short-term financial investments into operating and excess in my computations. There are lots of methods of computing operating money, however I utilize a particular portion of earnings, normally in between 5% and 10%. This is going to be invested in the everyday operations of the business for a year. Any staying money is thought about excess. In my viewpoint, investors have a claim on the excess money, however not the running one, due to the fact that business requires it.

Utilizing these computations, we discover an equity worth of $29.25 billion for NVR, which indicates a target share cost of $8,458. This is a 20% upside at the time of this short article’s writing.

NVR DCF Analysis

Dangers

This thesis is not without threats.

The marketplace appears to be encouraged that there are going to be a number of rate cuts in 2024. The marketplace just recently rose greater due to this extensive belief. If this expectation does not become a reality, and the Fed continues to stop briefly or perhaps increase rates, we may experience a decline in evaluations.

While I think that greater rates would prevent property owners from selling, consequently sustaining need for homebuilders, an adversely affected labor market and a possible economic downturn might lower this need.

Joblessness is a crucial metric to track to comprehend the acquiring power individuals have. High joblessness, in turn, might considerably impact the real estate market and the more comprehensive economy.

Conclusion

NVR is among the biggest homebuilders in the U.S. that focuses on conventional single-family homes and townhouses.

With its scale and distinct position, the business has actually benefited and is most likely to continue taking advantage of patterns such as the real estate scarcity and high home loan rates that disincentivize property owners from selling.

The stock has actually risen just recently, buoyed by expectations of rate cuts in 2024. Must these expectations not emerge, and home loan rates stay high, the stock might at first have a hard time. Nevertheless, with long-lasting patterns driving need, I believe NVR must trade greater.