Tippapatt

Please keep in mind all $ figures in $USD, not $CAD, unless otherwise kept in mind.

Financial Investment Thesis

Open Text ( NASDAQ: OTEX) simply reported Q2 2024 results on February 1st and shares are presently down about 2% following the outcomes. In my view, the business appears to be performing on all of its crucial metrics and I think the evaluation looks appealing enough for brand-new financiers to begin a position in this Canadian compounder. As a dominant gamer in the cloud software application area (particularly in business details management), the business has actually traditionally produced fantastic returns for investors. With a market leading position, the business has actually been on the ideal track to grow sales at an appealing rate, keep high margins and this quarter was an action in the ideal instructions.

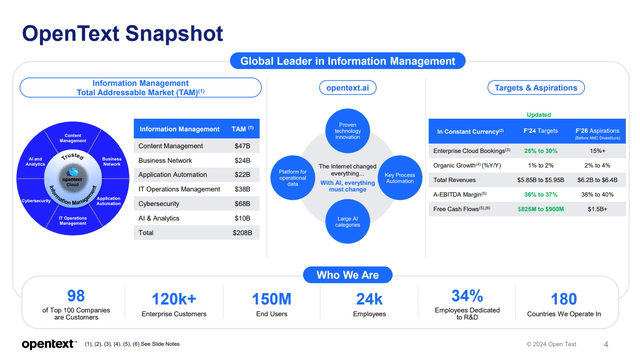

Financier Discussion

Background

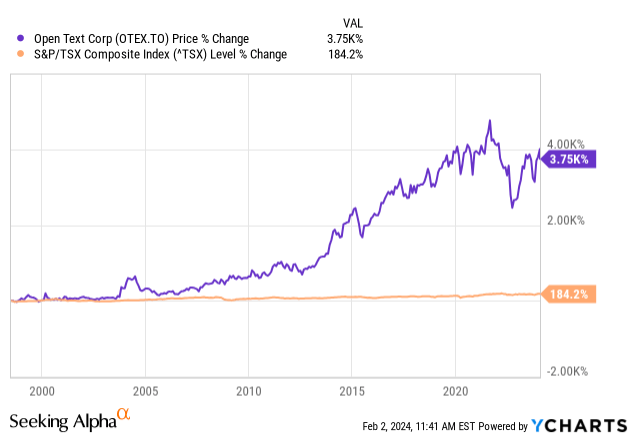

As one of the very best carrying out software application business in Canada, shares of Open Text have actually produced impressive returns for financiers over its life time as a public business. Considering that its IPO in 1998, the business has actually produced a 3722% return for investors compared to the TSX’s return of 184.2%, making it a fantastic entertainer for financiers who have actually hung on for the long-lasting.

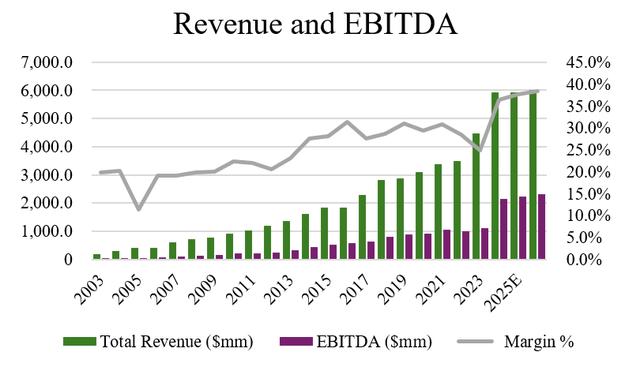

We can likewise observe this record of outperformance in Open Text’s financials, with profits and EBITDA growing at CAGRs 17.5% and 18.9%, respectively, over the last twenty years and 12.6% and 13.4% CAGRs, respectively, over the last years (S&P Capital IQ). With EBITDA increasing faster than sales development, this reveals that not just has actually the business had the ability to grow at high rates of return gradually, however it has actually likewise had the ability to show out margin growth. Considering that 2003, Open Text’s EBITDA margins have actually broadened over 500 bps.

Author, based upon information from S&P Capital IQ

Current Outcomes

Open Text revealed its Q2 2024 outcomes recently with incomes of $1.53 billion up 70.5% year over year, which represented a beat of $40 million compared to agreement price quotes. Remarkably, yearly repeating incomes clocked in at $1.146 billion which was up 58.0% (or 55.6% on a continuous currency basis).

Regardless of shares falling post-results, I see the quarter to be rather great with an enhancement throughout all metrics. With 70.5% development year over year, the primary factor for the beat was because of the c ompany’s acquisition of Micro Focus, which wa s a $ 6 billion offer that Open Text did as part of their development by acquisition technique. As the biggest handle Open Text’s history, this acquisition was really considerable, opening brand-new opportunities for development and cross-selling chances. Management kept in mind that Micro contributed a little over $600 million throughout the quarter, well going beyond the $575 million per quarter to grow naturally, so it would appear that Open Text is currently providing on their previous expectations of providing synergies from the offer.

In my view, this supports the financial investment thesis that Open Text is not simply a high development compounder growing by acquisition, however likewise by natural development and significant margin growth. Thinking about that Micro had actually been on a down course in both incomes, EBITDA, and margins the 4 years prior to being gotten, this is even more outstanding and speaks with management’s capability to incorporate the offer effectively (source: S&P Capital IQ).

On the margin front, Open Text continued to broaden its EBITDA margins to the tune of 36.9% which in my view concurs that expense synergies and cross offering synergies are being understood. In regards to assistance, management anticipates Micro to be on the Open Text design by the end of financial 2024 so it would appear that there is still space for more margin growth. As totally free capital conversion is likewise representing a bigger portion of EBITDA (54%), this shows really effective working capital management.

Among the aspects that thrills me about Micro’s service is that renewal rates are beginning to enhance. Remember that this was a weakening service before so greater renewal rates recommends that Open Text is turning the ship around. With assistance for renewal rates in the high 80s variety, it would appear that management is suggesting much better client assistance profits mix expectations.

In regards to Open Text’s tradition service, cloud reservations were up 63% year over year and management notes that they are “ simply starting” which they are winning with cloud additions, service clouds, information security, and trust requirements. All this bodes effectively half method through financial 2024 in my viewpoint and management anticipates ongoing development of 25-30% in financial 2024. They likewise raised the lower bound of the assistance variety with full-year totally free capital anticipated in between $825 million to $900 million. In general, my long-lasting expectation for the tradition service is for the business to be able to grow it the mid-teens.

When it comes to my outlook moving forward, I would anticipate management to decrease the rate of acquisition for the 2nd half of F2024 and maybe into F2025. With the Micro offer being the biggest in business history, this brings overall acquisitions for F2024 to nearly $5 billion, much bigger than the $1.3 billion average from F2019 to F2023 (source: S&P Capital IQ). So it would be sensible to anticipate the rate of acquisitions to slow as management concentrates on incorporating the acquisitions its performed in the last bit. While the business did reveal the sale of Open Text’s AMC service for $2 billion, take advantage of has actually definitely gotten.

Today, the business’s net take advantage of ratio is quite high at 3.7 x so it will take a couple of quarters for the business to de-lever, settling some financial obligation before it can resume M&A. On the balance sheet, the business has about $1 billion of money and $8.5 billion of financial obligation. The majority of the financial obligation is long-dated maturities so there isn’t much of a refinancing threat near-term. Longer-term, the business anticipates to return 30% of totally free capital by means of dividends and buybacks and the other 70% as M&A.

Evaluation

Based Upon the 4 sell side experts who cover Open Text’s stock, there are 3 buy rankings and 1 hold ranking with a typical rate target of CAD$ 65.87, a high price quote of CAD$ 70.88, and a low price quote of CAD$ 58.85 (source: TD Price quotes). From the existing rate to the typical rate target one year out, this suggests 12.4% upside not consisting of the 2.3% dividend yield. So it would appear that with overall return capacity of 14.7%, experts are reasonably bullish on the business’s outlook.

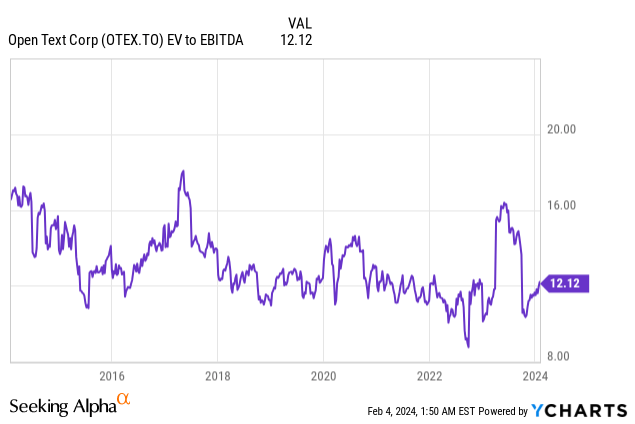

At present, the business’s shares trade at about 12.1 x EV/EBITDA, which is at the lower bound of the business’s historic variety. For a business that I anticipate to grow totally free capital in the mid-teens long-lasting, a 12.1 x EBITDA numerous appears like really sensible evaluation to spend for this compounder. The forward numerous on the stock is around 11.8 x (based upon agreement price quotes for next year) so this makes shares a lot more luring.

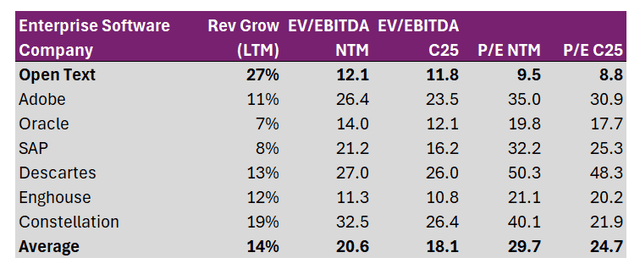

Compared to business software application business like the ones noted below, we can see that in spite of growing at two times the sales development of its peer group, Open Text trades at nearly half the evaluation of its peers on a EV/EBITDA basis and about one-third the numerous on a P/E basis. For that reason, for financiers searching for a GARP stock that has actually had a performance history of producing incredible returns for long-lasting investors, I believe financiers are getting a respectable margin of security at the existing evaluation. The larger peers definitely have their competitive benefits and name brand names in the cloud area, however such an appraisal detach is unjustified in my view.

Author, based upon information from TD Price quotes

In regards to the threats to my financial investment thesis, the primary one would be the business’s balance sheet. The last 2 years have actually been extremely strong years for M&A for Open Text and it appears like the staying duration will spend some time for the business to pay for financial obligation. Management anticipates by 2025 they must have the ability to go from 3.7 x net take advantage of to under 3.0 x. It’s likewise crucial to mention that half of the business’s financial obligation is at repaired rates and the weighted typical maturity is 5.3 years so the refinancing concern isn’t impending. That stated, the expense of financial obligation is on the greater side of the peer group with a weighted-average rate of interest of 6.3%. With long-lasting financial obligation representing about 73.7% of the business’s market capitalization, this is most likely the greatest reason that it trades at such a huge discount rate in the market’s view.

Another threat may be the low natural development profile of Open Text’s service. In cloud, leaving out the current huge acquisition, Open Text’s natural development rate had actually been 3.6%. While this quarter represented the business’s 11th successive quarter of business cloud natural development, the 3.6% figure is quite low (hardly above long-lasting GDP development of 3.1%) so the development story here is definitely more about acquisitions than it has to do with natural development.

Conclusion

In summary, I was quite shocked by the market response to Open Text’s outcomes as digging much deeper highlights that the business has actually been performing well on its metrics with both profits development and margin growth. What we have actually seen indicators up until now is that the business has actually been providing on its synergies from its Micro Focus acquisition, the biggest in business history, and this quarter is yet another testimony to Open Text’s growth-by-acquisition technique. So in spite of issues about the business’s financial obligation and high net take advantage of ratio, I would state that the business has actually shown that it can make wise capital allotment choices which assistance from management recommends that the next top priority is to de-lever. So while the rest of 2024 and early 2025 may not be that amazing, I think that the business’s existing evaluation (at half the multiple of the peer group) provides an engaging margin of security. Hence for long-lasting financiers, I believe Open Text might make a fantastic addition to a well-diversified portfolio at the existing rate.