- House owners are sitting tight longer than they remained in the early aughts. That’s mostly due to the fact that older Americans are aging in location and it’s hard to discover and pay for homes, however partially due to the fact that it was simple to get home mortgages in the early 2000s.

- Period has actually decreased a bit from its 2020 peak due to the pandemic moving craze.

- House owners hanging onto homes is adding to the stock scarcity and increasing home costs.

- California house owners generally sit tight longest, partially due to the fact that of a state property-tax reward. House owners move usually in fairly economical southern cities like Louisville, KY and Nashville.

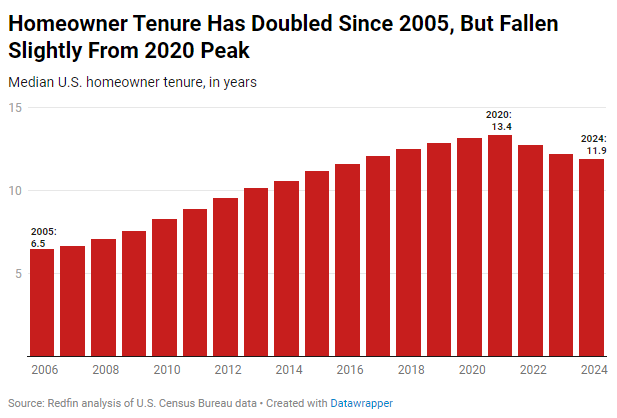

The common U.S. house owner has actually invested 11.9 years in their home, up from 6.5 years twenty years earlier.

Property owner period peaked at 13.4 years in 2020, simply when the pandemic triggered a moving craze, and has actually decreased ever since.

This information is from a Redfin analysis of typical house owner period by year in the U.S. since 2023, utilizing historic county records. Home period for 2023 is specified as the variety of years in between the most current sale date of a home and December 1, 2023. Information on house owner period by generation is from a Redfin analysis of the U.S. Census Bureau’s 1-year American Neighborhood Study in 2022, the most current year for which the information is readily available.

Child boomers are aging in location, driving house owner period up

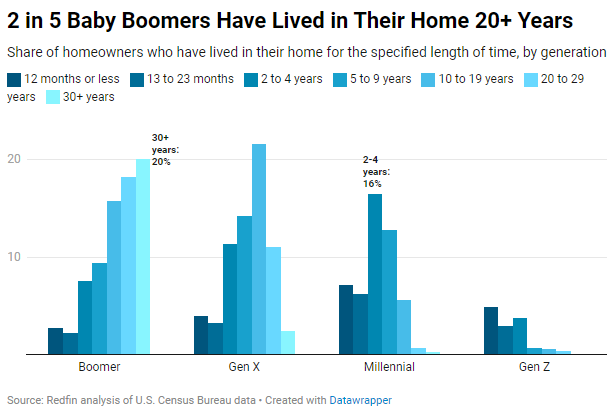

Older Americans remaining in their homes is the driving force behind longer house owner period. Almost 40% of child boomers have actually resided in their home for a minimum of twenty years, and another 16% have actually resided in their home for 10-19 years. For Gen Xers, more than one-third (35%) have actually resided in the very same home for a minimum of ten years.

Millennials generally remain in homes for much shorter durations, mostly due to the fact that they’re more youthful and partially due to the fact that they change tasks more than older generations. Less than 7% of millennials have actually resided in their home for ten years or longer, 13% have actually resided in their home for 5-9 years, and 30% have actually resided in their home for less than 5 years. Almost all Gen Zers who own a home have actually had it for less than 5 years, which stands to factor due to the fact that the earliest Gen Zer was 26 in 2023.

The time durations for each generation kept in mind in the chart above do not amount to 100%. That’s due to the fact that not everybody owns a home; the rest are either occupants or residing in organizations like nursing home.

Child boomers and Gen Xers have an outsized influence on general housing-market patterns for a couple of factors. One, the American population is aging: Approximately 17% of individuals in the U.S. were 65 and older since 2020, up from 13% in 2010. 2, they’re more than likely to own homes: Almost 80% of child boomers and 72% of Gen Xers own their home, compared to 55% of millennials and 26% of Gen Zers.

There are numerous reasons that house owner period has actually increased considering that the early aughts:

- Older Americans are hanging onto their homes due to the fact that they’re economically incentivized to do so. A lot of (54%) child boomers who own homes own them complimentary and clear, without any exceptional home loan. For that group, the typical month-to-month expense of owning a home– that includes insurance coverage and real estate tax, to name a few things– is simply over $600 (comparable to the month-to-month expense for other generations without any exceptional home loan, however other generations are far less most likely to own homes complimentary and clear).

- Almost all boomers who do have a home mortgage have a much lower rate than they would if they offered and purchased a brand-new home with today’s 7%- ish rates.

- Some state tax systems have policies that make it economically helpful for individuals to remain in their homes as they age. Texas house owners over 65 can delay real estate tax up until the home is offered, and in California, Proposal 13 restricts property-tax boosts.

- Lots of older Americans choose aging in their household home instead of transferring to a various home or getting in an assisted-living center: Almost 9 in 10 Americans in between 50 and 80 years of ages stated in a current study it is essential to remain in their homes as they age. And with medical and tech developments, it’s progressively possible to do so.

- It was low-cost and simple to relocate the early 2000s. More individuals than normal had the ability to get home mortgages and purchase homes due to the fact that mortgage-lending requirements were loose, which eventually caused the subprime home loan crisis.

Individuals hanging onto their homes is adding to the stock scarcity

Absence of homes for sale and high real estate expenses adds to individuals remaining in their homes longer, and individuals remaining in their homes longer adds to absence of stock and presses costs higher.

Long house owner period, especially amongst child boomers, is a barrier for young newbie purchasers attempting to burglarize the marketplace. A current Redfin analysis discovered that empty-nest child boomers own two times as numerous three-bedroom-plus homes than millennials with kids. Some young households are turning to brand-new building and construction, and others are leasing homes.

Property owner period has actually dropped 1.5 years from its 2020 peak and is anticipated to remain flat

Property owner period has actually decreased somewhat each year considering that 2020 due to the fact that the pandemic started a moving craze, with remote work and record-low home loan rates resulting in more homes altering hands in 2021 than any year considering that 2006.

Moving on, we anticipate house owner period to remain flat or boost somewhat for the foreseeable future. Existing-home sales struck a 15-year low in 2015, with numerous house owners secured by low home loan rates, and while sales ought to get a bit this year, it’ll be more of a drip than a flood.

Metro-level highlights: Property owner period, 2023

-

- House owners sit tight longest in California. The common Los Angeles house owner has actually resided in their home for 18.7 years, followed by 17.8 years in San Jose, CA. Next come Cleveland, OH (17.4 ), San Francisco (16.7) and Memphis, TN (16.5 ). Californians tend to keep their homes for a long period of time partially due to the fact that they’re incentivized to do so by Proposal 13.

- House owners move usually in fairly economical cities, primarily in the South. Period is fastest in Louisville, KY (7.4 years) and Las Vegas (8 ). Next come Nashville, TN, Charlotte, NC and Raleigh, NC, which each have a mean period of 8.5 years. Period is much shorter in those cities partially due to the fact that they have actually been popular migration locations over the last couple of years, which indicates a great deal of homes have actually altered hands just recently.

| Metro-level summary: Property owner period, 2023

Average house owner period, in years 41 most populated U.S. cities for which we have adequate information |

|||||

| U.S. city location | Average house owner period (2023 ) | Average house owner period (2022 ) | Average list price (2023 ) | Average list price, YoY modification (2023 ) | Active listings, YoY modification (2023 ) |

| Atlanta, GA | 8.9 | 8.7 | $ 378,795 | 4% | -20% |

| Baltimore, MD | 15.6 | 15.5 | $ 350,000 | 5% | -7% |

| Birmingham, AL | 9.6 | 9.7 | $ 280,000 | 4% | -2% |

| Buffalo, NY | 11.7 | 11.5 | $ 235,000 | 9% | -8% |

| Charlotte, NC | 8.5 | 8.3 | $ 375,000 | -3% | -6% |

| Chicago, IL | 15.2 | 15.3 | $ 306,500 | 8% | -19% |

| Cincinnati, OH | 13.3 | 13.4 | $ 265,000 | 8% | -21% |

| Cleveland, OH | 17.4 | 17.1 | $ 199,900 | 4% | -9% |

| Columbus, OH | 11.3 | 11.9 | $ 315,000 | 5% | -2% |

| Denver, CO | 9.3 | 8.8 | $ 550,000 | 0% | -2% |

| Detroit, MI | 13.2 | 14.1 | $ 170,000 | 6% | -8% |

| Hartford, CT | 13.4 | 13.2 | $ 327,950 | 15% | -28% |

| Jacksonville, FL | 10.0 | 10.3 | $ 372,112 | 4% | -9% |

| Las Vegas, NV | 8.0 | 7.6 | $ 420,000 | 5% | -31% |

| Los Angeles, CA | 18.7 | 18.2 | $ 850,000 | 7% | -14% |

| Louisville, KY | 7.4 | 6.9 | $ 251,000 | 5% | 2% |

| Memphis, TN | 16.5 | 16.2 | $ 257,990 | -1% | 15% |

| Miami, FL | 11.7 | 12.5 | $ 510,000 | 12% | 1% |

| Milwaukee, WI | 11.0 | 11.1 | $ 280,000 | 6% | -2% |

| Minneapolis, MN | 10.3 | 10.2 | $ 355,000 | 2% | -1% |

| Nashville, TN | 8.5 | 8.2 | $ 450,000 | 0% | -2% |

| New Orleans, LA | 15.6 | 15.1 | $ 265,000 | -5% | 26% |

| New York City, NY | 15.4 | 15.4 | $ 700,000 | 8% | -15% |

| Oklahoma City, OKAY | 11.4 | 11.4 | $ 250,000 | 6% | 5% |

| Orlando, FL | 8.6 | 8.5 | $ 400,000 | 3% | 11% |

| Philadelphia, PA | 16.1 | 15.7 | $ 250,000 | -3% | -7% |

| Phoenix, AZ | 8.6 | 8.3 | $ 444,990 | 5% | -18% |

| Pittsburgh, PA | 15.5 | 15.3 | $ 217,000 | 10% | -3% |

| Portland, OR | 11.4 | 11.3 | $ 530,000 | 5% | -5% |

| Providence, RI | 16.3 | 15.6 | $ 447,500 | 10% | -12% |

| Raleigh, NC | 8.5 | 8.2 | $ 432,671 | 1% | -34% |

| Richmond, VA | 15.4 | 15.2 | $ 370,599 | 9% | -3% |

| Riverside, CA | 12.2 | 12.4 | $ 550,000 | 5% | -15% |

| Sacramento, CA | 11.6 | 11.9 | $ 560,000 | 8% | -15% |

| San Diego, CA | 15.0 | 15.4 | $ 840,000 | 10% | -16% |

| San Francisco, CA | 16.7 | 16.3 | $ 1,297,500 | -1% | -13% |

| San Jose, CA | 17.8 | 17.3 | $ 1,400,000 | 11% | -16% |

| Seattle, WA | 13.0 | 12.7 | $ 750,000 | 6% | -22% |

| Tampa, FL | 9.0 | 8.9 | $ 375,000 | 1% | 9% |

| Virginia Beach, VA | 11.9 | 12.7 | $ 330,000 | 6% | -5% |

| Washington, DC | 13.6 | 14.0 | $ 524,900 | 7% | -14% |