JamesBrey

Extremely appreciated high-yield credit financiers Oaktree Capital who handle the openly traded Oaktree Specialized Financing Corporation ( OCSL) and lots of other personal funds under the management of famous billionaire financiers Howard Marks and Brookfield’s ( BAM)( BN) Bruce Flatt have just recently asserted that:

the case for high-yield bonds stays really strong …[with a] high anticipated return … which is well above the ten-year average.”

In this post, we will explore the ramifications of the bullish setup for high-yield bonds on the SPDR Portfolio High Yield Bond ETF ( NYSEARCA: SPHY).

Ramifications Of Bullish High-Yield Bond Setup on SPHY

To comprehend why high-yield bonds are appealing in the present macroeconomic environment, let’s very first discuss their qualities.

As bonds, they are legal securities in which the customer is lawfully obliged to pay a set interest rate to the lending institution and after that return the initially obtained principal to the lending institution on the bond’s maturity date. Furthermore, the lending institution’s right to be made entire on these commitments takes concern over any equity or chosen equity that the customer might have impressive. This makes high-yield bonds more conservative financial investments than equity or chosen equity financial investments in the very same business and for that reason makes them less conscious changes in macroeconomic conditions.

2nd, as their name suggests, high-yield bonds typically use remarkable yields relative to other bonds. This is since high-yield bonds are typically described as “scrap” bonds to differentiate them from investment-grade bonds. Considering that the debtors do not get approved for investment-grade status based upon evaluations from credit ranking firms, they need to use lending institutions a greater interest rate to attract their financial investment due to greater viewed danger.

Lastly, as formerly specified, high-yield bonds typically are higher-risk financial investments than investment-grade bonds considered that the monetary strength of the customer is viewed to be lower. As an outcome, in basic, high-yield bonds tend to underperform investment-grade bonds throughout durations of substantial financial distress due to a rise in defaults amongst weaker business and expanding yield spread in between investment-grade and non-investment-grade bonds throughout durations of financial distress while outshining investment-grade bonds throughout durations of financial success and even moderate financial slumps because business defaults stay fairly low throughout these durations and the greater rate of interest paid by the high-yield bonds relative to investment-grade bonds more than compensate financiers for the only a little greater default rate experienced throughout all macroeconomic environments aside from more extreme or extended financial slumps.

With these qualities in mind, the outlook for high-yield bonds – and for that reason SPHY offered its broadly varied direct exposure to the high-yield bond sector that makes it an excellent proxy for it (with over $1 trillion worth of this classification financial obligation represented by the 1,892 securities it purchases) – is really favorable today for the following factors.

To Start With, there is growing proof that a soft landing is the most likely result for the U.S. economy as it comes out of the current Federal Reserve tightening up cycle. Heading inflation is now down to ~ 3% and over the previous 6 months, Core PCE (the Fed’s primary inflation metric) is annualizing at a ~ 2% rate (which is the Fed’s target number). CPI omitting real estate is at 1.5% and the previous 2 quarters have actually revealed incredibly strong GDP development. On the other hand, the tasks market stays on strong footing and the customer continues to invest at an impressive level. This situation manifesting itself would imply that the Fed must have the ability to slowly decrease rate of interest in the coming years while defaults stay fairly low. Considered that SPHY is filled with lower quality/non-investment grade loans, this will benefit them by minimizing pressure on the balance sheets of the counterparties to the loans it purchases.

2nd, the present weighted typical high-yield bond yield to maturity is around 8%, a level that is well above its 10-year average and likewise about 300 basis points above what the investment-grade bond market uses at present. Furthermore, SPHY’s present TTM yield is really appealing at 7.5%.

Third, approximately 50% of the sector is ranked simply one level listed below financial investment grade and just a little over 10% of it is ranked in the most affordable tier, showing that its qualitative strength is in fact not too bad. Since December 31, 2023, SPHY’s portfolio breakdown was not too various, with its quality direct exposure breakdown of:

- BBB or Greater: 1.04%

- BB: 45.46%

- B: 40.34%

- CCC: or Lower 12.41%

- Not Ranked 0.75%.

4th, the typical period to maturity in the sector is simply 3.3 years and the typical cost is 92 cents on the dollar, implying that there is not excessive danger of yield spreads blowing up in case of a sharp decline considered that the cost of these bonds will be closing towards par as they approach maturity even if the yields on high yield bonds increase in case of monetary distress. Considered that SPHY’s option-adjusted period was simply 3.17 years, it delights in comparable defenses.

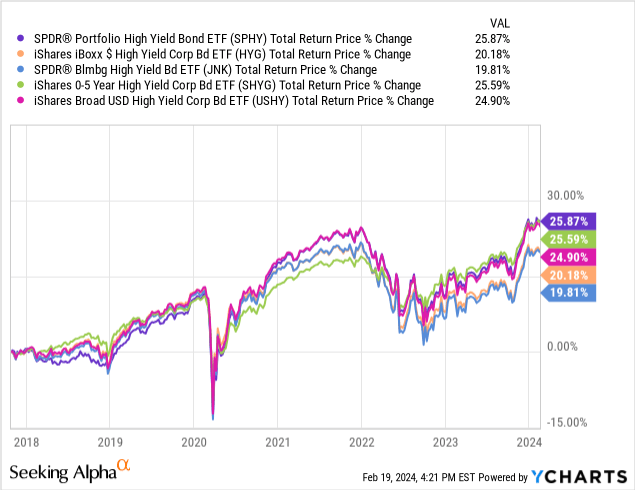

Lastly, its overall return efficiency outlook relative to other high-yield bond funds is strong, considered that it charges a simple 0.05% cost ratio and has actually outshined its peers ( HYG)( JNK)( SHYG)( USHY) in time:

Financier Takeaway

While a soft landing is far from ensured (in truth, various leading economic downturn indications continue to reveal that there is a high danger of economic downturn striking quickly), high-yield bond funds like SPHY appear to use financiers appealing risk-reward today.

In between its low cost ratio, strong performance history, well-diversified structure, high yield, discount rate to book worth, and fairly brief typical term to maturity, SPHY uses financiers substantial outperformance capacity relative to more conservative mutual fund in case of a soft landing without excessive drawback capacity in case an economic downturn does undoubtedly struck.