Maddie Meyer

Background

In late July 2023, I released a post with a strong buy score on CVS Health ( NYSE: CVS), which you can gain access to here At the time, CVS was securely in the market’s “dog house”: the stock was 52% off its all-time highs, well listed below its historic typical appraisal levels, and having a hard time to discover instructions.

Nevertheless, my bullish thesis was grounded in 4 core aspects:

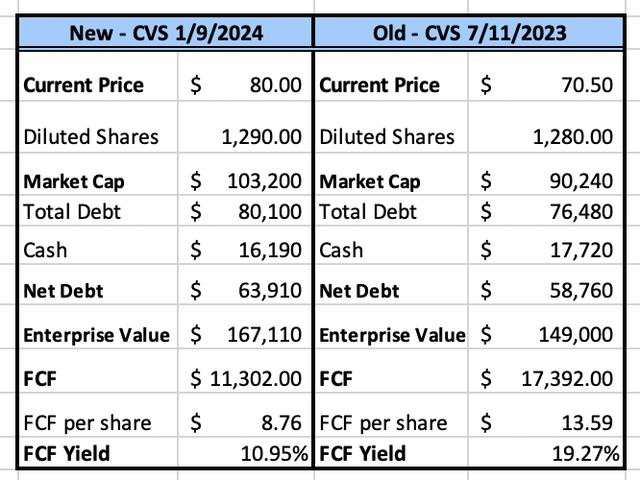

- Strong capital: At the time of composing, CVS boasted a totally free capital yield of 19.27%, among the greatest I had actually seen throughout all markets.

- Under-appreciated M&A: I thought financiers were ignoring the capacity of the business’s 3 current acquisitions: Aetna, Signify Health, and Oak Street Health. This propensity to swelling CVS in with its out-of-date and having a hard time peer, Walgreens ( WBA), was an error.

- Inexpensive appraisal: When I composed my preliminary short article, CVS was trading at a P/E of 8.3 x, substantially listed below its 10-year average of simply above 12x.

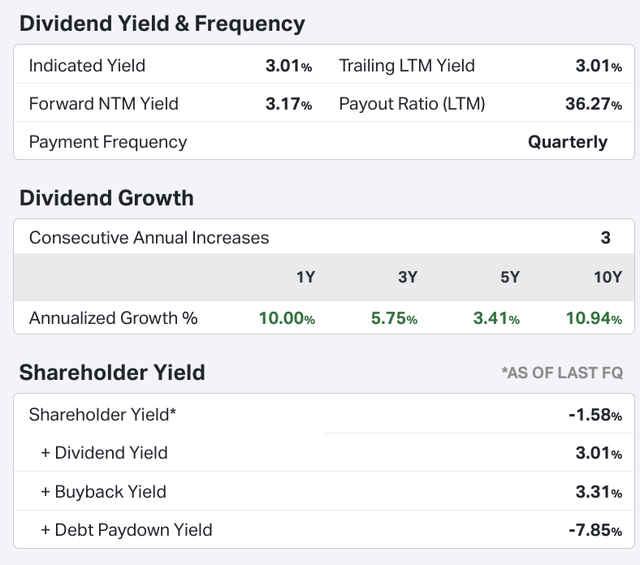

- Dividend defense: Even after the 50% rate correction, CVS still had enough capital to easily keep its decent dividend, with a yield surpassing 3%, supplying important disadvantage defense for financiers.

When I at first composed my short article, CVS was at $70.5 per share. It has actually because climbed up 13%, and my view on the stock has actually moved somewhat. While the upward motion has actually been a hit for financiers and I still think in CVS for the long term, its present rate and appraisal no longer require a strong buy and even a buy score in my viewpoint.

New Financial Investment Thesis

I now rank CVS stock a hold. I stay positive in the diversity the business and brand name have actually attained through their acquisitions. They now provide more than simply conventional drug store items and retail products, and still keep a strong credibility of a safe, trusted, and available area hassle-free shop for lots of people around the world.

Walgreens CEO stated on CNBC today that about 10 million day-to-day shop check outs makes me think CVS’s numbers are most likely in a comparable variety.

The dividend likewise continues to provide defense. While the yield is presently 3%, it stays decent, specifically thinking about the capacity for 6-10% rate gratitude. The decreasing payment ratio is a favorable indication, recommending a capacity for a good dividend boost in 2024, most likely surpassing Walgreens’ current cut.

CVS Dividend Introduction ( Koyfin)

For present long-lasting CVS holders, standing by stays a feasible choice. Gather your dividend and take pleasure in prospective additional gains of 4-5% by year-end without concern. Nevertheless, if you’re a freshly interested financier, it may be time to take revenues or minimize your position, as I have actually done.

My modification in thesis comes from 2 crucial aspects:

- Damaged capital: CVS’s totally free capital has actually almost cut in half, dropping from $17 billion with a 19.27% yield to $11 billion and a 10.95% yield. This decrease, combined with increasing financial obligation, raises issues.

- More costly appraisal: While I comprehend greater expenses associated with M&A, development, and growth, this drop in capital is considerable. Tighter capital allowance, implying less share buybacks, slower dividend development, and possibly soft company development, may end up being truths if capital continues to reduce.

Nevertheless, I stay positive that CVS is tactically investing this money, and we’ll see enhanced financials and a decent return on invested capital (‘ ROIC’) in the future.

CVS FCF first Article.vs. Now ( Author Estimations)

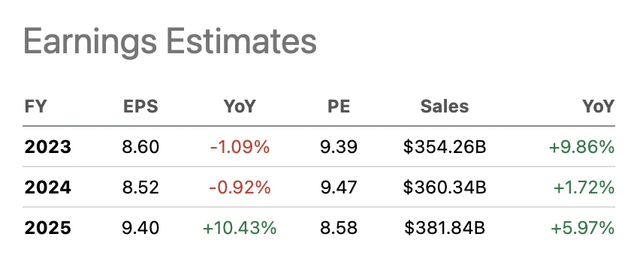

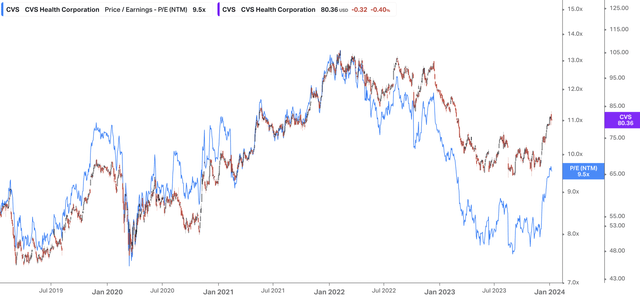

In regards to appraisal, CVS presently trades at a 9.3 x P/E for 2024, still lower than its historic average of 12.4 x over the previous ten years. While we may be seeing a shift in CVS’s appraisal variety, it deserves keeping in mind that the stock is likewise somewhat off its five-year average of 9.8 x This low appraisal raises concerns, and truly so.

Expert s do anticipate incomes per share (‘ EPS’) to dip somewhat in both 2023 and 2024, which might validate a lower P/E several like 9x.

CVS Expert Quotes ( Looking For Alpha)

CVS is likewise dealing with an altering company landscape. The increase of huge tech gamers like Amazon ( AMZN) and Apple ( AAPL), brand-new entrants like Teladoc ( TDOC), and consistent competitors from Walgreens are all affecting their brick-and-mortar design.

In Spite Of this, I still see some capacity in CVS at its present 9x P/E. There might be space for growth, however the risk-reward profile is less appealing than previously.

When I at first ranked CVS a strong buy, the R: R was 4.9 x and the stock was 19% far from my reasonable worth target. Now, it’s simply 4% away and the R: R has actually diminished to 1.4 x. While still above 1, it’s not almost as beneficial or safe as formerly.

Offered these modifications and the current rate boost, I am required to downgrade the stock to a hold at $80 per share. Up until I see continual fundamental development or a pullback in the stock rate, I would beware about purchasing into CVS at present levels. Prospective dangers still exist.

Danger

The dangers I determined 6 months ago stay pertinent. Nevertheless, I ‘d include a brand-new one: appraisal danger. At its present P/E several north of 9x, a contraction might take place if development continues to stall and CVS and WBA battle to adjust their company designs. This circumstance might press the stock pull back to the low $70s and even the high $60s.

CVS FWD P/E & & Historic Cost Chart ( Koyfin)

One significant danger, as I have actually pointed out previously, stays the business’s having a hard time shops. Aging, understaffed, costly, and swarming with theft, these areas deal with intense competitors from hassle-free and lower-cost competitors like Walmart, Amazon, and Kroger ( KR). These rivals provide comparable items at substantially lower costs, both in-store and online, through Amazon’s fast shipment.

The concern then ends up being: how can CVS keep foot traffic versus these difficulties? The drug store itself, especially with its Aetna insurance coverage offerings, and the extensive benefit of CVS areas, are crucial aspects. Lots of consumers discover it much easier to pop into a neighboring CVS instead of selecting another drug store. Naturally, for some, it may just refer which shop is on the easier side of the roadway!

Theft stays a substantial concern afflicting CVS. Securing whatever and requiring consumers to await understaffed staff members to open cages for affordable products is plainly not the response. Executing AI and advanced camera/facial acknowledgment innovation might possibly provide options, not just decreasing theft, however likewise enhancing the bottom line.

Cost Targets

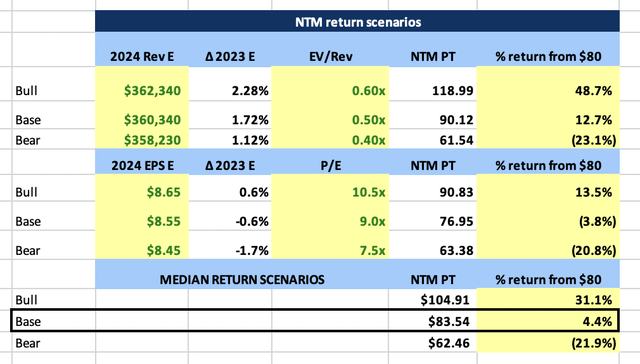

Utilizing a Next Twelve Months (NTM) Cost Target Circumstance table together with the stock’s historic appraisal variety and present expert quotes, I have actually produced a bull, base, and bear rate target outlook.

Formerly, when I evaluated CVS, I was 19% far from my base case rate target with an extremely beneficial 4.9 x risk-reward ratio. This indicated I saw 49% prospective advantage to my bull case PT and just 10% disadvantage danger to my bear case PT. The stock was currently substantially marked down, making it a terrific purchasing chance.

Nevertheless, the scenario has actually altered. Now, I’m simply 4% far from my base case reasonable worth, and the R: R has actually diminished to a weak 1.4 x. This equates to 31% prospective advantage to my bull case circumstance, however likewise a worrying 21% disadvantage danger to my bear case PT.

As you can picture, it’s substantially much easier to validate investing when the prospective return is 50% with just 10% disadvantage, compared to 30% return with 20% disadvantage danger.

For your referral, I have actually consisted of the present NTM Cost Target Circumstance table:

CVS NTM Cost Target Circumstance Table ( Author Estimations Based Upon Expert Quotes From Information on S.A.)

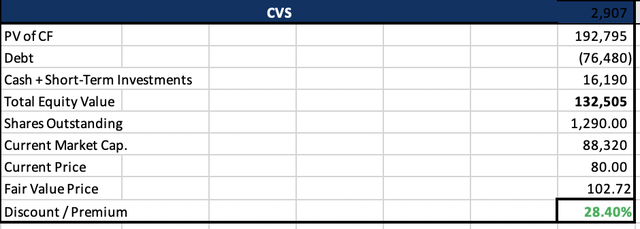

This time, I went an action even more and established a DCF design. This design enables us to approximate the stock’s worth based upon the presumption that CVS will continue running efficiently, creating excess totally free capital, and regularly increasing its dividend. Under this circumstance, my long-lasting rate target (2-3 years) is $103 per share, representing roughly 28.5% upside prospective from the present rate of $80. While the course might not be direct, I think that continual company distinction and ingenious offerings will allow CVS to keep its capital generation and client base.

CVS DGM Outcomes ( Author Estimations)

Reaching $103 is definitely a high order, and it may take even longer than the 2-3 year timeframe I detailed. Eventually, their success depends upon how successfully they handle their shops, draw in foot traffic, and establish ingenious profits streams. $354 billion in anticipated profits for 2023 is an effective engine, however continual development can end up being tough at such a big scale.

In spite of the difficulties, I stay positive in CVS’s capability to adjust and flourish in the long run. Compared to Walgreens, I see them with a clearer course to browse the altering retail landscape. This raises a fascinating concern: as I was asked this previously today, could WBA be the next stock to leave the Dow Jones 30?

Conclusion

While I stay basically favorable on CVS long-lasting, I’m devaluing my score to a hold due to appraisal issues, prospective future capital restrictions, and a weakened risk-reward profile. The current run-up to $80 has actually compressed the appraisal, making entry less appealing at this moment.

Nevertheless, I restate that existing CVS financiers can easily hold their positions. For prospective brand-new entrants, I suggest care. Display the stock’s motions over the next couple of weeks before thinking about entry. With incomes on February 7th, a short-term stall isn’t unexpected. A dip listed below $80 might provide a purchasing chance, however verification of ongoing capital generation and favorable incomes assistance will be crucial for financier belief.

My core thesis for CVS stays partly undamaged. They’re actively diversifying, using several development methods, and creating strong totally free capital. The vital concern is long-lasting sustainability: can this momentum continue, or is business design ending up being obsoleted? While I rely on the management group and brand name, present prices needs vigilance due to an unsure customer and financial environment.