alvarez

Financial Investment Thesis

Eagle Products ( NYSE: EXP) is anticipated to continue taking advantage of beneficial rates driven by strong need, particularly in the cement section. The business’s favorable outlook is additional supported by increased financial investment in facilities enhancement through the IIJA and tactical bolt-on acquisitions. In the approaching quarters, these aspects ought to offer extra assistance to the cement section.

The Wallboard section, which concentrates on domestic brand-new building in addition to renovation and restoration (R&R), is expected to gain from a robust pipeline of multifamily systems presently under building. Furthermore, the section needs to delight in a nonreligious tailwind due to an undersupply of houses and an increasing variety of houses reaching the prime renovation age. The Federal Reserve’s anticipated adoption of a less hawkish position following the current banking mess ought to lead the way for a healing in the brand-new domestic building market next year. For that reason, a downturn in the real estate market ought to be less worrying moving forward.

Eagle Products’ margins are anticipated to gain from strong rates. Additionally, continued financial investments in functional and innovation abilities, together with the enhanced inexpensive manufacturer position accomplished through current acquisitions, are most likely to lead to expense savings and additional margin growth in the coming years.

Presently, the stock is trading at a discount rate compared to historic levels. Thinking about the beneficial long-lasting potential customers of the business and the reduced assessment of the stock, I advise a buy score for this stock.

EXP Q4 FY2023 profits

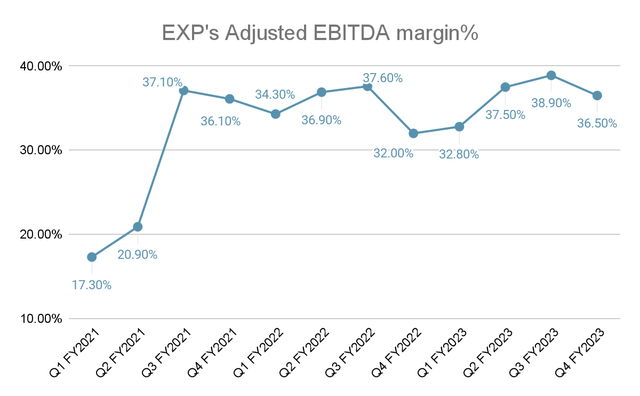

EXP just recently reported better-than-expected outcomes for the 4th quarter of FY 2023. Sales for the quarter reached $452 million, showing a 13.8% year-over-year boost and exceeding the agreement price quotes of $455.38 million. The profits per share (EPS) likewise showed substantial development, increasing by 47% year-over-year to $2.79, going beyond the agreement price quote of $2.30. The boost in income throughout the quarter was driven by continual robust need, especially in the cement section, and strong rates development. Regardless of dealing with greater functional and input expenses, the combined adjusted EBITDA margin broadened by 450 basis points year-over-year to 36.5%. This enhancement in the adjusted EBITDA margin added to the development in EPS for the quarter.

Income Analysis and Outlook

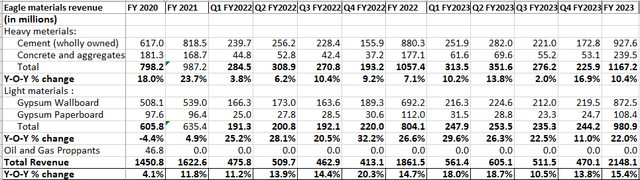

The business is taking advantage of strong rate awareness throughout both the Heavy Product and Light Product sectors, leading to strong year-over-year income development in the last quarter.

In the Heavy Product service, that includes the Cement and Aggregates sectors, there was 16.9% year-over-year income development to $225 million. This was mostly driven by a 16.4% boost in the typical net prices in the Cement section and the contribution from the just recently obtained aggregates service which more than balance out the effect of reduced cement sales volume brought on by record snowfall in Northern Nevada and Northern California market throughout the quarter.

On the other hand, in the Light Products service, that includes the Plaster Wallboard and Plaster Paperboard section, there was increased volume in the wallboard section. This, integrated with beneficial rates, led to 11% year-over-year income development to $244 million in this section throughout Q4 FY23.

EXP’s Income ( Business information, GS Analytics Research Study)

Looking ahead, a healthy need environment, especially in the Cement service, which has actually led to a sold-out position in the U.S. cement market ought to support near-term sales. The medium to long-lasting outlook for this service likewise looks excellent and there is a high level of public assistance for facilities enhancement which appears from a considerable variety of infrastructure-related costs that were passed in the mid-term elections held last November. This paired with the increased financing from the Facilities Financial Investment and Jobs Act (IIJA) has actually led to a 35% development in facilities agreements for highways, bridges, and tunnels over the previous 12 months. Additionally, costs at the state and regional level is likewise anticipated to stay strong driven by healthy spending plan and tax invoices, especially in the states where Eagle runs. In addition to driving volume development, this strong need needs to allow the business to carry out additional rate boosts. So, the outlook for the heavy side of business looks excellent.

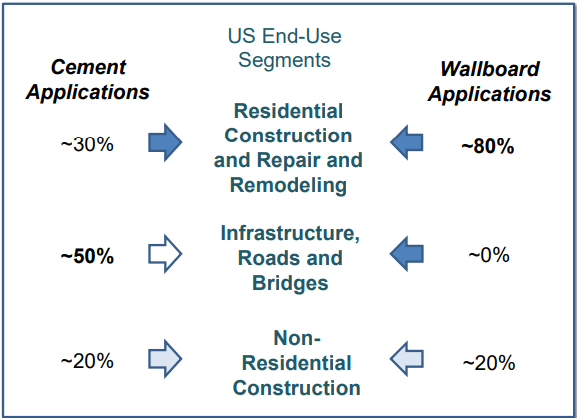

EXP’s Endmarket by Use ( EXP’s financier discussion)

The outlook for the Wallboard section, whose main end-markets include domestic brand-new building and renovation and restoration (R&R), stays rather combined due to the downturn in the real estate market due to increasing rates of interest. Nevertheless, the advantage is the Federal Reserve is anticipated to end up being less hawkish after the current banking mess which ought to pave a course to healing for this market next year. Even more, there are numerous company-specific aspects that ought to assist it succeed. For instance, the business has excellent direct exposure in the southern states which are succeeding in regards to real estate starts compared to other markets. Likewise, the business has excellent direct exposure to multifamily real estate which is doing fairly well. Additionally, traditionally low stock levels of real estate stock due to over a years of underbuild because the fantastic real estate economic downturn of 2008, suggest a favorable outlook for domestic brand-new building in the coming years.

The long-lasting outlook for the repair work and redesigning market is likewise excellent. The aging real estate stock getting in the prime renovation age is anticipated to grow over the next couple of years. Additionally, house owners are resting on all-time high levels of house equity, recommending increased costs on renovation and restoration in the future. These aspects are anticipated to drive EXP’s income development in the coming quarters.

In addition to natural development, the business is actively looking for chances for service growth through acquisitions, mostly on the Heavy side. Just Recently, EXP revealed the acquisition of Martin Marietta’s ( MLM) Cement Import Organization in Northern California that includes its cement import terminal in Stockton, Northern California. This acquisition becomes part of the business’s method to broaden and reinforce its circulation reach within the cement network throughout the United States. By taking part in a robust market and conference consumer requires in locations where the cement production supply is challenged, the cement service is anticipated to benefit in the future.

Additionally, the business preserves a sound monetary position, with utilize listed below 1.4 x. This monetary stability supports the pursuit of tactical bolt-on acquisitions in the future, which will even more improve the business’s income in FY24 and beyond.

Margin Analysis and Outlook

The business’s changed EBITDA margin broadened by 450 basis points year-over-year to 36.5% in the 4th quarter of FY 2023. This development can be credited to numerous aspects, consisting of strong rates and the application of cost-control efforts in the Wallboard service. These steps efficiently balance out the effect of lower cement sales volume and greater running expenses in the cement service, in addition to greater input expenses in the wallboard service.

EXP’s Adjusted EBITDA margin ( Business information, GS Analytics Research Study)

Looking ahead, the rates increases ought to continue particularly in the cement service offered the tight demand-supply condition. This ought to offer continuous assistance for the business’s margin in the approaching quarters. Furthermore, the business continues to purchase functional and innovation abilities which is anticipated to lead to expense savings for the business in the future. Even more, the current bolt-on acquisitions are expected to improve the business’s position as an affordable manufacturer. This, in turn, is anticipated to add to cost savings and help with margin growth in the coming years.

Appraisal and Conclusion

The business’s stock is presently trading at a price-to-earnings (P/E) ratio of 12.53 x based upon FY23 agreement EPS price quotes of $13.50. This assessment represents a discount rate compared to its five-year average forward P/E of 14.59 x.

The business’s income is anticipated to continue taking advantage of strong rates, nonreligious tailwinds coming from increased financial investment under the Facilities Financial Investment and Jobs Act (IIJA), an undersupply of real estate stock in the U.S., and an increasing variety of houses getting in the prime renovation age.

Additionally, the business’s margins ought to gain from the strong rates environment and continued financial investment in cost-saving efforts.

Among the most significant threats to the business was the downturn in the brand-new domestic building market. Nevertheless, with the current banking mess, there is a likelihood that the Federal Reserve embraces a less hawkish position, which ought to help with the healing of this end-market. So, we are most likely near the bottom of this market also.

Thinking about the business’s favorable long-lasting development potential customers and the stock’s appealing assessment, I advise a buy score on Eagle Products’ stock.