krblokhin

Background

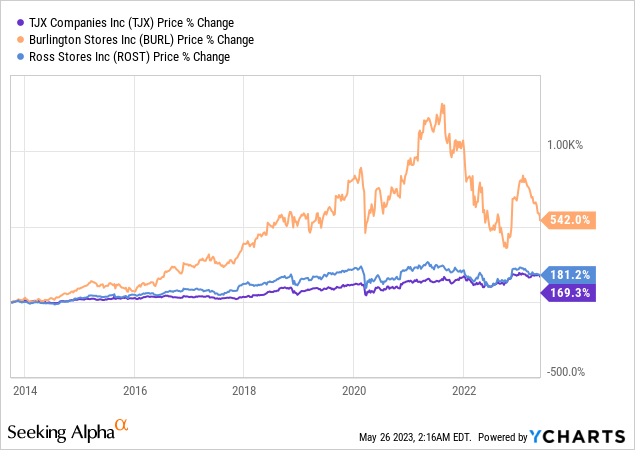

Burlington Shops ( NYSE: BURL) is a leading off-price merchant operating in more than 500 places across the country offering high quality branded garments and other devices. It sources items from a large network of 5,000+ suppliers with a concentrate on nationally acknowledged brand names. BURL has substantially surpassed its bigger peers; nevertheless, current development has actually lagged its bigger peers resulting in its underperformance in current times. Post the statement of Q4 outcomes, BURL stock stopped by over a 5th, which showed the pessimism constructed into the stock.

Revenues Miss however Momentum Strong

Burlington reported a lower than anticipated income numbers with compensation sales development of 4% compared to its own assistance of 5-7%. The softness was mostly driven by lower tax refunds which impacted the low earnings consumers, which the business concentrates on along with cooler weather condition leading up to Easter. Nevertheless, patterns chose up because mid-April and continued in Might and the downturn seen throughout March might be temporal. Management assisted for a compensation development of 2-4% for the quarter with the chance to beat its assistance if the present patterns hold, which is a favorable as they bake in some conservatism. Shops in greater earnings locations have actually been carrying out well, along with, greater priced items are prospering, showing the starting of a trade down impact. Together with that lower priced products are likewise seeing an uptick in the momentum, showing BURL’s worth proposal towards its core customer is driving traffic. Similar shop stocks increased 10% YoY and accessibility stays strong need to the patterns hold. Reserve stock continues to decrease on YoY and QoQ basis from 50% in Q1 2022 and 48% in Q4 2022 to 44% in the present quarter.

Gross margins enhanced by 130 bps, mostly driven by freight (~ 150 bps), partially balanced out by pressure in product margins as it sought to increase markdowns in the later end of the quarter due to unexpected shift in patterns. EBIT assistance stayed listed below price quotes with it anticipating 10-50 bps growth for the quarter, in spite of lapping a diminish accrual of 105 bps in 2Q 2022. It associated it for timing of particular costs along with lapping somebody off gains in property in last quarter as a dampener. It kept its assistance of compensation sales development of 3 – 5% for the year with EBIT margin anticipated to broaden by 80 – 120 bps and EPS series of $5.5 – $6.0.

Will the complete year assistance hold?

While the Q1 profits missed out on expectations, management kept its complete year assistance, in spite of directing Q2 softer with its assistance more 2H weighted. Our company believe the assistance is possible as an outcome of listed below:

1) Trade Down as tailwind: A number of sellers have actually reported indications of a trade down as customers tighten their wallets due to harder macro background and inflationary headwinds, consisting of BURL. Off-price sellers have actually had the ability to grow in a duration of macro obstacles as customers flock to the shops looking for much better worth. Our company believe BURL would be a significant recipient in addition to other off-price sellers of the trade down impact and get market share off the other outlet store and specialized shops.

When we take a look at our shops based upon the earnings profile of the trade location that they remain in, we’re seeing that shops in locations with greater family earnings are exceeding the rest of our chain. And it deserves keeping in mind that, that is the total reverse of the historic pattern that we have actually seen over several years. Historically, our development and efficiency has actually been driven by shops that lie with low to moderate earnings families. And our company believe that, that turnaround simply shows the phase of the financial cycle that we remain in. And it recommends that we might be beginning to see a trade down buyer.

– Michael O’ Sullivan, Burlington Stores

2) Sales assistance: Management has actually kept its sales assistance for the year at a midpoint of 4% compensation sales development. Our company believe the assistance is possible and might likely be beaten mostly as a) the patterns for Q2 appears strong and might exceed its of 2 – 4% compensation development offered the present run rate and b) beneficial base as it is lapping a weaker Q3 and Q4 2022 where in it reported a compensation sales decrease of 17% and 2% respectively as it raised costs throughout items throughout the 2 quarters while other sellers enhanced their advertising activity.

3) Margin growth: Assistance of 80 – 120 bps margin growth driven by product margins and lower freight expenses. Offered Q2 is most likely to stay a drag due to temporal costs, it anticipates 100 – 150 bps margin growth for the later part of the year, which our company believe is possible mostly driven by lower freight expenses serving as a tailwind for the whole retail sector. In addition, deleverage of SG&A costs and repaired expense tenancy on the back of compensation sales would serve as a tailwind. Enhancement in product margin along with optimization of item sourcing expenses would even more help margin and might shock the street.

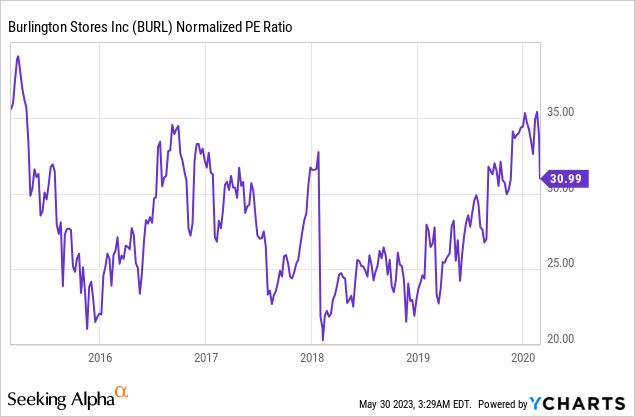

Appraisal

Our company believe BURL, in spite of its stumble in 2015, is completely placed within off-price retail to get market share in the middle of the present environment. We rank this as a Buy on Dips chance with a target rate of $180 (at 30x 2023 P/E), in line within its historical average (pre-pandemic).

Dangers to ranking consist of 1) decrease in equivalent sales as an outcome of competitors advertising environment of management’s failure to evaluate the marketplace as seen throughout Q3 2022 2) boost in markdowns to balance out the gains in freight expenses resulting in margin pressure 3) item sourcing and supply chain expenses stay raised offered the increased mix of real closeout product along with the lower AURs as experienced in Q1 2023

Last Ideas

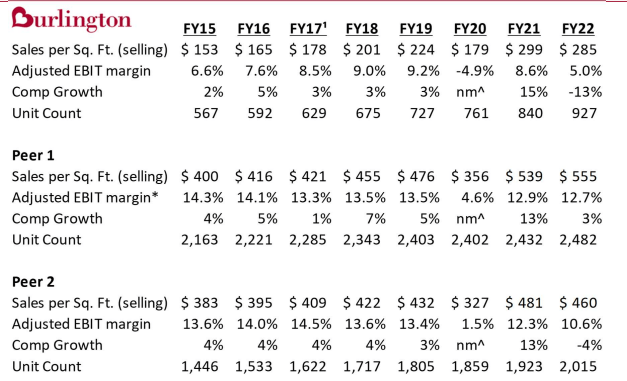

BURL, in spite of its strong performance history of development, has actually stumbled just recently and lags the peers TJX and ROST in compensation development, margins and sales/ shop.

Business Discussion

Our company believe the business is making needed actions with its Burlington 2.0 technique concentrated on growth driven by smaller sized shop models offering enough whitespace, strong balance sheet (Net Financial obligation/ EBITDA of 1.1 x) and outsized margin capacity on the back of enhancement in supply chain, versatile shop staffing design and faster stock turns offering selection closer to the client. We start this as a buy on dips chance with target rate of $180.