It utilized to be that a primary monetary officer‘s main focus was on the conventional functions of the task: keeping track of capital and monetary activities; working as a controller and accounting professional; restricting unneeded costs; and guaranteeing that monetary choices complied with standard procedure.

These tasks are still crucial, obviously, however they’re significantly ending up being secondary to the tactical functions CFOs are being asked to play. As the speed of service speeds up and innovation advances, the modern-day CFO needs to take a more comprehensive, more forward-thinking and growth-oriented method to the task.

The consulting company Accenture caught this improvement in a 2022 study, discovering that common financing chiefs now invest the majority of their time leading companywide efforts to change and enhance service operations, with a focus on speeding up earnings and earnings development.

It’s a brand-new truth that I have actually seen play out amongst fast-growing little and medium-size health care companies where I have actually held a variety of management positions. These business not just anticipate you to be a practical CFO, providing on standard accounting duties, they likewise anticipate you to be a tactical CFO, dealing with the management group to check out development chances and make the most of success.

So how do you establish this tactical know-how? Through experimentation, I have actually discovered that the most efficient method is to concentrate on your existing financing abilities and duties– those functions that are currently within your province as a CFO– and raise them to provide the tactical insight your business requires.

In this post, I share 6 locations where I advise you focus. The advancement of the abilities I go over can be used broadly to development business and used throughout a large spectrum– by fractional CFOs dealing with later-stage start-ups, by interim CFOs in distressed circumstances, or perhaps by financing chiefs used by public business.

When it concerns broadening and strengthening your existing abilities, I go over the simplest locations initially. The later ones, specifically business vision, will most likely take in more of your time, however I anticipate you’ll discover that mastering them is well worth it to you and your business. I consist of examples to reveal you how I put each of these ideas into action.

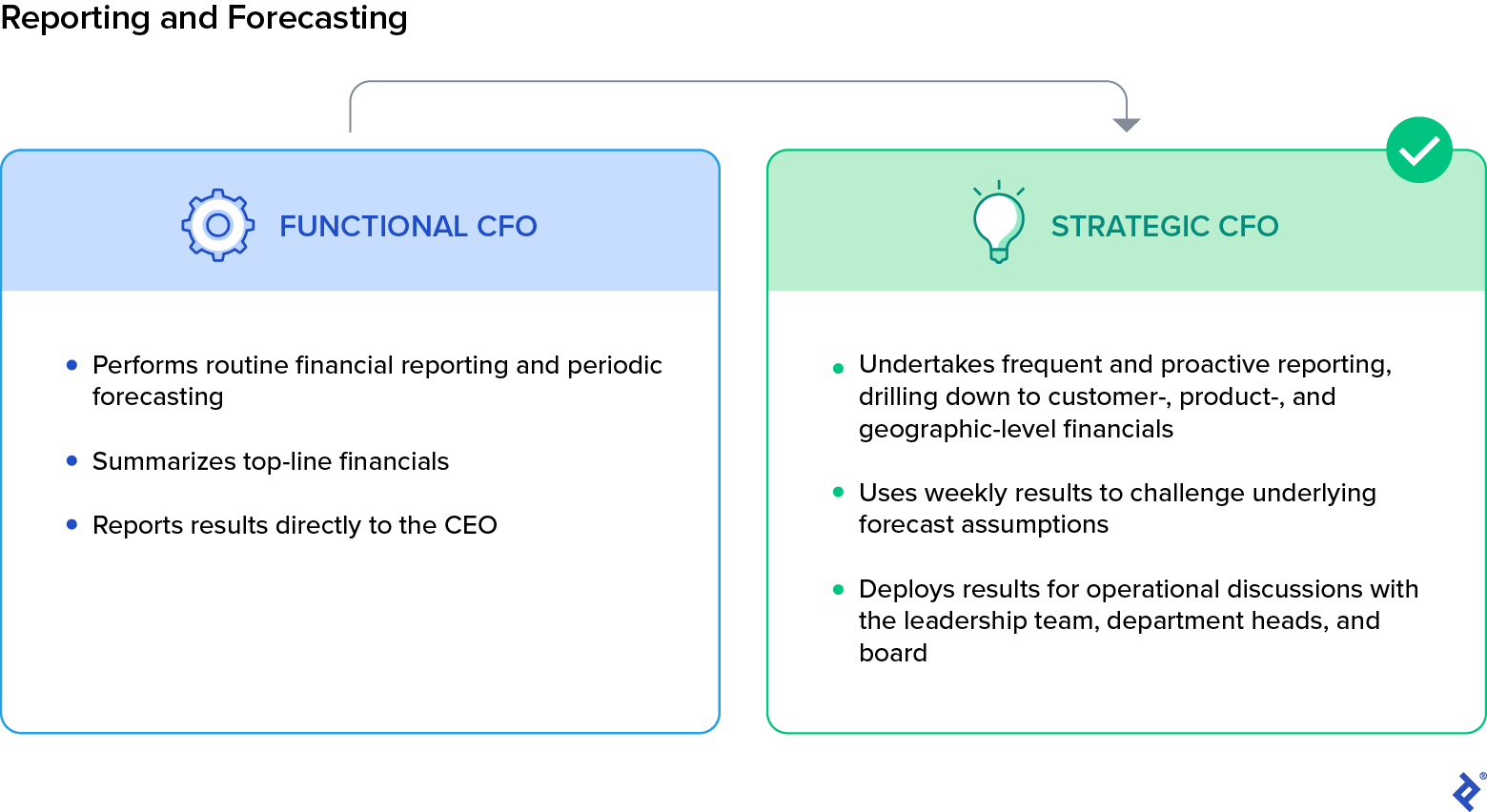

1. Reporting and Forecasting

Reporting and forecasting are table stakes for a financing chief. The expansion of software application as a service (SaaS) and cloud services has actually made it simpler and more affordable to incorporate effective accounting systems throughout a company. A practical CFO needs to guarantee that everybody who requires access to these systems has actually been completely onboarded and is utilizing them, while a tactical leader searches for chances to dive much deeper into the details to surface area actionable insights for the company.

I can best describe how to establish this location by sharing how I showed to one business that completely onboarding a group is an important action– even for management. I worked for an early-stage health care services business where the CEO tracked business financials on an Excel worksheet he saved money on his desktop and upgraded in the evening and on weekends. This practice developed apparent issues. Initially, his shadow financials were typically insufficient. Second, his practice triggered a detach that avoided the financing group from establishing a regimen of upgrading details and producing beneficial and prompt insights for the CEO. Without this regular, the CEO was flying blind when it pertained to sales and success decision-making.

When I signed up with, I assisted the business standardize all the accounting, functional, and monetary reporting design templates, and the chart of accounts The business and I then settled on a reporting calendar for when the financing group would offer the CEO and board the most recent earnings declaration, balance sheet, capital declaration, and client- and product-level division. That report likewise frequently supplied details on the efficiency of private departments, comparing the figures for each with that department’s spending plan, projection, and prior-year numbers.

We didn’t stop with standardizing companywide reporting, nevertheless. We leveraged the details to advise functional modifications that would enhance locations of monetary underperformance. This not just maximized the CEO’s nights and weekends, however likewise offered us tactical insight into the business’s operations while decreasing the management group’s stress and anxiety and tension under the previous fragmented reporting system.

2. Financial Preparation and Analysis

The next sensible action for a tactical CFO is to try to find methods to use standardized databases and quantitative abilities in monetary preparation and analysis FP&A is usually utilized to produce data-driven responses to monetary and functional efficiency concerns dealing with any element of the business. Some are regular analyses, such as comparing the existing duration’s efficiency to the previous one’s, while others are advertisement hoc analyses such as determining the roi for a brand-new sales enablement innovation platform. A tactical CFO utilizes the very same procedures and might deal with a few of the very same concerns as a practical CFO however takes a more proactive method.

When I signed up with a pharmaceutical producer as CFO, I discovered that few of the business’s senior leaders understood which client, item, or location produced the greatest development or earnings. This ended up being an issue when the business needed to rapidly increase success. After carrying out standard reporting enhancements, I carried out a thorough success analysis of the business’s numerous service and client sectors to start to address wider tactical concerns.

Utilizing FP&A service intelligence tools like Microsoft Power BI, we identified the sources of the greatest development and the best revenues and losses. We then broke them down by item classification, item SKU, client, service system, and location. However we didn’t simply produce a report that beinged in associates’ inboxes. We looped in cross-functional groups to assist us style, establish, and obtain insights from the reports, and hosted thorough discussions with executive leaders of each practical location about industrial and functional modifications that would make the most of monetary efficiency.

Within a brief time, the business had a holistic understanding of which sectors contributed revenues. Simply as crucial, we had total positioning amongst senior leaders that we need to concentrate on the most successful sectors. This technique enabled us to almost double the business’s success in less than a year.

3. Danger Management and Mitigation

If financing leaders believed threat management was simply an administrative footnote to monetary oversight, then the COVID-19 pandemic and breakdowns in worldwide supply chains overthrew that misunderstanding. Today, CFOs should take a function in pressing groups throughout the company to make threat evaluations and frequently address concerns of mitigation. At the very same time, they require to see threat management through the prism of chance, trying to find where it produces prospective industrial openings.

For instance, from 2017 to 2020, I was accountable for a group of business that imported crucial elements for medical items to China or assembled them there. The business took pleasure in cross-border, lower-cost arbitrage and regularly broadened gross margins for several years. Nevertheless, when I signed up with, I might see functional, regulative, and macroeconomic dangers on the horizon We engaged senior leaders in thought-provoking quarterly conversations to expect possible risks so we might devote resources and do something about it to alleviate the most important product dangers. The groups regularly highlighted the possible functional and monetary dangers of cross-border trade barriers interfering with crucial part deliveries.

This showed prescient when a trade war flared in between the United States and China in 2018. Since we were prepared through our threat preparation, my group of business had the ability to decrease supply chain disturbances by leveraging backup part sources in other parts of Asia and Europe. Incorporating threat management into the business culture let us not just lower or reduce the effects of dangers, however likewise restricted effect on the bottom line, producing industrial chances for our sales and marketing groups to increase market share. We continued dependably providing items and services while our rivals were still handling disturbances.

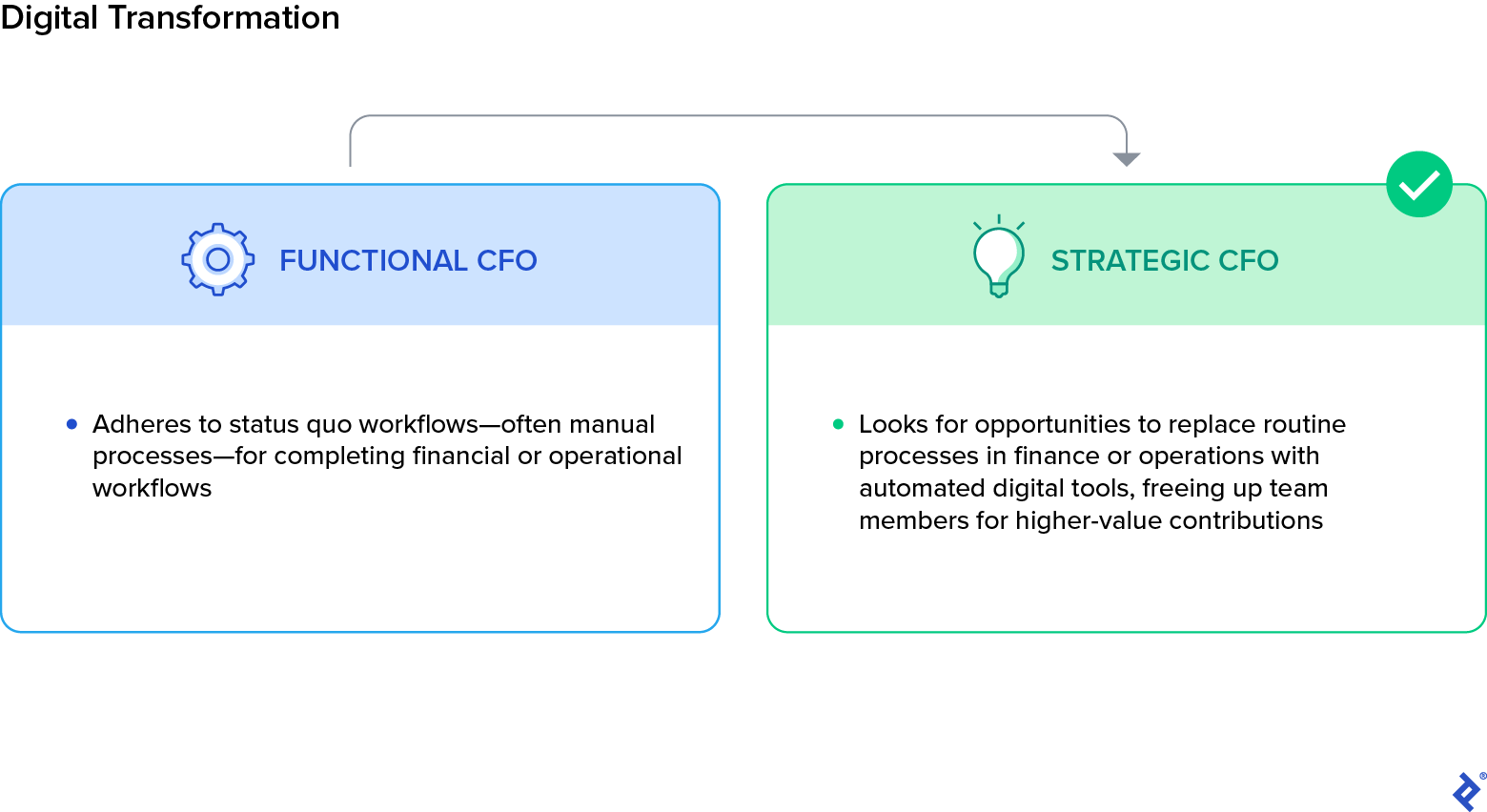

4. Digital Improvement

It’s regular for a CFO to ask department heads to do more with less. Financing chiefs can blaze a trail by doing so themselves, analyzing methods to automate back-office operations to totally free staff members from recurring jobs while conserving money and time. Automation can likewise assist the financing department as it handles the continuous cycle of work spiking within tight schedules: regular monthly closes, immediate analysis demands, and the crunch duration around mergers and acquisitions Being constantly except hands and hours undoubtedly causes high levels of tension.

I discovered how required this shift was direct. After a reorganization at a worldwide production company, my financing group was staffed with simply 2 service experts. This lean group was accountable for reporting and examining monetary outcomes for 25 portfolio business on a monthly basis within 2 service days. It merely wasn’t possible for 2 individuals to finish this spreadsheet-based copy-and-paste job within 2 days. Automation was the only service.

We invested a percentage into robotic procedure automation to manage regular reporting procedures and reorganized the group’s method, assisting the 2 experts end up being professionals in service intelligence and visualization programs. Utilizing these innovations, the 2 had the ability to finish the reporting jobs in one working day. They utilized the time they conserved to carry out analysis and deal with magnate to match the reporting with actionable insights.

Taking on these knowings, our business advancement groups took a comparable method: They automated their regular monthly outreach, permitting them to call 10 times the variety of potential acquisition targets and therefore cultivate a bigger partner pipeline.

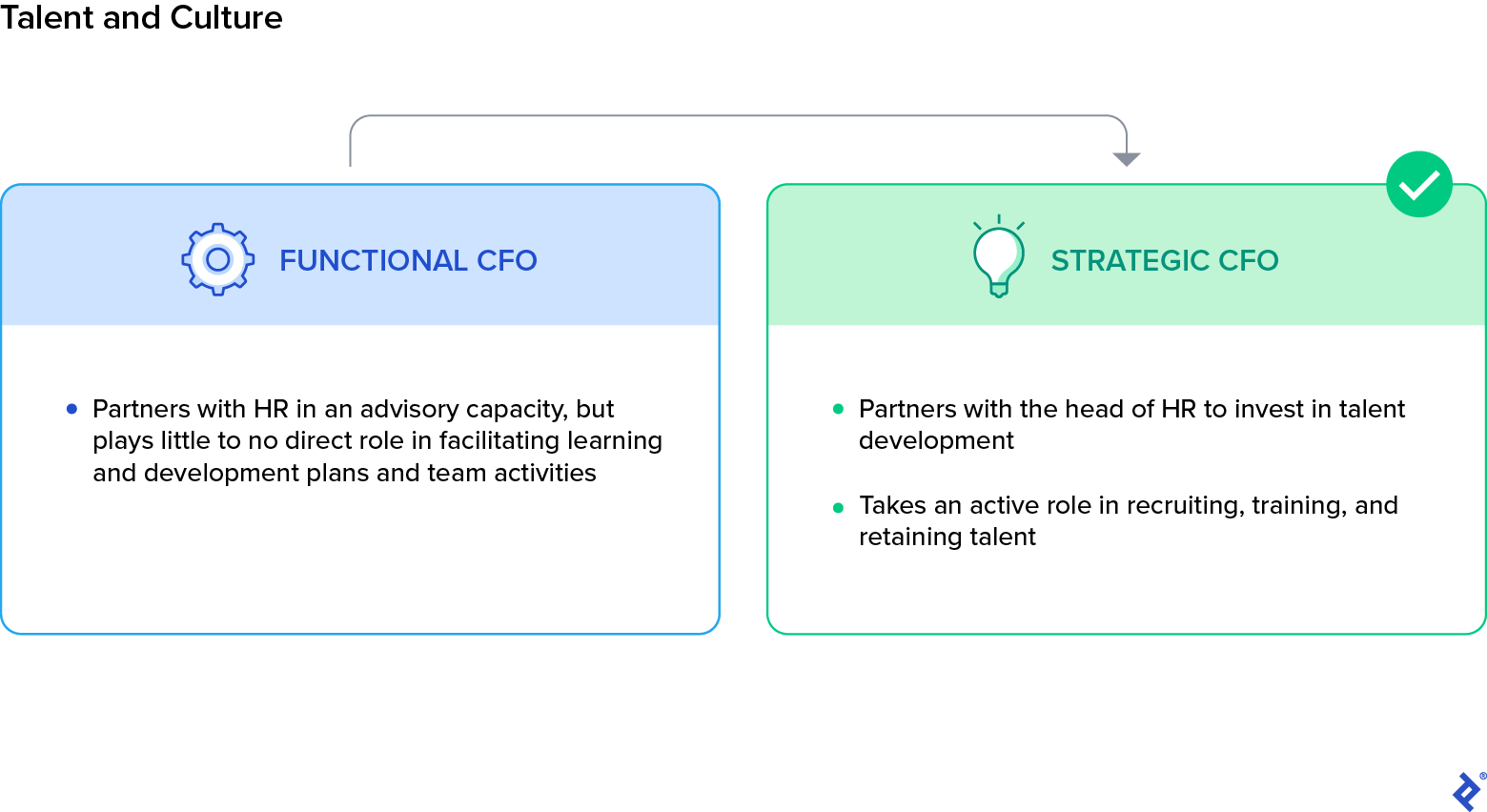

5. Skill and Culture

One important method a CFO can take a more tactical function is by ending up being more straight associated with recruiting and cultivating skill Rather of simply encouraging HR on staffing requirements, a tactical CFO will partner with HR to produce chances to bring high-performing monetary skill into the company.

For example, I when assisted hire a really skilled executive to a little health care gadget making business that my company owned, although I understood we were going to offer it within the next year. We asked this individual to sign up with as the vice president of financing, support the business, and effectively finish the sale– although we didn’t have a particular function lined up for him later. This would have been a tough sell had we not approached this prospect with openness, sincerity, and a dedication to maintaining him in a senior function.

A year after the sale, we provided on the dedication and he ended up being CFO of our biggest portfolio service. 3 years later on, he was promoted to be the holding business financing chief, supervising all portfolio business.

As CFO, taking an active function in establishing a high-potential financing leader indicated I was adding to the business’s long-lasting technique by assisting to protect a staff member who might guide the business in a post-sale future. While all of this taken place in the financing department, others in various practical locations saw and embraced comparable techniques to recruiting and cultivating high-potential skill in sales, marketing, operations, and innovation.

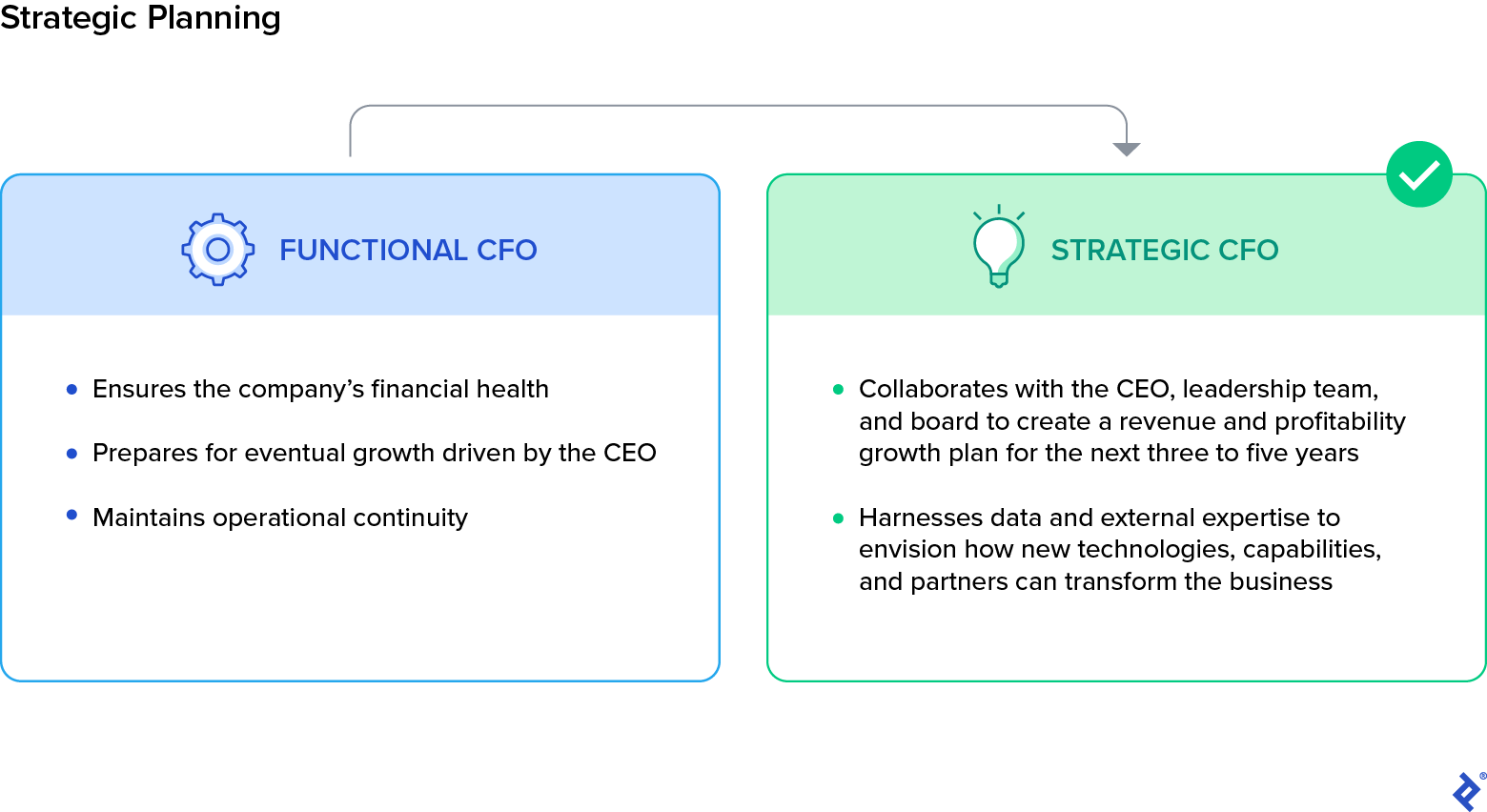

6. Strategic Preparation

Business value the difficult information and empirical state of mind that a financing chief provides to tactical preparation. The CFO can utilize this as a chance to add to the improvement of a business’s industrial objectives or abilities, for example, by promoting acquisitions or presenting collaborations to extend competitive benefits.

I had the chance to put this into action while dealing with an emerging markets cardiovascular diagnostic business that made heart screens. The business had actually aggregated terabytes of heart rhythm information through the countless gadgets it had actually offered. This information was a distinct possession, however the business didn’t utilize the details for any industrial functions. As CFO, I thought about any big source of distinct information as a prospective chance in a world where SaaS service designs can be advertised rapidly.

I challenged the group to utilize that information as the basis of an analytics service while securing client privacy. After months of advancement with regional software application partners, the group revealed a brand-new service to health centers to supply real-time tracking, analysis, and notifies if the software application spotted unusual rhythms in a client. The service deepened client relationships and included an extremely successful earnings stream.

With higher exposure and much deeper insights about the business, the tactical CFO establishes a perspective about what items, abilities, and M&A chances can produce transformative worth for their business. Yet it is necessary to bear in mind that what really raises your contribution to a development business boils down to management.

The need on companies to fulfill targets is enormous, specifically as macroeconomic pressures increase and equity capital, personal equity, and public market expectations for monetary efficiency continue to climb up. Business require management, and leaders should provide development. The tactical CFO is distinctively empowered in this regard. When the modern-day CFO increases above their practical duties and supplies important tactical insights, they can assist their business change and grow for the future.