Last month, we reported that energy specialists have actually been growing progressively bearish on the oil rate outlook compared to previous belief. 4 energy companies consisting of the IEA and OPEC Secretariat have actually made their forecasts for oil need development in 2023, with the only typical style being that all 4 anticipate need to grow compared to 2022, however all are less positive than they were a year or two back.

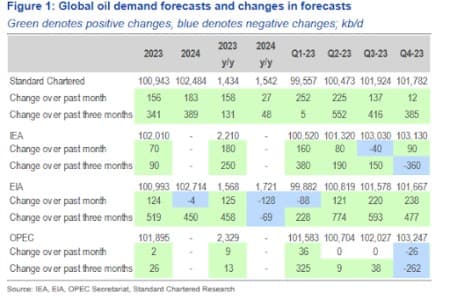

Formerly, the OPEC Secretariat was the most positive, and had actually forecasted that need will grow by some 2.3 million barrels daily while the International Energy Company (IEA) sees need broadening by 2.0 mb/d. On the lower end of the spectrum, Requirement Chartered is the least positive, and sees need growing just 1.3 mb/d while U.S.-based Energy Info Administration (EIA) anticipates development to clock in at 1.4 mb/d.

However these financial experts are now turning more bullish even as the total market ends up being more bearish.

The International Energy Company (IEA) released its regular monthly oil balances report on Tuesday

Might, about a week after comparable reports were launched by the Energy Info Administration (EIA) and OPEC Secretariat. Product specialists at Requirement Chartered have actually produced a heatmap of need projection modifications, including their own, in the current reports relative to one and 3 months back. You will see that the heatmap supplies a favorable view of need, with a lot of price quotes for 2023 quarters and the yearly typical having actually moved greater over both period. Remarkably, the most significant upwards modifications have actually originated from the more bearish companies specifically StanChart and the EIA, while more bullish ones consisting of the IEA and OPEC Secretariat have actually not altered substantially.

In sharp contrast, there’s a detach in between what energy financial experts are seeing in the information and what speculative traders are acting upon. Oil rates have actually touched multi-year short on a number of events over the previous 2 months, with StanChart hypothesizing that the detach might be the outcome of the progressively top-down and macro-led nature of oil-market belief.

Source: Requirement Chartered Research Study

Brief Sellers Take Control Of

Certainly, brief sellers are ending up being bolder and threatening to overrun the marketplaces.

The collapse of Silicon Valley Bank in March activated enormous capital flight from oil to rare-earth elements as panic spread that this might be the early innings of yet another banking and monetary crisis.

According to product experts at Requirement Chartered, the SVB collapse caused the fastest-ever relocate to the brief side in oil markets, with speculative brief volumes more than 6 times bigger than those after the collapse of Lehman Brothers and Bear Stearns in 2008. Money-manager positions throughout the 4 primary Brent and WTI futures agreements ended up being much shorter by a record 228.9 million barrels (mb) in the area of simply 2 weeks.

Naturally, oil rates cratered to multi-year lows in a matter of days prior to installing a half-hearted rally thanks to the second of April choice of some OPEC+ members to make voluntary output cuts. Related: Opportunities Of World Reaching Net-Zero By 2050 Unlikely: Exxon

Sadly for the bulls, the shorts have actually now returned with a revenge.

Recently, StanChart reported that money-manager positions throughout the 4 primary Brent and WTI futures agreements ended up being much shorter by 184.6 mb over the previous 2 weeks, a speed just surpassed by the boost in speculative shorts after the SVB collapse, and at the start of the pandemic.

At this moment, it’s unclear whether these sharp swings in the very same instructions are because of an over-reliance on comparable algorithms by traders. And, similar to us, StanChart states the extreme bearishness is exaggerated relative to underlying news circulation and essential information.

Petroleum stocks have actually fallen listed below the five-year average for the very first time this year.

Usually, U.S. stocks and oil rates have a strong inverted relationship, with falling stocks pressing rates higher while increasing stocks have the opposite result. Nevertheless, big stock draws over the previous number of weeks have actually stopped working to avoid substantial rate falls. As product experts at Requirement Chartered have actually kept in mind, these dislocations tend to be short-lived and come at times when rates are moved mainly by other oil market principles, expectations, more comprehensive possession markets and monetary circulations. In this case, current optimism relating to OPEC+ production cuts has actually stopped working to counter stress over need connected to a deteriorating financial background and a hawkish Federal Reserve resulting in oil rates staying range-bound. Even more, reports have actually emerged that Russian crude deliveries stay strong in spite of sanctions and embargoes: Reuters reported April oil loadings from Russia’s western ports were on track to reach their greatest given that 2019 at more than 2.4 M bbl/day.

Too Bearish

As we have actually mentioned previously, it’s tough to discover a correct reason for the growing bearishness in the oil markets.

According to the International Energy Company, international oil intake stays on track to increase by 2M bbl/day this year to an all-time high 101.9 M bbl/day. Stocks are slowly tightening up and ought to diminish even more as OPEC+ carries out brand-new production cuts. Petroleum stocks have actually fallen listed below the five-year average for the very first time this year. Recently, indicated fuel need increased by 992 thousand barrels daily (kb/d) w/w to a 15-month high of 9.511 mb/d.

StanChart has actually forecasted that the OPEC+ cuts will ultimately remove the surplus that had actually developed in the international oil markets over the previous number of months. According to the experts, a big oil surplus began integrating in late 2022 and overflowed into the very first quarter of the present year. The experts approximate that present oil stocks are 200 million barrels greater than at the start of 2022 and an excellent 268 million barrels greater than the June 2022 minimum.

Nevertheless, they are now positive that the construct over the previous 2 quarters will be passed November if cuts are preserved all year. In a somewhat less bullish circumstance, the very same will be attained by the end of the year if the present cuts are reversed around October. This ought to fortify rates.

On the other hand, gas rates are anticipated to increase in the latter half of the year as Europe goes on yet another purchasing spree. Europe has stopped working to protect enough long-lasting LNG agreements to balance out cut-off Russian gas imports, with Reuters forecasting this might show pricey next winter season and might dramatically tighten up the marketplace. The European Union views gas as a bridge fuel in the shift to renewable resource, and purchasers typically have a hard time to devote to long-lasting agreements. This indicates that Europe may be required to purchase more from the area markets as it carried out in 2022, which in turn is most likely to press rates up:

“ Because the green lobby in Europe has actually handled to convince political leaders mistakenly that hydrogen to a big level can change gas as an energy provider by 2030, Europe has actually ended up being far too dependent on area and short-term purchases of LNG,” expert Morten Frisch has actually informed Reuters.

By Alex Kimani for Oilprice.com

More Leading Reads From Oilprice.com:

.