Sean Gallup/Getty Images News

In my last short article released at the end of October 2022, I was bullish about Allianz ( OTCPK: ALIZF) and although I saw the danger of lower share rates in the months and quarters to come that did not take place (a minimum of not previously). Rather, Allianz acquired nearly 30% and plainly surpassed the S&P 500 ( SPY).

And not just due to the greater stock rate, we ought to reevaluate at Allianz. Thinking about current advancements – specifically collapsing banks in the United States and Switzerland – we need to ask as soon as again if Allianz is a great financial investment. The stock decreased in the week the SBV collapse occurred however carried out well in the following weeks (compared to other banks) and we can for that reason conclude that financiers do not appear to be fretted about Allianz. I, on the other hand, see the stock exchange on the verge and the banking crisis is simply the next domino falling.

Yearly Outcomes

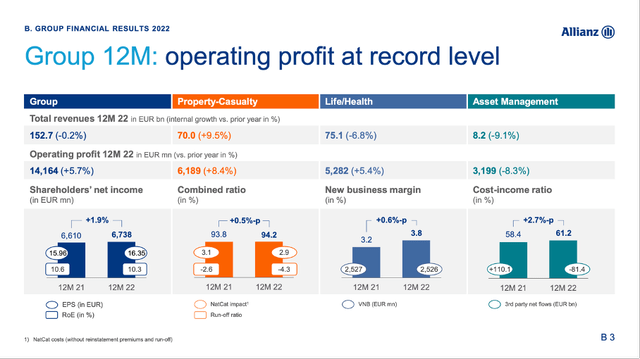

When discussing Allianz we can begin by taking a look at the earnings declaration and results for financial 2022, which can be viewed as strong. Overall income increased 2.8% year-over-year from EUR148.5 billion in financial 2021 to EUR152.7 billion in financial 2022. Operating revenue increased 5.7% year-over-year from EUR13,400 million in financial 2021 to EUR14,164 million in financial 2022. Watered down revenues per share likewise increased somewhat from EUR15.83 in financial 2021 to EUR16.26 in financial 2022 – 2.7% YoY development.

Return on equity decreased somewhat from 10.6% in financial 2021 to 10.3% in financial 2022 and Solvency II capitalization ratio decreased from 209% in the previous year to 201% in financial 2022.

And for financial 2023, Allianz is anticipating operating revenue to be comparable to financial 2022 (around EUR14.2 billion). Nevertheless, Allianz has a target series of EUR1 billion greater or EUR1 billion lower, which would lead to either 7% decrease or 7% boost.

When taking a look at the 3 various sections, just Property-Casualty might report growing income (increasing 9.5% YoY to EUR70 billion) with the other 2 sections reporting decreasing income. Sales for the Life/Health sector decreased 6.8% to EUR75.1 billion and income for Possession Management decreased 9.1% YoY to EUR8.2 billion. And while Possession Management likewise needed to report a decreasing operating revenue (8.3% decrease to EUR3,199 million), operating revenue for Life/Health increased 5.4% YoY to EUR5,282 million and running revenue for Property-Casualty increased 8.4% YoY to EUR6,189 million.

Balance Sheet

Aside from the earnings declaration, we ought to likewise have a look at the balance sheet. And in the last twelve months, the balance sheet worsened – we are comparing the balance sheet on December 31, 2022, to one year previously and overall equity for Allianz decreased from EUR84,222 million one year earlier to just EUR55,242 million. Overall properties likewise decreased from EUR1,139 billion at the end of 2021 to EUR1,022 billion at the end of 2022.

And while the chaos was specifically in the banking sector (and primarily impacting local banks in the United States), we ought to likewise beware relating to Allianz. Aside from its insurance coverage service, Allianz was likewise creating about 23% of its operating earnings from its possession management service. And naturally, Allianz is not dealing with the danger of a bank run (which brought Silicon Valley Bank to its knees), however financiers can likewise take out financial investments.

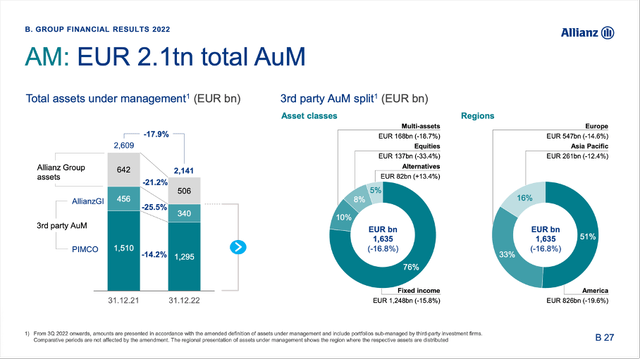

When taking a look at financial investments under management, we see a decrease of 17.9% year-over-year from EUR2,609 billion in AUM to just EUR2,141 billion today. And third-party properties under management decreased from EUR1,966 billion in financial 2021 to EUR1,635 million in financial 2022. The most significant part of this decrease is coming from lower rates for many properties, however Allianz likewise needed to report EUR81 billion in 3rd part net outflows.

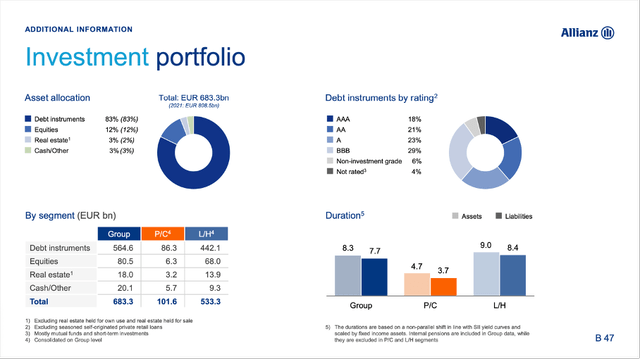

The financial investment portfolio likewise decreased from EUR808.5 billion at the end of financial 2021 to EUR683.3 billion at the end of financial 2022. The most significant part is still financial obligation instrument (accounting for 83% of properties) with about 2 3rd being A-rated (either AAA, AA or A).

General, a decreasing financial investment portfolio or lower properties under management are not worrying and it does not likewise suggest big issues for Allianz immediately. And while we need to not fear solvency or liquidity issues, outflows and lower properties under management will have an unfavorable impact on the success of Allianz.

Economic Crisis

And when taking a look at the efficiency of Allianz in the previous years, the outcomes were changing rather greatly. However regardless of these variations one pattern is rather apparent: Allianz was constantly carrying out well and reported excellent lead to the years prior to a bearishness and economic crisis however throughout economic crises the outcomes were typically awful. In 2002 and 2008, Allianz even needed to report a loss.

Allianz is definitely an excellent and strong service, however it is not economic crisis resistant. In the chart above, I marked the years prior to the economy went into an economic downturn (in dark blue) and we can plainly see that results decreased in each of the last 4 economic crises. And while the lead to 1992 and 2020 were still appropriate, the outcomes throughout the Great Financial Crisis and the years following the Dotcom bubble were dreadful.

And today, it appears once again as if the world economy is on the eve of an international economic crisis and although Allianz did not see the outstanding development rates leading up to the year 2000 and once again to 2007, we ought to beware as 2022 may be comparable and 2023 and/or 2024 might see much lower revenues per share. In my last short article I currently discussed why an economic downturn has an unfavorable effect on Allianz:

And when the bearishness is becoming worse (and in my viewpoint, it will worsen over the next couple of quarters), properties are most likely withdrawn for various factors (i.e., panic, liquidity) and decreasing possession rates will likewise cause diminishing overall AuM for Allianz.

And when discussing a possible economic crisis, bearishness and a possible banking crisis we ought to likewise not neglect that the lead to the very first quarter up until now are looking rather helpful for financials. According to FactSet, financials are among the very best carrying out sectors and the banks that reported up until now, increased income by 10.5% year-over-year and revenues 5.4% year-over-year. Speaking about a banking crisis due to these outcomes may appear a bit unreasonable. I would likewise like to discuss Howard Mark’s most current memo “ Lessons from Silicon Valley Bank” in which he argued that the SVB collapse may rather be an outlier and he is seeing the danger for a 2nd Great Financial Crisis rather low. And who am I to disagree with Howard Marks – however, I would not be so positive. While I may be a little bit more cynical about the outlook for the banking sectors, Howard Marks appears to have a comparable viewpoint about the instructions of the economy and the marketplaces and is anticipating bumpy rides ahead

Development

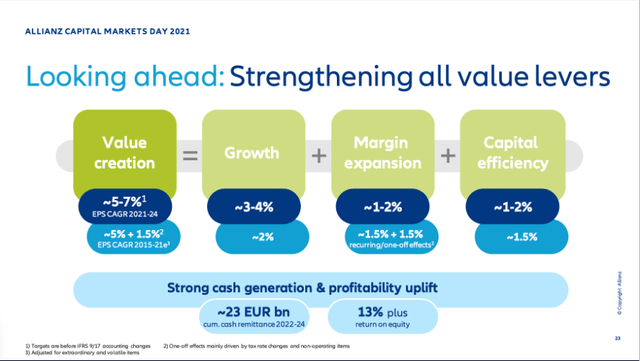

And while we ought to be rather mindful, management was rather positive throughout its 2021 Capital Markets Day. The bottom line development target was 5% to 7% development, which was primarily coming from natural development, however likewise from margin growth along with capital effectiveness.

Allianz Capital Market Day 2021 Discussion

Throughout the revenues call, CFO Giulio Terzariol was likewise positive that Allianz will beat its own outlook for financial 2023 – as it has in many years in the past:

And as you understand, we have a performance history to beat the outlook. It occurred all the time, other than in 2020 when we had COVID. So I think history tends to duplicate itself. So I will state that more than likely we’re going to be much better than this number.

Experts are likewise positive for 2023 and are anticipating much greater revenues per share (near to $24 revenues per share). I nevertheless would be rather doubtful – specifically for financial 2023 along with financial 2024. For the years after the prospective economic crisis, I believe these development rates are practical.

And while I am rather cynical for the coming quarters (and perhaps next 2 or 3 years), I likewise anticipate that Allianz will have the ability to grow in the mid-single digits over the long term. As I stated above, the outcomes of Allianz were changing rather greatly gradually and when determining long-lasting development rates, it depends rather a lot on which year one is taking as beginning point. When taking 2007 for instance as beginning point, we need to specify that Allianz saw revenues decrease somewhat over the last 15 year – however this is not a precise description of Allianz as 2007 was rather a severe outlier.

|

Development |

Because 2017 |

Because 2012 |

Because 2005 |

Because 2004 |

Because 1997 |

Because 1992 |

Because 1987 |

|

EPS CAGR |

1.42% |

3.65% |

2.23% |

5.72% |

5.86% |

9.48% |

8.74% |

However I believe development rates in the mid-single digits are practical for Allianz in the long run.

Dividend

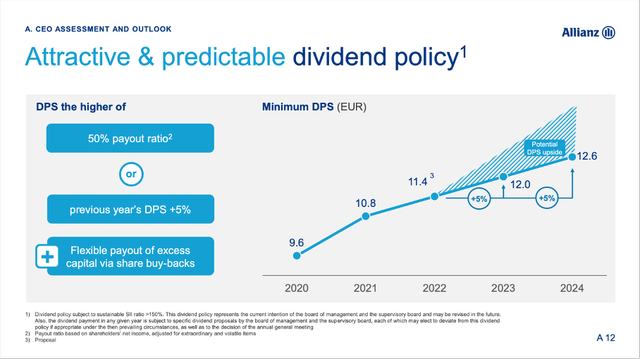

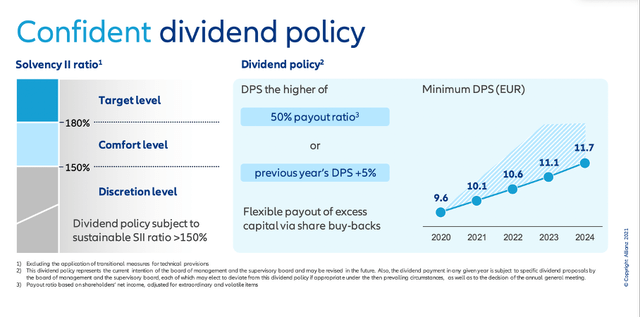

Allianz likewise proposed a dividend of EUR11.40 per share and compared to EUR10.80 in the previous year this is showing a 5.6% YoY boost. Management is likewise anticipating dividend development in the years to come, and Allianz will increase its dividend a minimum of 5% each year leading to an anticipated dividend of a minimum of EUR12.00 in financial 2023 and EUR12.60 in financial 2024.

Today, Allianz has a dividend yield of 5.1% and although the dividend yield was currently greater for Allianz in the past, this is still a really appealing dividend yield. An issue, nevertheless, is the rather high payment ratio. The existing dividend is leading to a payment ratio of 70% when utilizing the financial 2022 revenues and as Allianz is targeting a payment ratio of 50% the existing dividend is plainly above the target variety.

And because 2008, Allianz increased the dividend from EUR3.50 to a proposed dividend of EUR11.40 in financial 2022 – this is leading to a CAGR of 10.34%. By the method, Allianz goes ex-dividend on May 5, 2023, and financiers can still benefit from the dividend.

Intrinsic Worth Estimation

When attempting to determine an intrinsic worth for Allianz or figure out a cost target, we can begin by taking a look at the price-earnings ratio. Utilizing the revenues per share for financial 2022 (which were EUR16.26), Allianz is trading for a P/E ratio of 13.7 today. While this is not a high appraisal numerous in outright terms, it is a rather high appraisal numerous for monetary corporations (and lots of significant banks are trading for much lower appraisal multiples today).

Nonetheless, I would not call Allianz misestimated and when determining an intrinsic worth by utilizing a discount rate capital computation we will reach the exact same conclusion. As constantly, I will determine with 10% discount rate along with 403.3 million exceptional shares. Let’s make the following presumptions: For financial 2023, we presume EUR0 earnings (although I do not believe this is practical, it is simply a method to show an economic downturn in the computation – it might likewise take place in 2024). For the list below year we presume half of the earnings of financial 2022 and for 2025 we presume a complete healing (exact same earnings as in financial 2022). In the years after 2025 we presume Allianz will continue its course of low-to-mid-single digit development and various development rates cause various intrinsic worths.

|

2% development |

3% development |

4% development |

5% development |

|

|

Intrinsic Worth |

EUR191.34 |

EUR217.63 |

EUR252.67 |

EUR301.73 |

So, depending upon what development rates we view as practical in the years to come, Allianz may be somewhat misestimated, or it might even be underestimated.

Conclusion

I would beware about Allianz for a number of factors. The stock does not appear costly, however Allianz is dealing with a comparable issue as lots of banks and when taking a look at the last economic crises, we need to anticipate the stock to decrease rather high in case of an economic downturn or bearishness. Furthermore, Allianz is at a significant resistance level, and I believe Allianz will have difficulties to break above this resistance level in the existing market environment.

And we ought to constantly bear in mind that the very first quarter of financial 2023 is not shown in any outcomes. Allianz will supply details for the very first quarter on May 12, 2023, and it stays to be seen if any unfavorable results are currently noticeable (most likely not as many banks reported strong outcomes up until now).

Editor’s Note: This short article talks about several securities that do not trade on a significant U.S. exchange. Please know the threats related to these stocks.